Resume Worded | Career Strategy

14 credit manager cover letters.

Approved by real hiring managers, these Credit Manager cover letters have been proven to get people hired in 2024. A hiring manager explains why.

Table of contents

- Credit Manager

- Assistant Credit Manager

- Senior Credit Analyst

- Credit Risk Manager

- Alternative introductions for your cover letter

- Credit Manager resume examples

Credit Manager Cover Letter Example

Why this cover letter works in 2024, highlighting relevant experience.

This sentence emphasizes the candidate's years of experience in credit management and implies their expertise in the field. It's important to highlight your relevant experience so the hiring manager can quickly see your qualifications.

Specific Accomplishments

By providing specific numbers and accomplishments, this sentence demonstrates the candidate's ability to make a positive impact in their previous roles. Make sure to include quantifiable achievements that showcase your skills and expertise.

Expressing Gratitude

A simple, genuine thank you goes a long way. It shows appreciation for the hiring manager's time and consideration, and leaves a positive impression. Make sure to include a brief, heartfelt thank you in your cover letter.

Link your professional experience to the job role

In your cover letter, it's crucial to directly tie your current or past roles to the position you're applying for. Here, you're showing that you've already mastered similar responsibilities in your current role as a Senior Credit Analyst - and that's exactly what the hiring manager wants to see. This gives me confidence that you're already familiar with the tasks you'll be undertaking and won't need a lot of hand-holding.

Highlighting successful negotiations

By mentioning a specific project where you successfully negotiated credit terms with over 50 clients, you're showing that you're not just a credit analyst, but also a savvy negotiator. It's essential to highlight such 'extra' skills that may not be explicitly mentioned in the job description but are incredibly valuable in the workplace. It also shows that you're proactive and you can handle challenging tasks.

Highlighting Proven Abilities

This cover letter does a fantastic job of highlighting the candidate's proven ability to transform credit management strategies into tangible results. It's not just about saying you have a knack for something, but backing it up with concrete examples and achievements from previous roles.

Expressing Enthusiasm to Apply Existing Skills

What I appreciate here is the excitement expressed about applying existing skills to a new role. It's essential to communicate that you're not just looking for any job, but specifically excited about what you can do in the role you're applying for.

Emphasizing Role Alignment

This line does an excellent job of expressing why the role is a good fit. It's important to tell your potential employer that you understand what the role entails and why it suits you. This shows you have a thoughtful approach to your job search.

Polite and Gracious Sign-Off

Ending with a note of thanks shows consideration and leaves a positive impression. It may seem like a small thing, but it can differentiate you from candidates who fail to express gratitude for the opportunity to apply.

Show your enthusiasm for the credit manager role

Expressing excitement about the job and how the company's goals match yours makes your cover letter feel personal and genuine.

Demonstrate your credit analysis expertise

Detailing your specific achievements and how you improved your past employers' operations shows you have the skills necessary for the job.

Highlight your asset to the team

Talking about your experience in ways that show you can bring value to the new team reassures employers of your potential impact.

Share your passion for innovation in credit

When you mention looking forward to working with a team to drive innovation, it shows you're ready to contribute and grow with the company.

Close with a strong call to action

Ending on a note that invites further discussion about your fit for the role shows confidence and eagerness to move forward in the hiring process.

Does writing cover letters feel pointless? Use our AI

Dear Job Seeker, Writing a great cover letter is tough and time-consuming. But every employer asks for one. And if you don't submit one, you'll look like you didn't put enough effort into your application. But here's the good news: our new AI tool can generate a winning cover letter for you in seconds, tailored to each job you apply for. No more staring at a blank page, wondering what to write. Imagine being able to apply to dozens of jobs in the time it used to take you to write one cover letter. With our tool, that's a reality. And more applications mean more chances of landing your dream job. Write me a cover letter It's helped thousands of people speed up their job search. The best part? It's free to try - your first cover letter is on us. Sincerely, The Resume Worded Team

Want to see how the cover letter generator works? See this 30 second video.

Show enthusiasm for the company's financial leadership

Starting your cover letter with admiration for the company's financial excellence not only shows you've done your homework but also that you're genuinely interested in contributing to its success.

Detail your credit management expertise

Describing your proficiency in core tasks like credit analysis and risk assessment sends a clear message: you have the skills necessary to manage and improve the company's credit operations.

Highlight successful negotiations and risk reduction

Discussing specific achievements, like negotiating payment plans and reducing bad debt, demonstrates your ability to handle challenging situations and contribute to the company's financial health.

Express interest in the company's global and diverse operations

Your excitement about managing risks in a complex, international context shows you're ready for the challenges unique to a global company like PepsiCo.

Connect your passion with your potential contribution

Closing by linking your experience and enthusiasm for the role with how you can help the team signifies you're not just looking for a job but aiming to make a difference.

Show your enthusiasm for the credit management role

When you express excitement about applying for the position and acknowledge the company's strengths, it builds a good first impression. It shows you have done your homework about the company's mission and values.

Quantify your achievements in credit risk management

By stating how your efforts led to a decrease in default rates and supported portfolio growth, you effectively showcase your direct impact on business outcomes. This makes it easier for employers to visualize your potential contribution to their team.

Align your skills with the company’s goals

Mentioning how your ability to manage risk while focusing on business growth fits with the company’s objectives demonstrates you understand their key priorities. It suggests you can seamlessly integrate into their strategic vision.

Highlight your commitment to team growth

Discussing your passion for nurturing talent and enhancing a team's skill set emphasizes your leadership qualities and your value beyond just technical skills. It aligns with companies looking to build strong, supportive cultures.

Express eagerness for a follow-up

Concluding with a polite thank you and a look forward to discussing your application further shows professionalism and reiterates your interest in the position. It keeps the door open for future conversations.

Assistant Credit Manager Cover Letter Example

Showcase your achievements with hard data.

Using specific, quantifiable achievements is a great way to make your case. Here, you've shared that you managed a substantial portfolio and maintained an impressively low delinquency rate. This tells me two things: firstly, you can handle the responsibility of managing large sums of money, and secondly, you're effective at what you do. It's one thing to say you're good at your job, but showing me with solid data convinces me.

Illustrate your ability to leverage technology

Sharing an example of a time when you used technology to improve performance is brilliant. It lets me know that you're not stuck in old ways of doing things and that you're open to leveraging technology to enhance efficiency and accuracy. In a rapidly evolving industry like finance, this willingness to adapt and innovate is highly appreciated.

Senior Credit Analyst Cover Letter Example

Presenting past achievements.

I like how this cover letter zeroes in on the writer's past achievements. Mentioning a specific project or initiative that you contributed to significantly provides a strong proof of your abilities. It's always a good idea to quantify your successes when possible.

Expressing Eagerness to Contribute

It's good to show enthusiasm for the potential role, and this sentence does that well. It shows that the candidate is not just interested in the job, but is looking forward to bringing their skills to bear in a new environment.

Aligning with Company Values

Here, the writer expresses their excitement about working in an environment that values the same things they do. It's always a good idea to show that you've done your homework about the company's culture and values.

Appreciating the Opportunity

Again, ending with a note of gratitude is a nice touch that shows consideration and polite professionalism. It leaves a positive impression and signals that you're someone who understands the value of appreciation.

Expressing Confidence

This last line effectively communicates the candidate's confidence in their ability to contribute to the team. It's important to convey your belief in your ability to succeed in the role, without sounding arrogant or overconfident.

Connect your passion with the company's mission

Starting your cover letter by aligning your professional interests with the company's goals makes a compelling introduction.

Showcase your impact as a senior credit analyst

Providing examples of your past successes gives concrete evidence of your ability to perform well in the role.

Translate data into results

Illustrating how you can turn complex data into actionable insights demonstrates critical thinking and problem-solving skills.

Express excitement about contributing to risk management solutions

Your enthusiasm for the opportunity to bring your skills to a new team highlights your motivation and dedication to the role.

End with gratitude and a forward-looking statement

Thanking the reader for their time and expressing interest in further discussing your fit for the role leaves a positive, lasting impression.

Show enthusiasm for the company's values

Talking about your respect for a company’s way of doing things makes your interest in the job feel more real and shows you've done your homework.

Demonstrate impact with numbers

Mentioning specific outcomes like reducing payment terms or increasing sales by certain percentages provides solid proof of your effectiveness in previous roles.

Highlight key credit analysis skills

Detailing your experience with financial modeling and data analysis directly relates to core senior credit analyst responsibilities and shows you have the technical skills needed.

Connect skills to company needs

By expressing excitement to apply your analytical skills and business understanding at the company, you effectively link your strengths to how you can contribute to their success.

Value alignment enhances fit

Stating your appreciation for a company’s culture of innovation and improvement suggests a natural fit, making you a more appealing candidate for the role.

Connect your admiration with the company’s methodology

Starting by mentioning your respect for the company's approach to credit risk management instantly creates a connection. It shows you're aligned with their values and methodologies, making you a potentially great fit.

Balance risk management with operational efficiency

Detailing your success in optimizing processes while upholding standards of credit quality illustrates your ability to contribute to both operational efficiency and strategic risk management. Employers will value this dual capability.

Emphasize your commitment to staying updated on industry trends

Your passion for keeping abreast of industry developments and applying them to your work speaks volumes about your proactive nature and dedication to excellence. It suggests you will bring valuable insights and innovations to the team.

Share your enthusiasm for innovation in finance

Expressing excitement about bringing your innovative mindset to a company known for its forward-thinking is compelling. It shows you not only admire the company's achievements but are eager to contribute to its future successes.

Close with a courteous follow-up invitation

Ending your cover letter with gratitude and an openness to discuss how you can add value underscores your professionalism and eagerness to engage further. It's a positive note that encourages a response.

Credit Risk Manager Cover Letter Example

Show your passion for the credit risk sector.

Expressing admiration for a company's mission, like financial inclusion, shows you're not just looking for any job, but you're passionate about making a meaningful impact in the credit risk field.

Highlight your experience in credit risk management

Talking about your skills in risk assessment and leadership directly tells me you're not starting from scratch. You have a solid foundation that's ready to be put to use in new ways.

Demonstrate the impact of your analytical skills

By detailing your achievements with data and analytics, you're showing that you understand the key challenges in the credit industry and have practical solutions to offer.

Express eagerness to innovate in credit management

Highlighting your excitement to join a company known for innovation makes you stand out as someone ready to contribute fresh ideas and help the company stay at the forefront.

Convey readiness to contribute to financial inclusion

This wraps up your cover letter on a high note, reinforcing your enthusiasm to use your skills for a cause that aligns with the company's goals.

Express genuine admiration for the company

Starting with a personal connection to the company sets a positive tone and demonstrates that your interest goes beyond just the job.

Showcase a track record in credit risk management

Describing your comprehensive experience and success in the field establishes your credibility and suggests you can achieve similar results for Coca-Cola.

Negotiation skills are a plus

Detailing successful negotiations with suppliers not only highlights your skills in credit management but also your ability to positively affect supply chain costs.

Illustrate leadership in process improvements

Mentioning your role in leading teams to enhance accounts receivable processes underscores your leadership skills and your impact on financial health.

Emphasize adaptability and global perspective

Your enthusiasm for working in a diverse and dynamic environment like Coca-Cola’s indicates your readiness to handle the complexities of a global role.

Show your enthusiasm for the credit risk manager role

Starting your cover letter by expressing genuine excitement for the job and the company makes me feel you're truly interested. This is a good way to begin.

Highlight your data analytics expertise in risk management

You should tell us about specific projects where you used your skills to make a big difference. Mentioning the use of advanced analytics is especially valuable in the credit risk field.

Demonstrate leadership in credit risk teams

Talking about your experience in leading teams shows you're not just good on paper but also in guiding others to success. This is important for roles that need teamwork.

Link your values to the company’s culture

When you talk about your commitment to helping team members grow, and connect it with the company’s commitment to its employees, it tells me you've done your homework about what we value.

Ending your cover letter by expressing a clear desire to discuss how you can contribute shows confidence and proactiveness, which are qualities I look for in a candidate.

Alternative Introductions

If you're struggling to start your cover letter, here are 6 different variations that have worked for others, along with why they worked. Use them as inspiration for your introductory paragraph.

Cover Letters For Jobs Similar To Credit Manager Roles

- Commercial Credit Analyst Cover Letter Guide

- Credit Analyst Cover Letter Guide

- Credit Manager Cover Letter Guide

Other Finance Cover Letters

- Accountant Cover Letter Guide

- Auditor Cover Letter Guide

- Bookkeeper Cover Letter Guide

- Claims Adjuster Cover Letter Guide

- Cost Analyst Cover Letter Guide

- Finance Director Cover Letter Guide

- Finance Executive Cover Letter Guide

- Financial Advisor Cover Letter Guide

- Financial Analyst Cover Letter Guide

- Financial Controller Cover Letter Guide

- Loan Processor Cover Letter Guide

- Payroll Specialist Cover Letter Guide

- Purchasing Manager Cover Letter Guide

- VP of Finance Cover Letter Guide

Thank you for the checklist! I realized I was making so many mistakes on my resume that I've now fixed. I'm much more confident in my resume now.

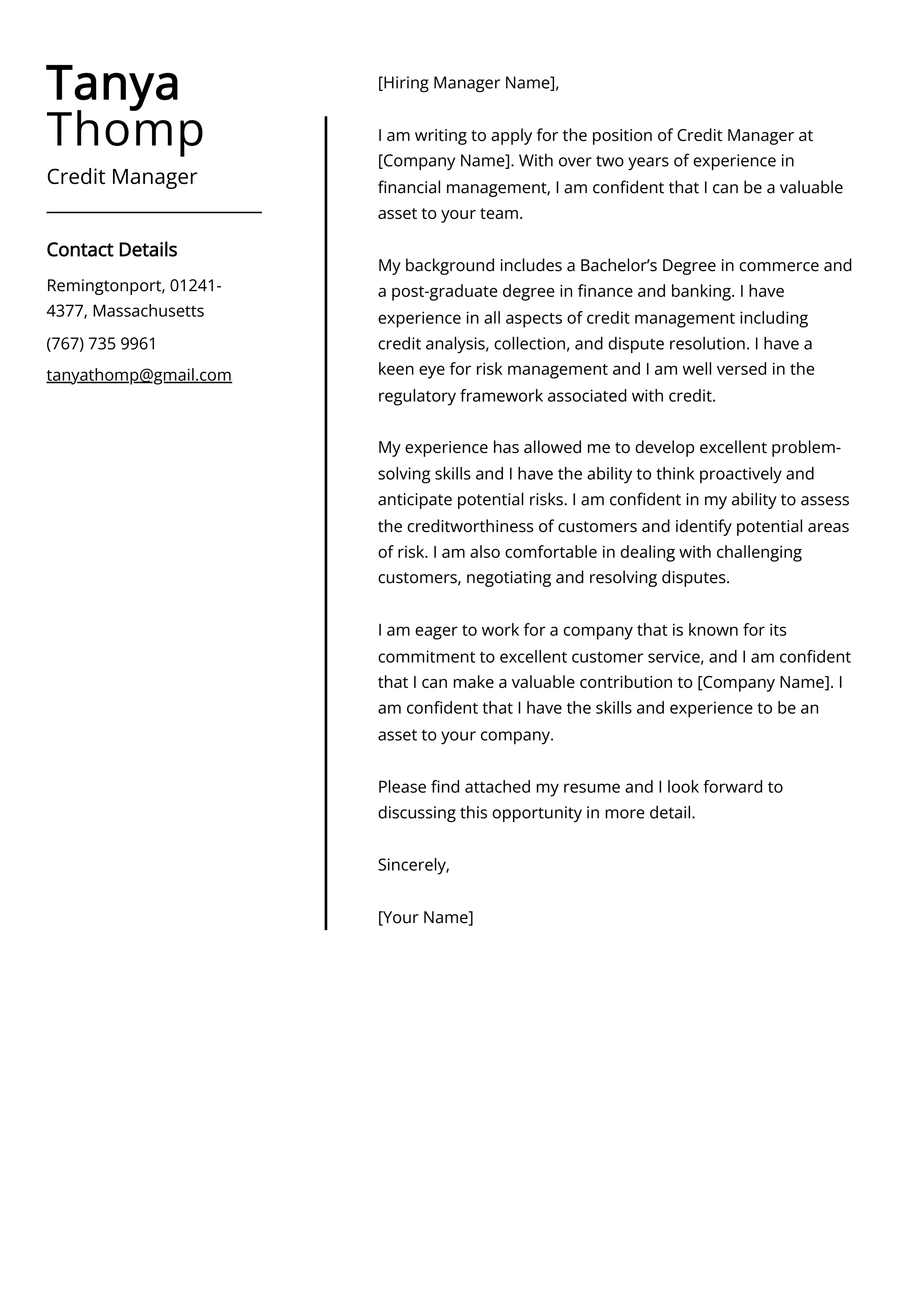

Credit Manager Cover Letter Example (Free Guide)

Create an credit manager cover letter that lands you the interview with our free examples and writing tips. use and customize our template and land an interview today..

Are you looking to apply for a Credit Manager position? Our Credit Manager Cover Letter Guide is here to help. We will provide you with tips on how to create a great cover letter and the key elements to include in your letter. We’ll also share some helpful samples and templates to get you started. Follow our guide and you’ll have a great cover letter that will get you noticed.

We will cover:

- How to write a cover letter, no matter your industry or job title.

- What to put on a cover letter to stand out.

- The top skills employers from every industry want to see.

- How to build a cover letter fast with our professional Cover Letter Builder .

- What a cover letter template is, and why you should use it.

Related Cover Letter Examples

- Finance Advisor Cover Letter Sample

- Experienced Real Estate Agent Cover Letter Sample

- Experienced Mortgage Advisor Cover Letter Sample

- Compliance Analyst Cover Letter Sample

- Credit Administrator Cover Letter Sample

Credit Manager Cover Letter Sample

- Finance Manager Cover Letter Sample

- Actuary Cover Letter Sample

- Claim Specialist Cover Letter Sample

- Account Administrator Cover Letter Sample

- Account Analyst Cover Letter Sample

- Accounting Analyst Cover Letter Sample

- Accounting Assistant Cover Letter Sample

- Accounting Associate Cover Letter Sample

- Accounting Auditor Cover Letter Sample

- Accounting Consultant Cover Letter Sample

- Accounting Coordinator Cover Letter Sample

- Accounting Manager Cover Letter Sample

- Accounting Specialist Cover Letter Sample

- Audit Director Cover Letter Sample

Dear Hiring Manager

I am writing to apply for the Credit Manager position at [Company Name], as advertised on [Job Site]. With my extensive knowledge of credit management and experience in customer service, I am confident I would be a great asset to the team.

I have six years of experience in credit management and customer service. During my time in this role, I have developed an excellent ability to manage customer accounts and relationships. I have a proven track record of successfully collecting and analyzing customer data, developing strategies to reduce bad debts, and managing customer disputes. I have a deep understanding of the financial industry and I am knowledgeable in credit compliance and risk management.

I am also highly skilled in problem-solving and decision-making. I have excellent communication and interpersonal skills, which I have utilized to effectively build relationships with customers and colleagues. I am comfortable working in a fast-paced and highly-regulated environment, as I have demonstrated the ability to multi-task and prioritize tasks according to deadlines.

I have also earned my Bachelor’s Degree in Business Administration. This has enabled me to develop my understanding of financial accounting, economics, and other related topics. I am also certified by the Association of Credit Management (ACM) and have been a member for four years.

I am confident I can bring my knowledge and experience to the role of Credit Manager and make a positive contribution to [Company Name]. I am eager to further discuss my qualifications and how I can help your team reach its goals. Please do not hesitate to contact me if you have any questions or would like to schedule an interview.

Sincerely, [Your Name]

Why Do you Need a Credit Manager Cover Letter?

- A Credit Manager cover letter is a great way to show employers that you are the right candidate for the job.

- It allows you to showcase your abilities and experience in the field, as well as demonstrate your passion for the role.

- Your cover letter also provides an opportunity to explain why you are the best choice for the job, and how you can help the company reach its goals.

- It will also help to highlight any special qualifications you have that may not be apparent from your resume.

- Finally, a Credit Manager cover letter can help you stand out from other applicants, making it easier to get noticed by employers.

A Few Important Rules To Keep In Mind

- Keep the cover letter short and to the point. Aim for a maximum of one page.

- Avoid using cliches such as "I'm the perfect candidate for the job". Instead, focus on specific qualities and experience that you possess.

- Address the letter to a specific contact in the company, either by name or title.

- Make sure to reference the position you are applying for in the first sentence.

- Mention relevant experience that you have that directly relates to the job you are applying for.

- Emphasize any unique traits that make you stand out from other applicants.

- Include your contact information at the top of the letter.

- Proofread the letter for any spelling or grammar errors.

- End the letter on a positive note, thanking the recipient for their time and consideration.

What's The Best Structure For Credit Manager Cover Letters?

After creating an impressive Credit Manager resume , the next step is crafting a compelling cover letter to accompany your job applications. It's essential to remember that your cover letter should maintain a formal tone and follow a recommended structure. But what exactly does this structure entail, and what key elements should be included in a Credit Manager cover letter? Let's explore the guidelines and components that will make your cover letter stand out.

Key Components For Credit Manager Cover Letters:

- Your contact information, including the date of writing

- The recipient's details, such as the company's name and the name of the addressee

- A professional greeting or salutation, like "Dear Mr. Levi,"

- An attention-grabbing opening statement to captivate the reader's interest

- A concise paragraph explaining why you are an excellent fit for the role

- Another paragraph highlighting why the position aligns with your career goals and aspirations

- A closing statement that reinforces your enthusiasm and suitability for the role

- A complimentary closing, such as "Regards" or "Sincerely," followed by your name

- An optional postscript (P.S.) to add a brief, impactful note or mention any additional relevant information.

Cover Letter Header

A header in a cover letter should typically include the following information:

- Your Full Name: Begin with your first and last name, written in a clear and legible format.

- Contact Information: Include your phone number, email address, and optionally, your mailing address. Providing multiple methods of contact ensures that the hiring manager can reach you easily.

- Date: Add the date on which you are writing the cover letter. This helps establish the timeline of your application.

It's important to place the header at the top of the cover letter, aligning it to the left or center of the page. This ensures that the reader can quickly identify your contact details and know when the cover letter was written.

Cover Letter Greeting / Salutation

A greeting in a cover letter should contain the following elements:

- Personalized Salutation: Address the hiring manager or the specific recipient of the cover letter by their name. If the name is not mentioned in the job posting or you are unsure about the recipient's name, it's acceptable to use a general salutation such as "Dear Hiring Manager" or "Dear [Company Name] Recruiting Team."

- Professional Tone: Maintain a formal and respectful tone throughout the greeting. Avoid using overly casual language or informal expressions.

- Correct Spelling and Title: Double-check the spelling of the recipient's name and ensure that you use the appropriate title (e.g., Mr., Ms., Dr., or Professor) if applicable. This shows attention to detail and professionalism.

For example, a suitable greeting could be "Dear Ms. Johnson," or "Dear Hiring Manager," depending on the information available. It's important to tailor the greeting to the specific recipient to create a personalized and professional tone for your cover letter.

Cover Letter Introduction

An introduction for a cover letter should capture the reader's attention and provide a brief overview of your background and interest in the position. Here's how an effective introduction should look:

- Opening Statement: Start with a strong opening sentence that immediately grabs the reader's attention. Consider mentioning your enthusiasm for the job opportunity or any specific aspect of the company or organization that sparked your interest.

- Brief Introduction: Provide a concise introduction of yourself and mention the specific position you are applying for. Include any relevant background information, such as your current role, educational background, or notable achievements that are directly related to the position.

- Connection to the Company: Demonstrate your knowledge of the company or organization and establish a connection between your skills and experiences with their mission, values, or industry. Showcasing your understanding and alignment with their goals helps to emphasize your fit for the role.

- Engaging Hook: Consider including a compelling sentence or two that highlights your unique selling points or key qualifications that make you stand out from other candidates. This can be a specific accomplishment, a relevant skill, or an experience that demonstrates your value as a potential employee.

- Transition to the Body: Conclude the introduction by smoothly transitioning to the main body of the cover letter, where you will provide more detailed information about your qualifications, experiences, and how they align with the requirements of the position.

By following these guidelines, your cover letter introduction will make a strong first impression and set the stage for the rest of your application.

Cover Letter Body

As a Credit Manager, I have a strong understanding of the financial and credit policies and procedures necessary for successful operations. My experience includes overseeing accounts receivable, managing credit policies, and minimizing risk. I have a proven track record of success in identifying and mitigating risk, while maintaining a high level of customer satisfaction.

I am a highly organized professional with strong communication, interpersonal, and problem-solving skills. I am confident I can bring the same level of excellence to your organization. I have the knowledge and experience needed to effectively manage credit and collections, as well as the ability to foster strong relationships with clients and vendors.

My key qualifications include:

- Risk Management: I have extensive experience in assessing, monitoring, and mitigating risk. I am adept at identifying potential risks and implementing strategies to reduce them.

- Financial Analysis: I am skilled in analyzing financial information to ensure accuracy and timeliness of payments. I also have experience in preparing financial reports.

- Credit and Collections: I have a strong understanding of credit and collections policies and procedures. I am adept at managing customer accounts and establishing payment plans.

- Customer Service: I am an excellent communicator, and I am committed to providing the highest level of customer service. I am experienced in resolving customer disputes and ensuring customer satisfaction.

I am a highly motivated professional with the experience and skills to be an asset to your organization. I am confident that I can help you achieve your goals. I look forward to discussing this opportunity further and thank you for your consideration.

Complimentary Close

The conclusion and signature of a cover letter provide a final opportunity to leave a positive impression and invite further action. Here's how the conclusion and signature of a cover letter should look:

- Summary of Interest: In the conclusion paragraph, summarize your interest in the position and reiterate your enthusiasm for the opportunity to contribute to the organization or school. Emphasize the value you can bring to the role and briefly mention your key qualifications or unique selling points.

- Appreciation and Gratitude: Express appreciation for the reader's time and consideration in reviewing your application. Thank them for the opportunity to be considered for the position and acknowledge any additional materials or documents you have included, such as references or a portfolio.

- Call to Action: Conclude the cover letter with a clear call to action. Indicate your availability for an interview or express your interest in discussing the opportunity further. Encourage the reader to contact you to schedule a meeting or provide any additional information they may require.

- Complimentary Closing: Choose a professional and appropriate complimentary closing to end your cover letter, such as "Sincerely," "Best Regards," or "Thank you." Ensure the closing reflects the overall tone and formality of the letter.

- Signature: Below the complimentary closing, leave space for your handwritten signature. Sign your name in ink using a legible and professional style. If you are submitting a digital or typed cover letter, you can simply type your full name.

- Typed Name: Beneath your signature, type your full name in a clear and readable font. This allows for easy identification and ensures clarity in case the handwritten signature is not clear.

Common Mistakes to Avoid When Writing a Credit Manager Cover Letter

When crafting a cover letter, it's essential to present yourself in the best possible light to potential employers. However, there are common mistakes that can hinder your chances of making a strong impression. By being aware of these pitfalls and avoiding them, you can ensure that your cover letter effectively highlights your qualifications and stands out from the competition. In this article, we will explore some of the most common mistakes to avoid when writing a cover letter, providing you with valuable insights and practical tips to help you create a compelling and impactful introduction that captures the attention of hiring managers. Whether you're a seasoned professional or just starting your career journey, understanding these mistakes will greatly enhance your chances of success in the job application process. So, let's dive in and discover how to steer clear of these common missteps and create a standout cover letter that gets you noticed by potential employers.

- Not customizing the cover letter to the job posting.

- Including irrelevant information.

- Focusing too much on your qualifications and not enough on the company’s needs.

- Using a generic salutation.

- Writing a cover letter that is too long.

- Using incorrect grammar and spelling mistakes.

- Not proofreading the cover letter.

- Failing to follow up after submitting the cover letter.

Key Takeaways For a Credit Manager Cover Letter

- Demonstrate a thorough understanding of the role of a credit manager and how it contributes to the success of the company.

- Highlight any relevant experience managing credit and collections, including any key successes.

- Showcase strong analytical and organizational skills.

- Mention any experience in financial analysis, budgeting and forecasting.

- Discuss any experience in performing credit and risk analysis.

- Highlight any knowledge of legal aspects of credit and collections.

- Emphasize excellent communication skills, both written and verbal.

- Discuss any proficiency in using computer systems and software related to managing credit and collections.

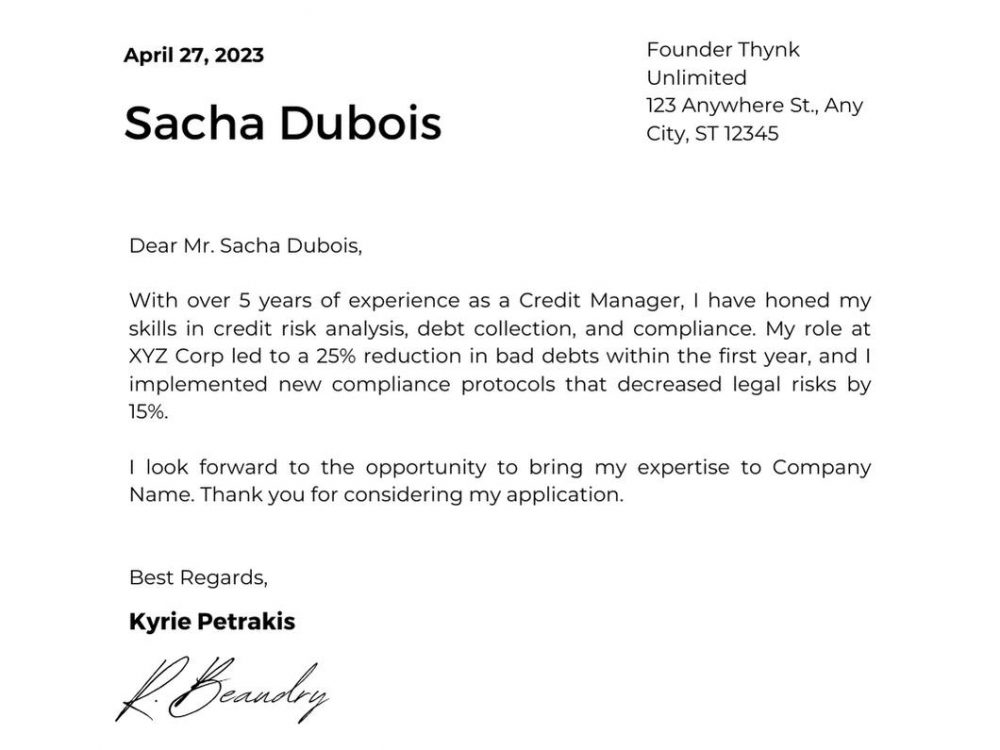

5+ Credit Manager Cover Letter Examples and Templates

Home » Cover Letter Examples » 5+ Credit Manager Cover Letter Examples and Templates

Create the simple Credit Manager cover letter with our top examples and expert guidance. Use our sample customizable templates to craft a cover letter that’ll impress recruiters and get you that interview today. Start now and make your dream job come true!

The role of a Credit Manager is both intricate and vital in the financial sector. A well-crafted cover letter can be the gateway to your dream job. In this guide, we’ll explore 5+ examples and templates of Credit Manager cover letters, offering insights and expert tips to help you stand out in a competitive job market. Crafting a cover letter that resonates with hiring managers requires a blend of professionalism, creativity, and understanding of the industry. Whether you’re an experienced Credit Manager or just starting your career, this guide will provide you with the tools and insights to create a compelling cover letter that showcases your unique qualifications.

What Makes a Great Credit Manager Cover Letter?

A Credit Manager cover letter should reflect your expertise, passion, and understanding of the role. It’s not just about listing your skills; it’s about weaving them into a narrative that aligns with the company’s goals and culture. Here’s what you need to know:

Key Responsibilities

- Credit Risk Analysis: Evaluating the creditworthiness of potential clients is crucial. This involves analyzing financial statements, credit reports, and other data to assess risk.

- Debt Collection: Implementing strategies to collect outstanding debts requires tact and persistence. This includes negotiating payment plans and working with legal teams if necessary.

- Compliance: Ensuring adherence to legal regulations and company policies is paramount. This involves staying up-to-date with laws and regulations and implementing policies to ensure compliance.

Essential Skills

- Analytical Skills: The ability to analyze financial data is key. This includes interpreting complex information and making informed decisions.

- Communication Skills: Effective communication with various stakeholders is essential. This involves both written and verbal communication, tailored to different audiences.

- Negotiation Skills: Skilled negotiation is vital in reaching favorable terms with clients. This requires a deep understanding of both the client’s needs and the company’s interests.

For more on skills, check out the Resume Skills section, where you can find detailed insights on various skills that can enhance your resume.

Tailoring Your Cover Letter

- Understand the Job Description: Aligning your skills with the specific requirements is essential. Study the job description carefully and highlight how your experience matches the needs.

- Use Relevant Keywords: Incorporate industry-specific terms that resonate with the role. This not only shows your industry knowledge but also helps in getting past Applicant Tracking Systems (ATS).

- Highlight Achievements: Showcase your successes in previous roles with quantifiable achievements. For example, “Reduced bad debt by 20% through effective risk management strategies.”

5+ Cover Letter Examples

1. Entry-Level Credit Manager Cover Letter

Starting your career as a Credit Manager? This example is tailored for entry-level applicants, focusing on education and internship experience.

Tips for Entry-Level Applicants

- Highlight Education: Emphasize relevant coursework, degrees, and any awards or honors that demonstrate your academic achievements.

- Showcase Internship Experience: Detail what you learned and achieved, such as specific projects or initiatives you were part of.

- Use Professional Tone: Maintain a respectful and formal tone, but don’t be afraid to let your personality shine through.

- Express Enthusiasm: Show your eagerness to contribute and learn. Mention specific aspects of the company or role that excite you.

2. Experienced Credit Manager Cover Letter

With years of experience under your belt, this example emphasizes your expertise and achievements in the field.

Tips for Experienced Professionals

- Highlight Achievements: Focus on measurable successes, such as percentage reductions in bad debts or improvements in compliance ratings.

- Tailor to the Role: Align your experience with the job description, using specific examples that demonstrate how your skills match the company’s needs.

- Maintain Clarity: Keep the language simple and clear, avoiding jargon that might confuse non-industry readers.

- Show Leadership: Demonstrate your ability to lead and mentor others, highlighting any team successes or leadership initiatives.

3. Credit Manager Cover Letter for a Specific Industry

Applying within a specific industry? This example is tailored to showcase your understanding of the unique challenges and opportunities in the field.

Tips for Industry-Specific Applications

- Showcase Industry Knowledge: Highlight your understanding of the industry, including specific trends, challenges, and opportunities.

- Use Relevant Examples: Provide examples specific to the industry, such as how you’ve adapted credit risk strategies to fit the automotive sector.

- Emphasize Adaptability: Demonstrate your ability to tailor strategies to different industry needs, showing flexibility and innovation.

- Highlight Collaboration: Show your ability to work with industry partners, suppliers, or other stakeholders, emphasizing teamwork and relationship-building.

4. Credit Manager Cover Letter with No Experience

Lacking direct experience? This example focuses on transferable skills and enthusiasm to learn and grow in the role.

Tips for Those Without Direct Experience

- Focus on Transferable Skills: Highlight skills from related fields, such as sales or customer service, that can be applied to the Credit Manager role.

- Show Enthusiasm: Express your eagerness to learn and grow, mentioning specific aspects of the role or company that align with your career goals.

- Provide Examples: Use examples from other roles or education that demonstrate your ability to adapt and succeed in new challenges.

- Highlight Problem-Solving: Demonstrate your ability to tackle challenges, such as how you’ve overcome obstacles in previous roles or developed new strategies to achieve goals.

5. General Credit Manager Cover Letter

Need a versatile cover letter? This general example is suitable for various applications, focusing on core skills and adaptability.

Tips for a Broad Range of Applications

- Be Versatile: Keep the language broad to suit various roles, but still specific enough to demonstrate your expertise.

- Highlight Core Skills: Focus on the essential skills of a Credit Manager, such as risk analysis, debt collection, and compliance.

- Maintain Professionalism: Use a respectful and engaging tone, balancing formality with a conversational style.

- Show Initiative: Demonstrate your proactive approach to tasks, highlighting how you’ve taken the lead on projects or implemented new strategies.

Credit Manager Cover Letter Templates & Writing Tips

Crafting a Credit Manager cover letter can be a daunting task. Whether you’re an entry-level applicant or an experienced professional, having the right template and writing tips can make the process smoother. Here’s what you need to know:

- Entry-Level Credit Manager Cover Letter Template: Ideal for recent graduates or those starting their career. Focuses on education, internships, and transferable skills.

- Experienced Credit Manager Cover Letter Template: Tailored for those with years of experience. Highlights achievements, leadership, and industry expertise.

- Industry-Specific Credit Manager Cover Letter Template: Perfect for those applying within a particular industry. Emphasizes industry knowledge, adaptability, and collaboration.

For more templates, check out the Resume Maker tool, where you can find customizable templates to fit your needs.

Writing Tips

- Use Action Verbs: Words like “achieved,” “managed,” and “implemented” add impact. They convey a sense of action and accomplishment.

- Be Concise: Keep your cover letter to one page. Focus on the most relevant details and avoid unnecessary filler.

- Personalize: Address the hiring manager by name if possible. Research the company to find the appropriate contact.

- Proofread: Ensure there are no grammatical or spelling errors. Consider having a friend or colleague review your cover letter for a fresh perspective.

- Show Passion: Convey your passion for the role and industry. Mention specific aspects of the company’s mission or values that resonate with you.

- Use Real Examples: Provide tangible examples to back up your claims. Use quantifiable data to demonstrate your achievements.

- Highlight Teamwork: Show your ability to work well with others. Mention specific team projects or collaborative efforts that resulted in success.

Common Mistakes to Avoid

Avoiding common mistakes can set your cover letter apart. Here’s what to watch out for:

- Generic Language: Tailor your cover letter to the specific role. Avoid using a one-size-fits-all approach that doesn’t address the unique needs of the position.

- Overly Formal Tone: Use a conversational style, as if you’re speaking to a colleague. While maintaining professionalism, let your personality shine through.

- Lack of Evidence: Provide examples to back up your claims. Use specific instances from your experience to demonstrate your qualifications.

- Ignoring the Job Description: Align your cover letter with the job requirements. Show how your skills and experience directly relate to the needs of the position.

Crafting the perfect Credit Manager cover letter is an essential step in landing your dream job. By following these examples, templates, and writing tips, you’ll be well on your way to impressing potential employers.

For additional help with your resume, explore the AI Resume Builder , Resume Design , Resume Samples , Resume Examples , Resume Help , Resume Synonyms , Career Advice , Interview Questions , and Job Responsibilities sections.

Happy job hunting!

Career Expert Tips:

- If you're stepping into the professional world, understanding the basics is crucial. Learn What is a cover letter and its role in the job application process.

- How to start a cover letter can be a challenging task. Get a comprehensive guide on how to kickstart your cover letter and make a strong first impression.

- Looking for inspiration to draft your own cover letter? Browse through these Cover letter examples to find a style that fits your profession.

- Why start from scratch? Use these Cover Letter Templates tailored for various professions to simplify your job application process.

- How long should a cover letter be : The length of a cover letter is vital in conveying your message concisely. Discover the optimal length to make sure your cover letter is not too short nor too long.

- Ensure that you know how to write a resume in a way that highlights your competencies.

- Check the expert curated popular good CV and resume examples

Privacy Overview

Privacy preference center

We care about your privacy

When you visit our website, we will use cookies to make sure you enjoy your stay. We respect your privacy and we’ll never share your resumes and cover letters with recruiters or job sites. On the other hand, we’re using several third party tools to help us run our website with all its functionality.

But what exactly are cookies? Cookies are small bits of information which get stored on your computer. This information usually isn’t enough to directly identify you, but it allows us to deliver a page tailored to your particular needs and preferences.

Because we really care about your right to privacy, we give you a lot of control over which cookies we use in your sessions. Click on the different category headings on the left to find out more, and change our default settings.

However, remember that blocking some types of cookies may impact your experience of our website. Finally, note that we’ll need to use a cookie to remember your cookie preferences.

Without these cookies our website wouldn’t function and they cannot be switched off. We need them to provide services that you’ve asked for.

Want an example? We use these cookies when you sign in to Kickresume. We also use them to remember things you’ve already done, like text you’ve entered into a registration form so it’ll be there when you go back to the page in the same session.

Thanks to these cookies, we can count visits and traffic sources to our pages. This allows us to measure and improve the performance of our website and provide you with content you’ll find interesting.

Performance cookies let us see which pages are the most and least popular, and how you and other visitors move around the site.

All information these cookies collect is aggregated (it’s a statistic) and therefore completely anonymous. If you don’t let us use these cookies, you’ll leave us in the dark a bit, as we won’t be able to give you the content you may like.

We use these cookies to uniquely identify your browser and internet device. Thanks to them, we and our partners can build a profile of your interests, and target you with discounts to our service and specialized content.

On the other hand, these cookies allow some companies target you with advertising on other sites. This is to provide you with advertising that you might find interesting, rather than with a series of irrelevant ads you don’t care about.

Credit Manager Cover Letter Example

Get more job offers & learn how to improve your new cover letter with our free, professionally written Credit Manager cover letter example. Copy and paste this cover letter sample at no cost or alter it with ease in our simple yet powerful cover letter maker.

Related resume guides and samples

How to build a professional executive resume?

Handy tips on how to build an effective product manager resume

How to build an effective project manager resume

How to craft an appealing risk manager resume?

How to write a top-notch strategy manager resume

Credit Manager Cover Letter Example (Full Text Version)

Saara rootare.

Dear Head of Talent,

I am writing to express my interest in the Credit Manager position with your organization. With over 4 years of experience in credit and risk management, I am confident in my ability to contribute positively to your team.

Currently, I hold the position of Senior Credit Specialist at BR Bank, where I oversee the credit granting process and lead a team of 10 individuals across various branches. My responsibilities include assessing client creditworthiness, managing financial documents, and implementing new corporate financing programs.

I am known for my strong communication and analytical skills, as well as my problem-solving abilities. Last year, I was honored to receive the Manager of the Year Award for exceeding targets and objectives.

In addition to my professional experience, I hold a Bachelor of Business Administration from Stanford University. During my time at the university, I was a top-performing student and served as President of the FinTech Society.

I have attached my resume for your review and consideration. Thank you for taking the time to consider my application. I am looking forward to hearing from you regarding next steps.

Sincerely, Saara Rootare 555-555-5555 | [email protected]

Milan Šaržík, CPRW

Milan’s work-life has been centered around job search for the past three years. He is a Certified Professional Résumé Writer (CPRW™) as well as an active member of the Professional Association of Résumé Writers & Careers Coaches (PARWCC™). Milan holds a record for creating the most career document samples for our help center – until today, he has written more than 500 resumes and cover letters for positions across various industries. On top of that, Milan has completed studies at multiple well-known institutions, including Harvard University, University of Glasgow, and Frankfurt School of Finance and Management.

Edit this sample using our resume builder.

Don’t struggle with your cover letter. artificial intelligence can write it for you..

Similar job positions

Finance Analyst Strategic Manager Bookkeeper Product Manager Risk Manager Insurance Agent Tax Services Accountant Investment Advisor Project Manager Executive Manager Auditor

Related accounting / finance resume samples

Related management cover letter samples

Let your resume do the work.

Join 6,000,000 job seekers worldwide and get hired faster with your best resume yet.

Professional Credit Manager Cover Letter Examples for 2025

When drafting your credit manager cover letter, it's essential to highlight your expertise in credit risk analysis. Demonstrate your ability to evaluate financial data efficiently and accurately. In your cover letter, emphasize your success in managing credit and collections teams. Show examples of how you've improved processes and mitigated risks, proving your value as a strategic credit manager.

Written by The Enhancv Team

Cover Letter Guide

Credit Manager Cover Letter Sample

Cover Letter Format

Cover Letter Salutation

Cover Letter Introduction

Cover Letter Body

Cover Letter Closing

No Experience Credit Manager Cover Letter

Key Takeaways

Crafting a credit manager cover letter can seem as daunting as crunching complex financial data. You've polished your resume and you're ready to apply, but now you face the challenge of discussing your achievements without echoing your resume. It's crucial to weave a compelling narrative around your proudest professional moment in a formal yet original tone, steering clear of tired clichés. Remember, brevity is key—a powerful story fits neatly in a single page. Let's begin your cover letter journey.

- Including all the must-have paragraphs in your structure for an excellent first impression;

- Learning how to write individual sections from industry-leading cover letter examples;

- Selecting the best accomplishment to tell an interesting and authority-building professional story;

- Introducing your profile with personality, while meeting industry standards.

And, if you want to save some time, drag and drop your credit manager resume into Enhancv's AI, which will assess your profile and write your job-winning cover letter for you.

If the credit manager isn't exactly the one you're looking for we have a plethora of cover letter examples for jobs like this one:

- Credit Manager resume guide and example

- Budget Analyst cover letter example

- Accounts Payable Clerk cover letter example

- Financial Administrator cover letter example

- Forensic Accounting cover letter example

- Billing Manager cover letter example

- Finance Intern cover letter example

- Project Accounting cover letter example

- Financial Counselor cover letter example

- Finance Officer cover letter example

- Bid Manager cover letter example

Credit manager cover letter example

Joseph White

Charlotte, North Carolina

+1-(234)-555-1234

- Highlighting specific contributions such as the "integration of AI-based credit scoring techniques" showcases an ability to implement innovative solutions and improve operational efficiency, which is key for a Credit Manager role.

- Demonstrating measurable success through metrics such as "enhancing underwriting efficiency by 25%" and improving "the risk profile of a $500M portfolio" provides evidence of past success and implies potential future benefits for the hiring company.

- Including an initiative that led to improved customer relations ("20% uplift in customer relations and payment timeliness") illustrates not only strategic competence but also an understanding of the importance of customer service in credit management.

What about your credit manager cover letter format: organizing and structuring your information

Here is one secret you should know about your credit manager cover letter assessment. The Applicant Tracker System (or ATS) won't analyze your cover letter.

You should thus focus on making an excellent impression on recruiters by writing consistent:

- Introduction

- Body paragraphs (and explanation)

- Promise or Call to action

- Signature (that's optional)

Now, let's talk about the design of your credit manager cover letter.

Ensure all of your paragraphs are single-spaced and have a one-inch margins on all sides (like in our cover letter templates ).

Also, our cover letter builder automatically takes care of the format and comes along with some of the most popular (and modern) fonts like Volkhov, Chivo, and Bitter.

Speaking of fonts, professionals advise you to keep your credit manager cover letter and resume in the same typography and avoid the over-used Arial or Times New Roman.

When wondering whether you should submit your credit manager cover letter in Doc or PDF, select the second, as PDF keeps all of your information and design consistent.

The top sections on a credit manager cover letter

Header: This section includes the candidate's contact information, the date, and the employer's contact information, essential for establishing a professional layout and ensuring the cover letter reaches the intended recipient.

Introduction: In this section, the credit manager candidate should clearly state the position they're applying for and briefly mention how their background makes them a strong fit for managing credit analysis and risk assessment functions.

Professional Experience: This section highlights specific past roles and responsibilities, such as credit policy development or debt management, demonstrating the candidate's relevant experience in credit and financial management.

Accomplishments in Credit Management: Candidates should detail how they've improved credit processes or risk mitigation strategies, quantifying achievements if possible to give recruiters clear evidence of their expertise and impact in previous positions.

Closing and Call-to-Action: This is where the prospective credit manager reiterates their enthusiasm for the role, invites the recruiter to review their attached resume for detailed professional history, and suggests setting up an interview to discuss how they can contribute to the company's financial stability.

Key qualities recruiters search for in a candidate’s cover letter

- Proven experience in credit analysis: Recruiters look for candidates who have hands-on experience in analyzing credit data and financial statements to assess the creditworthiness of individuals or companies.

- Strong understanding of credit risk management: Credit managers must be adept at identifying, measuring, and mitigating credit risk to minimize potential losses.

- Excellent negotiation and decision-making skills: In the credit manager role, making informed decisions and negotiating payment terms with clients is crucial.

- Knowledge of relevant laws and regulations: Understanding the legal framework surrounding credit, including fair lending practices and debt collection laws, is essential for compliance and ethical management.

- Experience with credit scoring models and software: Familiarity with the tools and technologies used to evaluate credit risk is important for efficiency and accuracy in credit decisions.

- Leadership and team management ability: Credit managers often lead a team of credit analysts or specialists, so strong leadership skills are important for maintaining team performance and morale.

Personalizing your credit manager cover letter salutation

Always aim to address the recruiter from the get-go of your credit manager cover letter.

- the friendly tone (e.g. "Dear Paul" or "Dear Caroline") - if you've previously chatted up with them on social media and are on a first-name basis;

- the formal tone (e.g. "Dear Ms. Gibbs" or "Dear Ms. Swift") - if you haven't had any previous conversation with them and have discovered the name of the recruiter on LinkedIn or the company website;

- the polite tone (e.g. "Dear Hiring Manager" or "Dear HR Team") - at all costs aim to avoid the "To whom it may concern" or "Dear Sir/Madam", as both greetings are very old-school and vague.

List of salutations you can use

- Dear Hiring Manager,

- Dear [Company Name] Team,

- Dear [Department Name] Director,

- Dear Mr./Ms. [Last Name],

- Dear [Professional Title] [Last Name],

- Good day [Last Name],

Get creative with your credit manager cover letter introduction

Recruiters are going to assess plenty of candidate profiles for the role. Thus, anything you do to stand out will win you brownie points.

Use your credit manager cover letter introduction to share something memorable about your experience .

But before you go down the rabbit hole of creativity and humor, align your message with the company culture.

For example, if you are applying for a role in some startup, use those first two sentences to tell a funny story (about your experience) to quickly connect with the recruiter.

Choosing your best achievement for the middle or body of your credit manager cover letter

Now that you have the recruiters' attention, it's time to write the chunkiest bit of your credit manager cover letter .

The body consists of three to six paragraphs that focus on one of your achievements.

Use your past success to tell a story of how you obtained your most job-crucial skills and know-how (make sure to back these up with tangible metrics).

Another excellent idea for your credit manager cover letter's middle paragraphs is to shine a light on your unique professional value.

Write consistently and make sure to present information that is relevant to the role.

Final words: writing your credit manager cover letter closing paragraph

The final paragraph of your credit manager cover letter allows you that one final chance to make a great first impression .

Instead of going straight to the "sincerely yours" ending, you can back up your skills with a promise of:

- how you see yourself growing into the role;

- the unique skills you'd bring to the organization.

Whatever you choose, always be specific (and remember to uphold your promise, once you land the role).

If this option doesn't seem that appealing to you, close off your credit manager cover letter with a follow-up request.

You could even provide your availability for interviews so that the recruiters would be able to easily arrange your first meeting.

Keep this in mind when writing your zero experience credit manager cover letter

Even though you may not have any professional experience , your credit manager cover letter should focus on your value.

As a candidate for the particular role, what sort of skills do you bring about? Perhaps you're an apt leader and communicator, or have the ability to analyze situations from different perspectives.

Select one key achievement from your life, outside work, and narrate a story that sells your abilities in the best light.

If you really can't think of any relevant success, you could also paint the picture of how you see your professional future developing in the next five years, as part of the company.

Key takeaways

Winning at your job application game starts with a clear and concise credit manager cover letter that:

- Has single-spaced paragraphs, is wrapped in a one-inch margin, and uses the same font as the credit manager resume;

- Is personalized to the recruiter (using their name in the greeting) and the role (focusing on your one key achievement that answers job requirements);

- Includes an introduction that helps you stand out and show what value you'd bring to the company;

- Substitutes your lack of experience with an outside-of-work success, that has taught you valuable skills;

- Ends with a call for follow-up or hints at how you'd improve the organization, team, or role.

Cover letter examples by industry

AI cover letter writer, powered by ChatGPT

Enhancv harnesses the capabilities of ChatGPT to provide a streamlined interface designed specifically focused on composing a compelling cover letter without the hassle of thinking about formatting and wording.

- Content tailored to the job posting you're applying for

- ChatGPT model specifically trained by Enhancv

- Lightning-fast responses

Changing Job Title On Resume

How to answer "where do you see yourself in 5 years", how to film a video resume, should i mention lack of experience in cover letter, awards on resume: how to list them on your resume, how to list tutoring on resume.

- Resume Builder

- Resume Templates

- Resume Formats

- Resume Examples

- Cover Letter Builder

- Cover Letter Templates

- Cover Letter Formats

- Cover Letter Examples

- Career Advice

- Interview Questions

- Resume Skills

- Resume Objectives

- Job Description

- Job Responsibilities

- FAQ’s

Credit Manager Cover Letter Example

Writing a cover letter when applying for a Credit Manager position can be an important step in the job application process. Crafting an effective cover letter can demonstrate your qualifications, set you apart from other candidates, and help you make a great first impression. With the right approach, it can be a great way to show you are the ideal candidate for the role. To help make the process easier, this guide provides key tips and an example cover letter for a Credit Manager position.

If you didn’t find what you were looking for, be sure to check out our complete library of cover letter examples .

Start building your dream career today!

Create your professional cover letter in just 5 minutes with our easy-to-use cover letter builder!

Credit Manager Cover Letter Sample

Dear [Employer],

I am writing to apply for the position of Credit Manager at [Company]. I am confident that I have the qualifications, experience and skills to be an effective leader in this role.

I have substantial experience in credit management and financial analysis. I currently serve as a Credit Manager at [Company], where I oversee the financial management of a portfolio of clients and ensure that credit terms and limits are in compliance with corporate policies and procedures. In this role I have successfully managed delinquencies and credit issues to bring accounts current and ensure timely payments. I am also experienced in cash forecasting, credit reviews and financial analysis.

I have an excellent understanding of credit analysis and risk management, and I am adept at evaluating customers’ creditworthiness and making loan decisions. I am also knowledgeable about federal and state regulations, and I have experience preparing reports for regulatory authorities.

In addition, I have strong interpersonal and communication skills. I am a capable leader, and I have the ability to motivate and encourage my team to do their best.

I am confident that I have the qualifications and experience necessary to excel in the Credit Manager role. I would welcome the opportunity to discuss my qualifications in more detail and would be pleased to meet with you in person.

Thank you for your time and consideration. I look forward to hearing from you soon.

Sincerely, [Your Name]

Create My Cover Letter

Build a profession cover letter in just minutes for free.

Looking to improve your resume? Our resume examples with writing guide and tips offers extensive assistance.

What should a Credit Manager cover letter include?

A Credit Manager cover letter should be tailored to the specific job posting and should include relevant details about the applicant’s qualifications and experience. It should be concise and to the point, highlighting the applicant’s key skills and achievements.

The cover letter should begin with an opening paragraph introducing the applicant and should also explain why they are the best person for the job. This can be followed with a brief overview of the applicant’s experience in credit management, mentioning any notable projects or accomplishments.

The next section of the cover letter should emphasize the applicant’s key skills and qualifications, such as financial analysis and understanding of banking regulations. It should also include any technical skills the applicant may possess, such as experience with credit software or analytics systems.

Finally, the cover letter should end with a call to action, asking the reader to contact the applicant for further discussion. It should also include contact information such as a phone number and email.

By including all these components, a Credit Manager cover letter will demonstrate why the applicant is the ideal person for the job.

Credit Manager Cover Letter Writing Tips

Writing a cover letter for a Credit Manager role can be daunting, but with the right tips and advice, you can create a compelling letter that will help you stand out from the rest of the applicants. Here are some tips to help you write a winning cover letter for a Credit Manager role:

- Research the company: Before you start writing your cover letter, take some time to research the company you are applying to. This will help you create a personalized letter that shows that you understand the company’s needs and values.

- Focus on your accomplishments: When writing your cover letter, focus on your accomplishments and the skills and experiences that make you a great fit for the position. Be sure to include specific examples of your work that showcase your abilities.

- Highlight your financial expertise: Credit Managers are responsible for managing financial records and budgets, so it is important to highlight your financial expertise and experience in your cover letter. Demonstrate your ability to analyze financial data and make sound decisions.

- Show your passion: Make sure to show your passion for the role in your cover letter. Demonstrate your enthusiasm for the position and why you think you would be a great fit for the company.

- Proofread and edit: Before you submit your cover letter, make sure to proofread it for any mistakes and edit as necessary. Typos and grammar errors can make your cover letter appear unprofessional, so be sure to double- check your letter before submitting it.

Common mistakes to avoid when writing Credit Manager Cover letter

Writing a cover letter for a Credit Manager position can be a tricky task, especially if you’re not sure what to include or how to present yourself. To make sure your cover letter stands out from the rest, here are some of the most common mistakes you should avoid when crafting your Credit Manager cover letter:

- Not customizing the letter: One of the biggest mistakes job seekers make is submitting the same generic cover letter to each employer. It is important to tailor the letter to the specific job description and highlight your qualifications that are relevant to the position.

- Not highlighting your strengths: Don’t be afraid to showcase your accomplishments and skills that make you an ideal candidate for the position. Don’t just list your job duties; instead, emphasize what you have achieved in each role.

- Using a generic greeting: Addressing the hiring manager by name makes your letter more personal and indicates that you have done your research.

- Omitting contact information: Make sure to include your full name, phone number, and email address at the top of the letter. Also, be sure to double- check that the information is correct and up to date.

- Making grammar and spelling mistakes: Poor grammar and spelling can be an immediate turn- off to employers. To ensure that your cover letter is error- free, read it over carefully and have someone else review it before submitting.

- Being too wordy: Your cover letter should be concise yet descriptive. Avoid repeating the same information in your resume and stick to the most relevant details that best showcase your skills and experience.

By avoiding these common mistakes, you can ensure that your Credit Manager cover letter stands out from the crowd and gets you noticed by potential employers. Use these tips to write a strong and effective cover letter that will help you land the job.

Key takeaways

Writing an impressive cover letter for a Credit Manager position can make a great impression on a potential employer. It shows that you have done your research and understand what the job entails. Here are some key takeaways for writing an impressive Credit Manager cover letter:

- Tailor your cover letter to the job description. Make sure you include relevant skills and experience that make you a great candidate.

- Show enthusiasm and excitement for the job. Make sure your cover letter conveys your passion for the job and your commitment to doing the best work possible.

- Use strong, clear language. Demonstrate the knowledge and expertise you have in the field and make sure to emphasize the value you will bring to the organization.

- Highlight any successes you have had in previous roles. Showing that you have a track record of success is a great way to stand out as a candidate.

- Show that you understand the company’s needs. Research the company and make sure to include information about how you can help them achieve their goals.

- Keep it short and to the point. A cover letter should be no more than two pages long; make sure you get to the point quickly and succinctly.

- Proofread your cover letter multiple times. Grammatical errors and typos can be a major turn- off, so take the time to check your work before sending it off.

Following these tips will help you write an impressive cover letter for a Credit Manager position. Make sure to tailor it to the job description and make sure it highlights your unique qualifications and experience. With a little bit of effort, you can create a powerful cover letter that will make you stand out as an ideal candidate.

Frequently Asked Questions

1.how do i write a cover letter for an credit manager job with no experience.

Writing a cover letter for a Credit Manager job with no experience can be a challenge. However, with careful planning, you can craft a compelling letter that showcases your strengths and emphasizes why you are a great choice for the job. Start by introducing yourself and explaining why you are interested in the role. Make sure to emphasize your enthusiasm for the job, and highlight any related skills that you possess or experiences you have had. Demonstrate an understanding of the company and the position, and explain why you would be a great fit. Close by thanking the reader for their time and expressing your interest in further discussing the role.

2. How do I write a cover letter for an Credit Manager job experience?

Writing a cover letter for a Credit Manager job with experience can be a great way to show off your skills and accomplishments. Start by introducing yourself and expressing enthusiasm for the position. Be sure to highlight any relevant experience you have that is relevant to the job. Demonstrate your knowledge of the company and the role, and explain why you are the right person for the job. You may also want to include specific accomplishments or results you have achieved in your previous roles that could be beneficial to the new job. Close by thanking the reader for their time and expressing your interest in further discussing the role.

3. How can I highlight my accomplishments in Credit Manager cover letter?

When writing a cover letter for a Credit Manager role, you should highlight any accomplishments or results achieved in your previous roles that could be beneficial to the new job. This could include successfully managing teams, delivering successful projects on time and within budget, or improving customer satisfaction rates. Be sure to provide specific examples of how your accomplishments have had a positive impact in the workplace. You may also want to emphasize how your specific technical and soft skills have helped you succeed in the past.

In addition to this, be sure to check out our cover letter templates , cover letter formats , cover letter examples , job description , and career advice pages for more helpful tips and advice.

Let us help you build your Cover Letter!

Make your cover letter more organized and attractive with our Cover Letter Builder

IMAGES

COMMENTS

This cover letter does a fantastic job of highlighting the candidate's proven ability to transform credit management strategies into tangible results. It's not just about saying you have a knack for something, but backing it up with concrete examples and achievements from previous roles.

A Credit Manager cover letter is a great way to show employers that you are the right candidate for the job. It allows you to showcase your abilities and experience in the field, as well as demonstrate your passion for the role.

Ignoring the Job Description: Align your cover letter with the job requirements. Show how your skills and experience directly relate to the needs of the position. Conclusion. Crafting the perfect Credit Manager cover letter is an essential step in landing your dream job.

Get more job offers & learn how to improve your new cover letter with our free, professionally written Credit Manager cover letter example. Copy and paste this cover letter sample at no cost or alter it with ease in our simple yet powerful cover letter maker. Rewrite Sample with AI

Apr 18, 2024 · Final words: writing your credit manager cover letter closing paragraph . The final paragraph of your credit manager cover letter allows you that one final chance to make a great first impression. Instead of going straight to the "sincerely yours" ending, you can back up your skills with a promise of: how you see yourself growing into the role;

A Credit Manager cover letter should be tailored to the specific job posting and should include relevant details about the applicant’s qualifications and experience. It should be concise and to the point, highlighting the applicant’s key skills and achievements.