- Contact Us: (916) 442-4204 Tap Here To Call Us

A Deed of Trust can be Assigned Apart from the Note, and that often occurs just before a foreclosure. But What Does That Mean? Not Much, the Deed of Trust is Inseparable from the Note

Notes and Deeds of Trust are often assigned to different parties. The question posed is what happens if the Deed of Trust alone is assigned ? A typical assignment of the Deed of Trust alone will purport to assign “all beneficial interest under that certain Deed of Trust dated xyz..” But the long-established law in California is clear: the beneficial interest under a Deed of Trust is held by the party who holds the Note (or is entitled to enforce it), without regard to the assignment of the Deed of Trust .

The subject was again addressed by the California Courts in Domarad v. Fisher & Burke, Inc. (1969) 270 Cal. App. 2d 543 ). The Court noted that a deed of trust is a mere incident of the debt it secures and that an assignment of the debt carries with it the security. “The deed of trust is inseparable from the debt and always abides with the debt, and it has no market or ascertainable value, apart from the obligation it secures and that a deed of trust has no assignable quality independent of the debt, it may not be assigned or transferred apart from the debt, and an attempt to assign the deed of trust without a transfer of the debt is without effect. (emph. added)”

In Stockwell v. Barnum ((1908) 7 Cal. App. 413) the Court stated that this Code “is wholly foreign to deeds of trust, which, instead of creating a lien only, as in the case of a mortgage, passes the legal title to the trustee, thus enabling him in executing the trust to transfer to the purchaser a marketable record title. It is immaterial who holds the note. The transferee of a negotiable promissory note, payment of which is secured by a deed of trust whereby the title to the property and power of sale in case of default is vested in a third party as trustee, is not an incumbrancer to whom power of sale is given…” Stockwell @ 417.

And more recently “it has been established since 1908 that this statutory requirement that an assignment of the beneficial interest in a debt secured by real property must be recorded in order for the assignee to exercise the power of sale applies only to a mortgage and not to a deed of trust.” ( Calvo v. HSBC Bank USA, N.A. (2011) 199 Cal.App.4th 118 , 122.)

Why is that? There is a technical difference between the two security instruments. The mortgage only involves two parties –the borrower who grants the power of sale to the lender, and the lender who then holds the beneficial interest in the mortgage plus the power of sale. A deed of trust, on the other hand, involves three parties: the borrower, the lender, and the trustee who is granted conditional title to the encumbered property as well as the power of sale.

Thus, the deed of trust may thus be assigned one or multiple times over the life of the loan it secures. But if the borrower defaults on the loan, only the current beneficiary may direct the trustee to undertake the nonjudicial foreclosure process. “[O]nly the ‘true owner’ or ‘beneficial holder’ of a Deed of Trust can bring to completion a nonjudicial foreclosure under California law.” Yvanova v. New Century Mortgage (62 Cal. 4th 919) (2016)

An Alternative The Commercial Code also provides a mechanism for recording an assignment of the security if there has been an off-record transfer of the note but no recorded assignment of the deed of trust or mortgage. The buyer of the note can record a copy of the transfer agreement whereby the note was acquired, together with a sworn statement that a default has occurred, and in that event may proceed with a nonjudicial foreclosure. ( Cal. Com. Code, § 9607, subd. (b))

Photos: flickr.com/photos/discoveroregon/49807993897/sizes/l/ flickr.com/photos/mlp52/5208316490/sizes/l/ flickr.com/photos/hazphotos/2615058018/sizes/c/

Creating a Promissory Note Secured by Deed of Trust

Note: Links to our free templates are at the bottom of this long guide. Also note: This is not legal advice

Introduction

Creating a promissory note is an essential part of any loan transaction. It’s a legally binding document that outlines the terms of the loan, such as the amount being lent, interest rate, repayment schedule and other specific provisions. With this legal basis in place, both lender and borrower can rest assured that their agreement is enforceable in court - making it critical to take promissory notes seriously when entering into a loan agreement.

Further to its legal significance, promissory notes are required for tax purposes; The Internal Revenue Service requires all loans to be documented for them to be considered legitimate for tax deductions or exemptions. Neglecting to draft a proper note also means missing out on important protections that come with it; acceleration clauses can allow lenders to recover their due amounts should borrowers fail to make payments on time. At the same time, borrowers can protect themselves from excessive interest or late fees by including provisions such as grace periods in the promissory note.

But drafting an appropriate promissory note may not always feel straightforward - which is why Genie AI provides free templates and step-by-step guidance to help you create your own customised version quickly and easily with its community template library. Whether you’re an individual looking for their own legal protection or setting up a business loan between two parties - you don’t need an account with Genie AI or need any expertise - just access our template library today and get started!

Definitions

Unsecured: A loan agreement between two parties without collateral or security. Demand: A written agreement that requires the borrower to pay the loan in full upon request. Installment: A loan agreement that requires the borrower to make regular payments over a period of time until the loan is paid off. Time: A loan agreement that requires the borrower to pay the loan in full by a specific date. Default: A situation in which the borrower fails to make payments on the loan. Acceleration clause: A clause in the agreement that outlines what will happen if the borrower fails to make payments on the loan. Lien: A legal right to take another person’s property in order to satisfy a debt.

Definition of a Promissory Note

Different types of promissory notes, installment, who are the lender and borrower, what terms should be included in a promissory note, amount of loan, interest rate, payment schedule, default and acceleration clause, signature of both parties, how to create a legally binding promissory note, draft a document, include all necessary terms, have all parties involved sign off, what happens if one party breaches the terms of the note, what are the legal implications of a promissory note, tips for creating a promissory note, clearly define the terms, include a repayment schedule, make sure all parties understand the terms, document all payments, store the promissory note in a secure place, how to file a promissory note, how to collect on a promissory note, get started.

- Understand what a promissory note is and how it works - it is a written document that includes an agreement to repay a debt

- Learn what is typically included in a promissory note such as parties’ names and contact information, amount of debt, repayment terms, and payment due dates

- Familiarize yourself with important legal terms such as “promise to pay”, “payor”, and “payee”

- When you have a complete understanding of a promissory note, you can check this step off your list and move on to the next step.

- Understand the two main types of promissory notes: secured and unsecured

- A secured promissory note is backed by collateral and is used when the borrower has a lower credit score

- An unsecured promissory note does not require collateral, though the borrower may be required to pay higher interest rates

- Consider the type of promissory note that best suits your needs

Once you understand the two main types of promissory notes and determine the type that best suits your needs, you can check this off your list and move on to the next step.

- Understand the basics of an unsecured promissory note. This type of promissory note does not require any collateral to be put up in order to secure the loan.

- Create the document. This document should include the date, the names of the parties involved, the amount of money being borrowed, and the interest rate, if applicable.

- Sign and date the document. Both parties should sign and date the document in order to make it legally binding.

- Have the document notarized. Having the document notarized is not required, but it is a good practice to ensure that the document will be accepted in a court of law if necessary.

Once you have completed these steps, you can check off this step and move on to the next step of creating a promissory note: ### Demand.

- Create a demand clause that states the amount of money due, the due date, and any other specific terms of payment

- Include the name of the lender and borrower, the amount of money being lent, and the due date

- The demand clause should state that the borrower is legally obligated to pay the amount of money due on the due date specified

- Make sure the demand clause is signed by both the borrower and the lender

- Once the demand clause has been created and both parties have signed it, this step is complete and you can move on to the next step of creating an Installment clause.

- Decide how much money will be borrowed and how many payments will be made

- Specify the amount of each payment and the due date for each payment

- List any late fees or other penalties associated with late payments

- Specify any fees that will be charged to the borrower

- Include a clause that allows the lender to declare the entire amount due immediately in the event of default

- Include a clause that states the note is secured by collateral

- Include a clause that stipulates the law under which the note will be enforced

- Sign and date the promissory note

Once these steps are completed, you will have a completed promissory note ready to be signed by both parties.

- Determine the term of the promissory note (the amount of time before the debt is due).

- Set the due date of the promissory note.

- Specify the interest rate and payment schedule.

- Include any clauses or stipulations that the borrower must adhere to.

- Make sure to provide clear language that states when and how the debt must be repaid.

- When you have completed all of the above, you can check off this step and move on to the next step.

• Determine who the lender and borrower are in the promissory note. The lender is the party that is providing the loan and the borrower is the party receiving the loan. • Record the names of both the lender and borrower in the promissory note. • You can check this off your list once the names of both the lender and borrower have been recorded in the promissory note.

- Include the date of the loan agreement

- Identify the lender and borrower

- Include the loan amount

- Specify the interest rate and payment due date

- Specify the terms of repayment

- Include a clause for late fees

- Include a clause for default

- Include a clause for acceleration

- Include a clause for attorney’s fees and costs

- Include a clause for governing law

- Include a clause for choice of venue

- Include a clause for waiver

- Include a clause for severability

- Include a clause for the entire agreement

When all the above terms are included, you can check this off your list and move on to the next step.

- Review the date of the loan in the document.

- Make sure it is accurate and matches the date of the loan.

- Update the date if needed.

- Ensure all parties sign the document on the correct date.

- Check off this step when the date is correct and all parties have signed the document.

- Estimate the total amount of the loan, including principal and any interest payments due

- Determine the payment structure for the loan, such as monthly payments over a specified period of time

- Include the total loan amount and payment structure in the promissory note

- When finished, move on to the next step of determining the interest rate for the loan.

- Decide on the interest rate to be charged for the loan.

- Discuss the interest rate with the borrower and agree on a rate that is fair to both parties.

- Include the interest rate in the text of the promissory note.

- Once the interest rate has been agreed upon and included in the promissory note, you can check this step off your list and move on to the next step.

- Determine the payment schedule: when and how often payments will be due

- Include the timing and amount of each payment

- Make sure the payment schedule is clear, as this will be legally binding

- Once the payment schedule is determined and included in the promissory note, you can check this step off your list and move on to the next step.

- Read over the default and acceleration clause in the promissory note to ensure it is in accordance with the laws of your state.

- Determine if you want to include a default and acceleration clause in the promissory note.

- If yes, include a clause that states that the entire balance of the loan will become due upon the borrower’s default.

- If no, remove any default and acceleration clause included in the promissory note.

- Check that the default and acceleration clause is correctly included in the promissory note.

You will know when you can check this off your list and move on to the next step when you have read over the default and acceleration clause, determined if you want to include it, and have checked that it is correctly included in the promissory note.

- Both parties must sign the promissory note in the presence of a witness

- The witness must also sign the document

- The signature of each party must be in blue or black ink

- Make sure to include the date of the signature of both parties

- When all parties have signed the document, you will have successfully completed this step and can move on to the next step.

- Identify the parties to the promissory note (i.e. the maker and the payee).

- Specify the amount of money owed, the interest rate (if any), and the due date or repayment schedule.

- Include language that explicitly states the maker’s obligations and promises to pay the payee.

- Include any additional details such as late fees or other penalties for non-payment.

- Sign and date the document in the presence of a witness.

Once you have completed the steps above, you can move on to the next step of drafting the document.

- Begin by drafting a document that states the loan amount, repayment terms, and payment schedule

- Include the date of the note, the names of the borrower and lender, and any other pertinent information

- Make sure to include the legal language required for a promissory note to be valid

- When the document is complete, have it reviewed by a lawyer for accuracy and compliance

- Once the document is approved and signed, the promissory note is legally binding and can be used in a court of law

- You will know you have completed this step when you have a written, legally binding promissory note that has been reviewed and approved.

- Ensure the promissory note includes the full legal name of all parties involved

- Include the amount of money being loaned, the interest rate and the payment schedule

- Specify what happens if payments are missed or not made

- Include the date when the note is signed

- Include any other information required by the state in which the note is being written

- Make sure the document is signed and dated by all parties involved

- Once all the necessary terms have been included in the document and all parties have signed, the promissory note is ready to be used.

- Make sure all parties involved sign the promissory note.

- All parties should provide their full legal names and addresses.

- Every signature should be accompanied by a date.

- Depending on the state, you may need the signature of a witness or notary public.

- You will know you have completed this step when all parties have signed the promissory note.

- Contact a lawyer and/or review the terms of the note to determine what the consequences for breaching the terms are

- Try to negotiate a new agreement if possible, or find a way to come to an amicable resolution

- If the breach is material, take legal action to enforce the promissory note and claim damages

- When all parties have agreed on a resolution or the breach has been addressed, you can check this step off your list and move on to the next step.

- Research the applicable laws and regulations related to promissory notes in your jurisdiction

- Speak with an attorney to ensure that any promissory note you create complies with applicable laws

- Understand the legal implications of a promissory note, including the rights and responsibilities of the parties involved

- Familiarize yourself with the applicable state and/or federal laws that govern the creation of a promissory note

When you can check this off your list and move on to the next step:

- When you have completed the research, spoken with an attorney, and are familiar with the applicable laws and regulations related to promissory notes.

- Make sure to include the amount of money being loaned, the interest rate, and the repayment schedule.

- Ensure that all parties involved have a clear understanding of the repayment terms, including any fees or late payment penalties that may be applicable.

- Consider adding a clause that states if the borrower is unable to pay the loan back, the lender can take legal action.

- Have both the borrower and lender sign the document, and have them both keep a copy for their records.

- Once all parties have agreed and signed the promissory note, you can check off this step and proceed to the next step.

- Define the amount of money being borrowed, the interest rate (if applicable), the repayment schedule, and any other specific terms of the loan

- Include language indicating that the borrower is responsible for repaying the loan, as well as any applicable late fees

- Specify whether the loan is secured (backed by collateral) or unsecured

- Include information on when the loan is to be repaid, including the date and location of repayment

- Include a clause indicating that the borrower is responsible for any costs associated with collecting the loan if the borrower defaults

- When finished, have the note reviewed by a qualified professional, such as an attorney

- Once reviewed and all parties agree to the terms, have the promissory note signed by all parties

You’ll know you can check this off your list and move on to the next step when the note is reviewed by a qualified professional, all parties agree to the terms, and the promissory note is signed by all parties.

- Determine the amount and frequency of payments that will be made

- Create a repayment schedule that outlines the amount and timing of each payment

- State whether payments are due monthly, quarterly, or annually

- State whether payments will be made in one lump sum or multiple payments

- Specify the date when the repayment schedule begins

- Make sure that all parties agree to the repayment schedule

Once the repayment schedule has been documented and agreed to by all parties, you can move on to the next step.

- Go over the terms of the promissory note with all parties involved, making sure everyone understands the agreement.

- This includes explaining any repayment schedules, the amount and dates of payments, and any other conditions that were agreed upon.

- Ask any questions and make sure everyone is in agreement before moving on.

- Once all parties understand the terms and agree to them, you can check this step off your list and move on to the next step.

- Make a copy of the promissory note for all parties involved

- Record the date and amount of each payment

- Keep track of any deadlines for payments

- Make sure all parties sign off on the payment records

- You can check off this step when all parties have signed off on the payment records and all payments have been documented.

- Make sure to keep a hard copy of the promissory note in a secure location, such as a safe or filing cabinet.

- If you choose to use an online platform to store the promissory note, make sure it is a secure, encrypted platform.

- Once the promissory note has been stored in a secure location, you can check this step off your list and move on to the next step.

- Gather all the necessary information for the promissory note, such as the amount due, payment terms and interest rate.

- Write the promissory note on paper and include all the necessary information.

- Make sure all the parties involved sign the promissory note.

- File the promissory note with the local court clerk.

- Once the promissory note is filed, you will receive a confirmation of its filing.

- You will know when you have completed this step when you have received the confirmation of the filing of the promissory note.

- Gather all the relevant documents related to the promissory note. These include the promissory note itself, any payment history or records, and any court orders that have been issued.

- Contact the debtor to let them know that you plan to collect on the note. You can do this by sending a letter or email, or by calling them directly.

- If the debtor is unwilling or unable to pay, take legal action. You may need to file a lawsuit or take other measures to ensure you get paid.

- Monitor the situation to make sure the debtor is making payments in accordance with the promissory note.

- Once the debt has been paid in full, make sure to get a written document from the debtor confirming the debt has been satisfied.

You’ll know you can check this off your list and move on to the next step when the debt has been paid in full and you have a written document from the debtor confirming the debt has been satisfied.

Q: Do I need to take meeting minutes?

Asked by Emma on April 15, 2022. A: Meeting minutes are a useful tool for recording the key points made and decisions taken during a meeting. They are particularly useful for tracking team progress, holding members accountable and providing clarity for future reference. Whether or not you need to take meeting minutes depends on the type of meeting, its purpose and its size. Generally speaking, it’s best practice to take meeting minutes in all formal meetings, as they provide a record of the discussion and help ensure that everyone is on the same page.

Q: What’s the difference between UK and US laws regarding taking meeting minutes?

Asked by Noah on February 12, 2022. A: The laws governing taking meeting minutes in the UK and US are quite similar. In both countries, corporate board meetings must be minuted in order to be legally valid. In addition, both countries require that meeting minutes be kept securely and confidentially, with only those attending the meeting having access to them. However, there are some differences between the two countries in terms of other aspects of taking meeting minutes. For example, in the UK it is not necessary for all formal meetings to be minuted whereas in the US it is generally required.

Q: How can I ensure my meeting minutes are accurate?

Asked by Abigail on August 24, 2022. A: Ensuring that your meeting minutes are accurate is essential for ensuring that everyone involved in the meeting has a clear understanding of what was discussed and agreed upon. One way to ensure accuracy is to have someone present at the meeting who is responsible for taking notes and recording the key points made during the discussion. It’s also important to follow up with those present after the meeting to confirm any decisions taken or points raised so that they can be accurately recorded in the meeting minutes. Finally, it’s also helpful to review your notes after each meeting to make sure everything has been accurately recorded before filing them away.

Q: What should I include in my meeting minutes?

Asked by Isabella on March 5, 2022. A: Meeting minutes should include an overview of who attended the meeting, when it took place and why it was held. It should also list any decisions taken during the discussion, any action points assigned to individuals or teams, any ideas or proposals put forward, any problems or issues identified and any further action required. Additionally, it’s important to note when further meetings or follow-ups are scheduled so that everyone is clear about when these will take place and what tasks need to be completed before then.

Q: How long should I keep my meeting minutes?

Asked by Elijah on September 7, 2022. A: The amount of time that you should keep your meeting minutes depends on the type of organization you have and its record keeping requirements. Generally speaking, for most organizations you should keep all formal meeting minutes for at least three years after they were taken as these could be needed for legal reasons or as evidence at a later date. For organizations with more stringent record keeping requirements such as government agencies or publicly traded companies you may need to keep your records for an even longer period of time so it’s best to check with your organization’s legal counsel before disposing of any records.

Q: If I don’t take professional meeting minutes what other options do I have?

Asked by Liam on November 19, 2022. A: If you don’t want to take professional meeting minutes there are some other options available depending on your specific needs and preferences. For example, you could use audio recordings or video recordings of meetings which can be kept as a record but do not need to be written up into formal documents unless necessary. You could also use informal notes taken during meetings which could then be used as a basis for creating formal notes if needed at a later date.

Q: What if I forget something important during a meeting?

Asked by Mia on October 8, 2022. A: If you find yourself forgetting something important during a meeting it can help to have someone else present who can act as an impartial note taker who can pick up on anything you may miss while also providing an additional perspective on things being discussed during the meeting. If there isn’t anyone else available then it’s worth asking everyone present if they can remember anything that was missed which can then be added into any official documents afterwards if necessary. It’s also useful to have an agenda prepared beforehand so that you have something to refer back to if you forget anything during the discussion which could help jog your memory or provide clarity if needed later on down the line.

Q: What format should I use when writing up my professional meetings?

Asked by Logan on December 21, 2022. A: When writing up professional meetings it’s best practice to use a consistent format so that all participants can easily refer back to them at any given time without having to search through multiple different versions of notes taken at different times throughout the course of a discussion. A standard format would include including an overview of who attended and when; a list of topics discussed; any decisions taken; action points assigned; ideas discussed; problems identified; further action required; next steps; and follow-up dates/times if applicable. Using this format will help ensure that all relevant information is captured accurately so that everyone involved can easily refer back to it in future discussions or meetings related to the same topic(s).

Q: How do I set up effective follow-up dates after taking professional meeting minutes?

Asked by Ava on July 31, 2022. A: Setting up effective follow-up dates after taking professional meeting minutes is essential for ensuring that all tasks assigned during a discussion are completed on time and that tasks aren’t forgotten about or overlooked in future meetings related to the same topic(s). It’s important to take into account individual workloads when assigning tasks so that everyone has enough time and resources available to complete them without becoming overwhelmed or overworked. Additionally, it’s helpful to assign tasks with specific deadlines and specify who is responsible for each task so that everyone involved knows exactly what needs to be done and when it needs to be done by in order for everything related to the task(s) assigned during the discussion is completed successfully and efficiently.

Q: How can I ensure my team understands my professional meetings?

Asked by Ethan on May 22, 2022. A: Ensuring that your team understands your professional meetings is essential for ensuring that everyone involved has clarity around what was discussed during a discussion and each person’s role within achieving any goals set out during the discussion either individually or as part of a team effort going forward afterwards if applicable . It’s worth having regular check-ins with each team member after each discussion so that any questions they may have can be answered in full and any misunderstandings clarified before moving forward with implementing any decisions taken during an earlier discussion . Additionally , providing written summaries of each discussion along with action points assigned & deadlines set can help provide clarity & encourage accountability within your team moving forward .

Q: What tools should I use when taking professional meetings?

Asked by Olivia on June 18, 2022 A: There are many different tools available which can help make taking professional meetings easier & more efficient . For example , using digital tools such as note taking apps & document editors like Google Docs & Microsoft Word can help streamline & simplify collating information & recording key points made during discussions , while project management software such as Asana & Trello can help track progress & assign tasks going forward . Additionally , using video conferencing tools like Zoom & Skype allow teams located remotely from one another across multiple locations around the world stay connected while still being able ensure successful & productive conversations between all participants .

Q: What do I do if someone disagrees with me during a professional meeting?

Asked by Noah on January 30, 2022 A : Disagreements are bound happen from time-to-time , particularly when discussing important topics within teams . It’s important not take disagreements personally , but rather approach them from an objective viewpoint & listen calmly & respectfully what others have say . It’s helpful encourage constructive dialogue between all parties involved by asking open-ended questions which allow all participants express their opinions freely without judgement or criticism . Additionally , finding common ground between conflicting arguments & looking ways come up with solutions which meet everyone’s needs without compromising anyone’s position allows everyone reach agreements quicker & more effectively than arguing back & forth without resolution .

### Q : Should I always follow protocol when taking professional meetings ? Asked by Emma on April 15 , 2022 A : While protocol should generally always followed when taking professional meetings , there may times where breaking protocol might actually beneficial depending on particular situation at hand . For example , protocols such setting agendas & assigning action points may not always necessary when dealing smaller informal discussions where decisions don't necessarily need be tracked afterwards . Additionally , following protocols rigidly without considering whether certain rules might actually hinder productivity within particular contexts might actually counterintuitive . Therefore , while following protocol generally helps ensure successful conversations occur between all parties involved , there may times where breaking protocol might actually beneficial depending particular situation at hand .

Example dispute

Suing companies on the basis of a promissory note.

- The plaintiff can bring a lawsuit against the company if they have a valid and enforceable promissory note.

- The promissory note must include clear terms and conditions that specify the parties’ obligations, including the amount of money owed, the interest rate, and the due date.

- The promissory note must also include a provision for damages in the event of a breach of contract.

- The plaintiff should be able to prove that the company did not fulfill its obligations under the promissory note, either by failing to make payments or by not fulfilling other requirements.

- The plaintiff can seek damages for any losses sustained as a result of the company’s breach of the promissory note, including any unpaid interest, late fees, or legal costs.

- The plaintiff must also be able to prove that the company had the ability to fulfill its obligations under the promissory note, such as having the necessary funds.

- The court may also consider any efforts the plaintiff made to resolve the issue before filing the lawsuit.

- The court may also impose punitive damages if the company’s breach of the promissory note was willful and/or malicious.

- Settlement may be reached out of court, in which case the plaintiff may receive a percentage of the amount owed or a lump sum payment.

- In the event that the court rules in favor of the plaintiff, the damages awarded may include the full amount owed plus any costs associated with the lawsuit.

Templates available (free to use)

Allonge To Promissory Note Commercial Property Loan California Allonge To Promissory Note Commercial Property Loan Florida Allonge To Promissory Note Commercial Property Loan Illinois Allonge To Promissory Note Commercial Property Loan Massachusetts Allonge To Promissory Note Commercial Property Loan New York Allonge To Promissory Note Commercial Property Loan Ohio Allonge To Promissory Note Commercial Property Loan Pennsylvania Allonge To Promissory Note Commercial Property Loan Texas Amended Restated And Renewal Promissory Note Lender Friendly Florida Assignment Of Promissory Note Unsecured To Revocable Trust Contingent Promissory Note Convertible Promissory Note Demand Promissory Note Extension Of Promissory Note Form Of Convertible Promissory Note Gap Promissory Note Lender Friendly New York Line Of Credit Promissory Note Loan Agreement And Promissory Note Negotiable Promissory Note Non Negotiable Long Form Promissory Note Non Negotiable Simple Promissory Note Plan Loan Promissory Note 401K Promissory Note Agreement Promissory Note And Security Agreement Promissory Note Commercial Property Loan Lender Friendly Promissory Note Commercial Property Loan Lender Friendly California Promissory Note Commercial Property Loan Lender Friendly Florida Promissory Note Commercial Property Loan Lender Friendly Georgia Promissory Note Commercial Property Loan Lender Friendly Illinois Promissory Note Commercial Property Loan Lender Friendly Texas Promissory Note Commercial Property Loan Lender Friendly Without Loan Contract New Jersey Promissory Note Commercial Property Loan Lender Friendly Without Loan Contract New York Promissory Note Extension Promissory Note Fixed Rate Full Recourse Residential Property Loan Lender Friendly California Promissory Note Line Of Credit Promissory Note Residential Property Loan Non Institutional Lender New Jersey Promissory Note Secured By Deed Of Trust Promissory Note Uk Recourse Promissory Note Revolving Line Of Credit Promissory Note Revolving Promissory Note Secured Convertible Promissory Note Subordinated Convertible Promissory Note Subordinated Promissory Note Unsecured Convertible Promissory Note Unsecured Promissory Note

Interested in joining our team? Explore career opportunities with us and be a part of the future of Legal AI.

Genie AI Raises $17.8 Million to build Agentic Legal AI

Driving Efficiency in Legal Negotiations: One Clause at a Time

Ditch the word processor - superdrafter is here, openai vs meta using - ai podcast - episode 18, related posts.

Creating a Professional Marketing Consulting Agreement

Creating an Employee Patent Policy (Including Invention Compensation)

Drafting a Finders Agreement

Draft quality legal agreements or review documents in 3 minutes.

Administration

Legal services, manufacturing, construction, company types, comparisons, business categories, information.

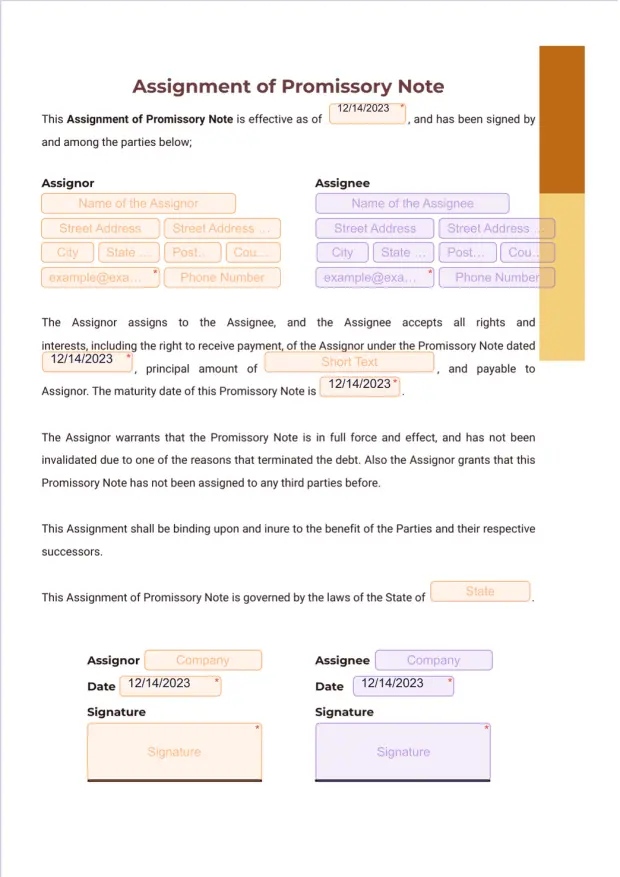

Assignment of Promissory Note

Generate an assignment of promissory note. Drag and drop to customize in seconds. Works great on any smartphone, tablet, or desktop. Converts to a PDF.

An Assignment of a Promissory note is a bilateral document that transfers the rights and obligations associated with a promissory note from one party (the assignor) to another party (the assignee). Jotform Sign ’s Assignment of Promissory Note shows the date the document was created, assignor information, assignee details, start and end dates of the promissory note, total amount due, interest rate percentage, and chosen payment method.

You can easily make changes to this Assignment of Promissory Note using our intuitive online builder. No coding or design experience is required — just drag and drop to add or edit form fields, update the wording of the document, include additional signature fields, change fonts and colors, and more. You can also set up an automated signing order to ensure signatures are received in a timely manner and in the correct order. Once signed, you’ll automatically receive a finalized version of the document for your records.

Letter of Authorization

Create a signable letter of authorization. Works seamlessly on any device. Android and iOS compatible. Convert to PDF. Easy to customize and share. No coding.

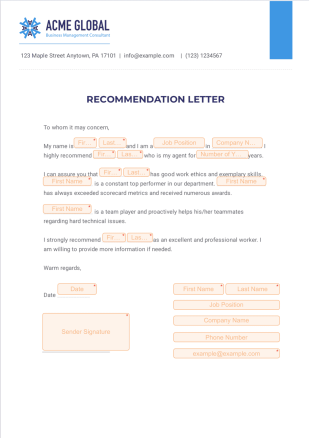

Professional Letter of Recommendation

Create a professional letter of recommendation in seconds. Works great on any device. Android and iOS compatible. Easy to customize and share. No coding required.

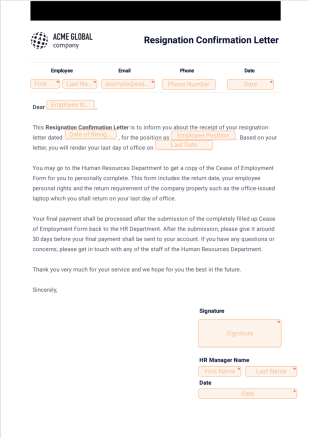

Resignation Confirmation Letter

Confirm your employee’s resignation with this easily customizable letter. Create once, send multiple times. Works on any device — desktop, tablet, and mobile.

Job Confirmation Letter

Create a job confirmation letter and send it out for signature. Works great on any device. Easy to customize. Download the finalized document as a PDF.

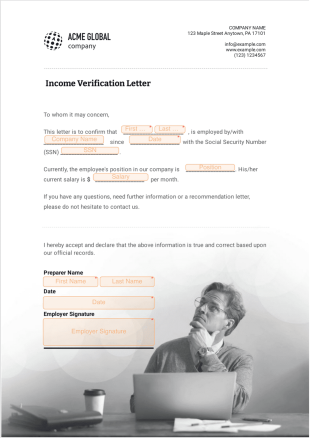

Income Verification Letter Template

Create an income verification letter that works for your business. Easily customizable. Works on all devices — iOS and Android. Download immediately as a PDF.

Letter of Recommendation for Student

Create and collect letters of recommendations for students with Jotform Sign. Drag and drop to customize. Works on mobile, tablet, and desktop devices.

These templates are suggested forms only. If you're using a form as a contract, or to gather personal (or personal health) info, or for some other purpose with legal implications, we recommend that you do your homework to ensure you are complying with applicable laws and that you consult an attorney before relying on any particular form.

- Diversity, Equity, and Inclusion

- Philanthropy

- Home Loan Calculators

- All In One Loan™ Simulator

- Rate Buydown Calculator

- Home Loan Types

- Loan Process

- Mortgage Loan Checklist

- Your Credit

- Mortgage Explainer Videos

- Communication

- Realtor Portal

- Builder Portal

- Operations & Admin

- Loan Originator

- Open a Branch

The Differences between the Deed, the Note, and the Deed of Trust

By Maria Hinerman

The Deed is a legal document which gives rights to something. In real estate, a Deed transfers title of ownership and gives the new owner the rights to use the property. Click here to find out more about Deeds and the different types there are.

The Note (or Promissory Note) is a contract where a party makes a promise to pay a sum of money to another party under specific terms. In real estate, the Note is the legal document that binds the borrower to repay a mortgage loan. This agreement will contain important loan specification, such as the loan amount, interest rate, due dates, late charges, and the terms of the mortgage.

The Deed of Trust

The Deed of Trust (or Mortgage or Security Instrument) is a legal document that grants the lender the rights to take the property if the borrower goes into default and does not pay under the terms of the Note. The lender holds title to the property until the borrower has repaid the debt in full.

The Differences

- The Note is signed by the people who agree to pay the debt (the people that will be making the mortgage payments). The Deed and the Deed of Trust are signed by those who will own the property that is being mortgaged. Typically in a residential settlement, the signers of the Note and the Deed of Trust are the same, but this is not always the case.

- The Note itself has virtually nothing to do with the property. If the borrower does not pay the agreed amount, the lender can sue “under the Note” and obtain remedies for breaching the contract. The Deed of Trust is the document that grants the lender the rights to take the property if the loan is not repaid.

- The Deed and the Deed of Trust need to be recorded in the recording office of the property’s county or town, while the Note is returned to the lender.

To learn more mortgage terms, please visit our Mortgage Terms Glossary page.

If you are ready to purchase a home or refinance your own, contact one of our licensed Mortgage Loan Originators today to get started !

These blogs are for informational purposes only. Make sure you understand the features associated with the loan program you choose, and that it meets your unique financial needs. Subject to Debt-to-Income and Underwriting requirements. This is not a credit decision or a commitment to lend. Eligibility is subject to completion of an application and verification of home ownership, occupancy, title, income, employment, credit, home value, collateral, and underwriting requirements. Not all programs are available in all areas. Offers may vary and are subject to change at any time without notice. Should you have any questions about the information provided, please contact us.

- I accept the privacy rules of this site

Recent Posts

- Energage and USA Today Names NFM Lending a Top Workplace USA 2024

- How the Mortgage Refinance Process Works

- NFM Lending welcomes Greg Bork and Kevin Holmes as Branch Managers in Maryland

- NFM Lending’s Managing Director Greg Sher to Speak at Inaugural HousingWire IMB Summit

- Home Loans for Teachers: Special Programs and Tips

- NFM Lending’s Managing Director Greg Sher Honored with HousingWire’s 2024 Vanguard Award

- First Name *

- Last Name *

- State * -- Select State -- Alabama Alaska Arizona Arkansas California Colorado Connecticut Delaware District of Columbia Florida Georgia Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire New Jersey New Mexico New York North Carolina North Dakota Ohio Oklahoma Oregon Pennsylvania Rhode Island South Carolina South Dakota Tennessee Texas Utah Vermont Virginia Washington West Virginia Wisconsin Wyoming Armed Forces Americas Armed Forces Europe Armed Forces Pacific

- Loan Number or last 4 digits of the Social Security Number *

- Telephone Number *

Contact Page

- Name * First Last

- Phone Number *

- Select what you are contacting us about: * Select General New Loan Appraisal Credit Inquiries Payoff Request FHA Case Transfer Complaints CCPA

All FHA Case Transfer Requests must be sent in writing via email to: [email protected] . The request must include the FHA Case number, the new lender’s Origination ID or Sponsor ID, the full subject property address, and a letter signed and dated by the borrower expressing desire for the transfer.

Request for payoff should be submitted to the current servicer of the loan: If your loan is being serviced by the NFM Lake Zurich Servicing Center, please call 1-866-352-6802 to request a payoff. You can also request a payoff via the online borrower portal, if you are a registered user on the portal. If your loan is being serviced by the NFM Lending Linthicum Maryland Office, you may submit the request to [email protected] or call 1-866-765-1827.

- Property Location Select State Alabama Alaska Arizona Arkansas California Colorado Connecticut Delaware District of Columbia Florida Georgia Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire New Jersey New Mexico New York North Carolina North Dakota Ohio Oklahoma Oregon Pennsylvania Rhode Island South Carolina South Dakota Tennessee Texas Utah Vermont Virginia Washington West Virginia Wisconsin Wyoming

- FHA Case Number *

- New Lender's Originator ID *

- Subject Property Address *

- New Borrower

- Comments This field is for validation purposes and should be left unchanged.

- Email Address *

- Property State * Select a State Alabama Alaska Arizona Arkansas California Colorado Connecticut Delaware District of Columbia Florida Georgia Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire New Jersey New Mexico New York North Carolina North Dakota Ohio Oklahoma Oregon Pennsylvania Rhode Island South Carolina South Dakota Tennessee Texas Utah Vermont Virginia Washington West Virginia Wisconsin Wyoming

- Loan Purpose * Choose One... Purchase Refinance Home Improvement (203k loan)

- How did you hear about us? My Realtor – RLTR My Builder – BLDR I’m a Past Client – PC A friend or family member Advertisement – AD (Zillow, Facebook, etc…) Business Contact - BUS (Financial Planner, Attorney, etc..)

- First and last name of referral source (if applicable)

- I agree to receive SMS Text Messages at the above phone number from NFM Lending for follow up purposes for banking products. Message and data rates may apply. Message frequency varies. Text HELP for help. Text STOP to cancel. By clicking this box, you agree to receive SMS.

- Name This field is for validation purposes and should be left unchanged.

IMAGES

VIDEO

COMMENTS

A promissory note refers to a written document stating that a certain amount of money will be paid to someone by a specified date. Generally, it is not necessary for the note to be recorded officially. The borrowe…

Transferring ownership of a promissory note without a formal contract can lead to confusion and potential legal issues. The importance of a promissory note transfer contract lies …

Simultaneous with the execution of this Agreement, Seller shall execute and deliver to Buyer a fully executed Assignment of Promissory Note and Assignment of Deed of Trust in forms …

But the long-established law in California is clear: the beneficial interest under a Deed of Trust is held by the party who holds the Note (or is entitled to enforce it), without regard to the assignment of the Deed of Trust.

Creating a promissory note secured by a deed of trust is an essential step in protecting the investment of lending parties, whilst providing enforceable repayment agreements for borrowers. Our free templates and this guide can …

Promissory Note means an instrument that evidences a promise to pay a monetary obligation, does not evidence an order to pay, and does not contain an acknowledgment by a bank that …

Generate an assignment of promissory note. Drag and drop to customize in seconds. Works great on any smartphone, tablet, or desktop. Converts to a PDF.

PARTIAL ASSIGNMENT OF DEED OF TRUST AND NOTE. KNOW ALL BY THESE PRESENTS, that on this _____ day of __________________, _________, for valuable …

The Note (or Promissory Note) is a contract where a party makes a promise to pay a sum of money to another party under specific terms. In real estate, the Note is the legal document that binds the borrower to repay a …