Claim Specialist Cover Letter Example (Free Guide)

Create an claim specialist cover letter that lands you the interview with our free examples and writing tips. use and customize our template and land an interview today..

Writing a compelling cover letter for a claim specialist role can be difficult. But, with the right knowledge and advice, you can make sure you stand out from the competition and get noticed by potential employers. This guide will provide you with the tips and tricks needed to create an effective cover letter for a claim specialist role.

We will cover:

- How to write a cover letter, no matter your industry or job title.

- What to put on a cover letter to stand out.

- The top skills employers from every industry want to see.

- How to build a cover letter fast with our professional Cover Letter Builder .

- What a cover letter template is, and why you should use it.

Related Cover Letter Examples

- Finance Advisor Cover Letter Sample

- Experienced Real Estate Agent Cover Letter Sample

- Experienced Mortgage Advisor Cover Letter Sample

- Compliance Analyst Cover Letter Sample

- Credit Administrator Cover Letter Sample

- Credit Manager Cover Letter Sample

- Finance Manager Cover Letter Sample

- Actuary Cover Letter Sample

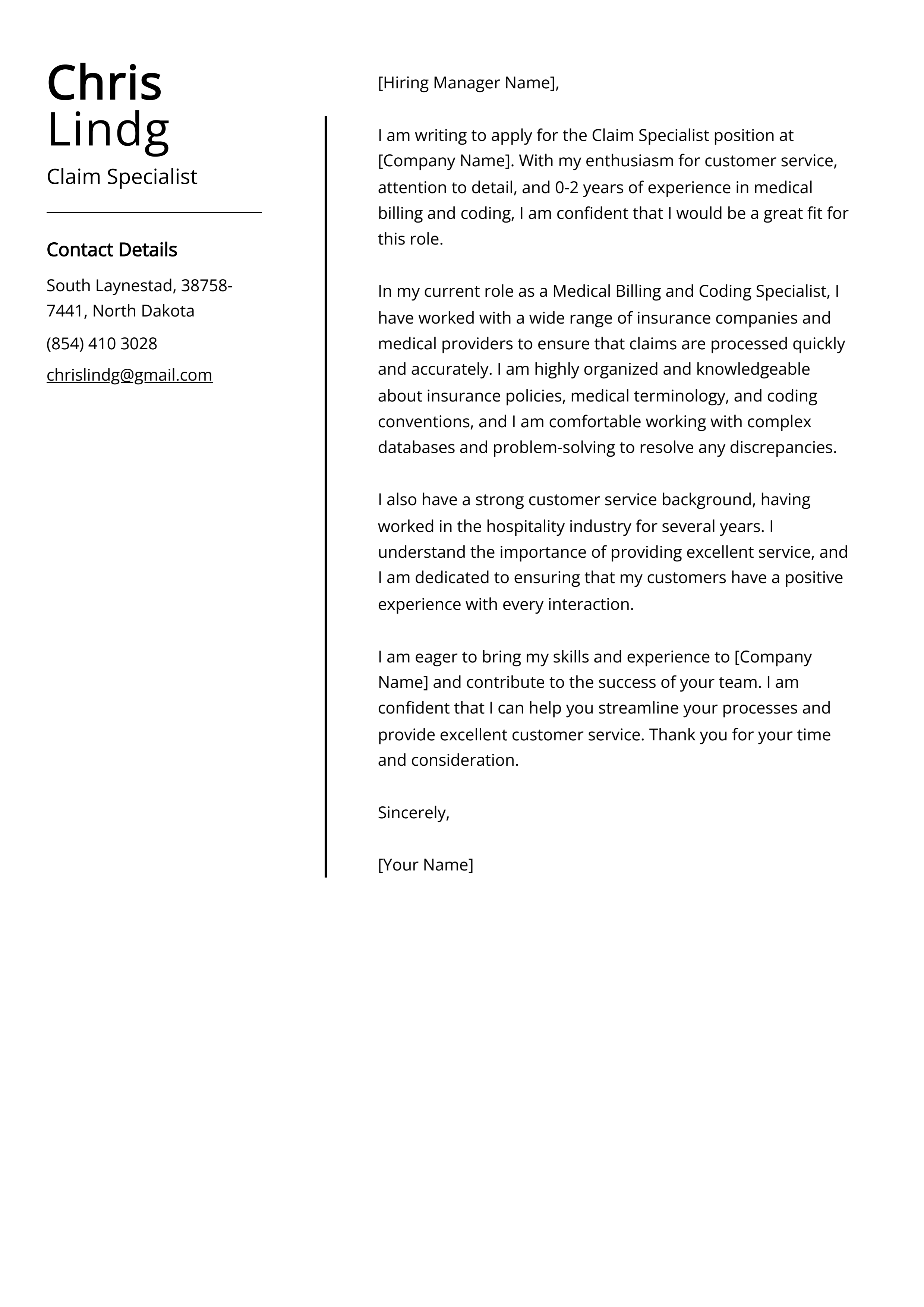

Claim Specialist Cover Letter Sample

- Account Administrator Cover Letter Sample

- Account Analyst Cover Letter Sample

- Accounting Analyst Cover Letter Sample

- Accounting Assistant Cover Letter Sample

- Accounting Associate Cover Letter Sample

- Accounting Auditor Cover Letter Sample

- Accounting Consultant Cover Letter Sample

- Accounting Coordinator Cover Letter Sample

- Accounting Manager Cover Letter Sample

- Accounting Specialist Cover Letter Sample

- Audit Director Cover Letter Sample

Dear Hiring Manager,

I am excited to apply for the position of Claim Specialist with your organization. As a highly organized professional with experience in the insurance industry, I believe I can make an immediate and positive contribution.

For the past five years, I have worked as a Claim Specialist for XYZ Insurance. In this role, I have gained a comprehensive understanding of the claim process, from the initial assessment to the resolution of the claim. I am adept at analyzing policies and regulations to ensure the proper compensation for claimants. I also have a good understanding of the nuances of the insurance industry, which has enabled me to provide exceptional customer service.

I am highly organized and have excellent time management skills. My ability to prioritize tasks and multitask has enabled me to stay on top of the claim process. I am also highly detail-oriented and take pride in ensuring accuracy in my work. I am a team player and accustomed to working with people in different departments to ensure that claims are properly processed.

In addition, I have a strong customer service background. I understand the importance of providing excellent customer service to claimants and I have the ability to handle difficult and emotional conversations in a professional manner. I am skilled at resolving conflicts and finding solutions that are satisfactory to all parties.

I am confident that I have the skills and experience necessary to be a successful Claim Specialist for your organization. Please review my attached resume and contact me if you have any questions. I look forward to hearing from you.

Sincerely, John Doe

Why Do you Need a Claim Specialist Cover Letter?

- A Claim Specialist cover letter is essential when applying for a job in the insurance claims industry.

- It serves as a way to introduce yourself to the employer and to explain why you are the best candidate for the position.

- In the cover letter, you can highlight your skills and experience related to the field of insurance claims and provide examples of how you can help the employer.

- A cover letter also helps you stand out from other candidates, as it allows you to demonstrate your knowledge and passion for the job.

- In addition, a well-crafted cover letter can give the employer a better understanding of why you think you are the right person for the job.

- Finally, a cover letter is a great way to showcase your writing skills and to demonstrate your enthusiasm for the position.

A Few Important Rules To Keep In Mind

- Make sure to include a brief introduction of yourself, emphasizing your relevant experience and qualifications.

- Highlight your ability to communicate effectively with customers, adjusters, and medical providers.

- Mention any specialized training you may have received in the claims field.

- Demonstrate your knowledge of the insurance industry, with an emphasis on claims.

- Provide examples of how you have successfully managed claim processes in the past.

- Describe any strategies you have used to improve the claims process.

- Explain how your skills and experience will benefit the insurance company.

- Use strong and clear language to explain your qualifications.

- Proofread your letter to ensure that it contains no errors.

What's The Best Structure For Claim Specialist Cover Letters?

After creating an impressive Claim Specialist resume , the next step is crafting a compelling cover letter to accompany your job applications. It's essential to remember that your cover letter should maintain a formal tone and follow a recommended structure. But what exactly does this structure entail, and what key elements should be included in a Claim Specialist cover letter? Let's explore the guidelines and components that will make your cover letter stand out.

Key Components For Claim Specialist Cover Letters:

- Your contact information, including the date of writing

- The recipient's details, such as the company's name and the name of the addressee

- A professional greeting or salutation, like "Dear Mr. Levi,"

- An attention-grabbing opening statement to captivate the reader's interest

- A concise paragraph explaining why you are an excellent fit for the role

- Another paragraph highlighting why the position aligns with your career goals and aspirations

- A closing statement that reinforces your enthusiasm and suitability for the role

- A complimentary closing, such as "Regards" or "Sincerely," followed by your name

- An optional postscript (P.S.) to add a brief, impactful note or mention any additional relevant information.

Cover Letter Header

A header in a cover letter should typically include the following information:

- Your Full Name: Begin with your first and last name, written in a clear and legible format.

- Contact Information: Include your phone number, email address, and optionally, your mailing address. Providing multiple methods of contact ensures that the hiring manager can reach you easily.

- Date: Add the date on which you are writing the cover letter. This helps establish the timeline of your application.

It's important to place the header at the top of the cover letter, aligning it to the left or center of the page. This ensures that the reader can quickly identify your contact details and know when the cover letter was written.

Cover Letter Greeting / Salutation

A greeting in a cover letter should contain the following elements:

- Personalized Salutation: Address the hiring manager or the specific recipient of the cover letter by their name. If the name is not mentioned in the job posting or you are unsure about the recipient's name, it's acceptable to use a general salutation such as "Dear Hiring Manager" or "Dear [Company Name] Recruiting Team."

- Professional Tone: Maintain a formal and respectful tone throughout the greeting. Avoid using overly casual language or informal expressions.

- Correct Spelling and Title: Double-check the spelling of the recipient's name and ensure that you use the appropriate title (e.g., Mr., Ms., Dr., or Professor) if applicable. This shows attention to detail and professionalism.

For example, a suitable greeting could be "Dear Ms. Johnson," or "Dear Hiring Manager," depending on the information available. It's important to tailor the greeting to the specific recipient to create a personalized and professional tone for your cover letter.

Cover Letter Introduction

An introduction for a cover letter should capture the reader's attention and provide a brief overview of your background and interest in the position. Here's how an effective introduction should look:

- Opening Statement: Start with a strong opening sentence that immediately grabs the reader's attention. Consider mentioning your enthusiasm for the job opportunity or any specific aspect of the company or organization that sparked your interest.

- Brief Introduction: Provide a concise introduction of yourself and mention the specific position you are applying for. Include any relevant background information, such as your current role, educational background, or notable achievements that are directly related to the position.

- Connection to the Company: Demonstrate your knowledge of the company or organization and establish a connection between your skills and experiences with their mission, values, or industry. Showcasing your understanding and alignment with their goals helps to emphasize your fit for the role.

- Engaging Hook: Consider including a compelling sentence or two that highlights your unique selling points or key qualifications that make you stand out from other candidates. This can be a specific accomplishment, a relevant skill, or an experience that demonstrates your value as a potential employee.

- Transition to the Body: Conclude the introduction by smoothly transitioning to the main body of the cover letter, where you will provide more detailed information about your qualifications, experiences, and how they align with the requirements of the position.

By following these guidelines, your cover letter introduction will make a strong first impression and set the stage for the rest of your application.

Cover Letter Body

As a claim specialist, I am highly knowledgeable in all aspects of claim processing. I have a proven track record of successfully resolving complex claims and providing excellent customer service. With my expertise and experience, I am confident that I can make a positive impact on your organization.

I have a comprehensive understanding of the claims process, from filing, to investigation, and resolution. I am adept at identifying and correcting discrepancies, as well as researching and negotiating settlements. In addition, I am well-versed in insurance laws and regulations, and I am comfortable working with many different types of policies. My analytical skills and attention to detail have enabled me to identify and resolve issues quickly and efficiently.

I am also an excellent communicator, both in person and over the phone. I am able to provide clear and concise explanations of policies, procedures, and outcomes to customers. I am also able to build positive relationships with customers, which helps to ensure they have a positive experience with the company.

In addition, I have experience working with various software systems, such as Microsoft Office and claims management programs. I am comfortable learning new software and have the ability to quickly become proficient in its use. I am always looking for ways to increase efficiency and accuracy when processing claims.

I am confident that I can be an asset to your team. I am excited to have the opportunity to discuss my qualifications in further detail. Thank you for your time and consideration.

Complimentary Close

The conclusion and signature of a cover letter provide a final opportunity to leave a positive impression and invite further action. Here's how the conclusion and signature of a cover letter should look:

- Summary of Interest: In the conclusion paragraph, summarize your interest in the position and reiterate your enthusiasm for the opportunity to contribute to the organization or school. Emphasize the value you can bring to the role and briefly mention your key qualifications or unique selling points.

- Appreciation and Gratitude: Express appreciation for the reader's time and consideration in reviewing your application. Thank them for the opportunity to be considered for the position and acknowledge any additional materials or documents you have included, such as references or a portfolio.

- Call to Action: Conclude the cover letter with a clear call to action. Indicate your availability for an interview or express your interest in discussing the opportunity further. Encourage the reader to contact you to schedule a meeting or provide any additional information they may require.

- Complimentary Closing: Choose a professional and appropriate complimentary closing to end your cover letter, such as "Sincerely," "Best Regards," or "Thank you." Ensure the closing reflects the overall tone and formality of the letter.

- Signature: Below the complimentary closing, leave space for your handwritten signature. Sign your name in ink using a legible and professional style. If you are submitting a digital or typed cover letter, you can simply type your full name.

- Typed Name: Beneath your signature, type your full name in a clear and readable font. This allows for easy identification and ensures clarity in case the handwritten signature is not clear.

Common Mistakes to Avoid When Writing a Claim Specialist Cover Letter

When crafting a cover letter, it's essential to present yourself in the best possible light to potential employers. However, there are common mistakes that can hinder your chances of making a strong impression. By being aware of these pitfalls and avoiding them, you can ensure that your cover letter effectively highlights your qualifications and stands out from the competition. In this article, we will explore some of the most common mistakes to avoid when writing a cover letter, providing you with valuable insights and practical tips to help you create a compelling and impactful introduction that captures the attention of hiring managers. Whether you're a seasoned professional or just starting your career journey, understanding these mistakes will greatly enhance your chances of success in the job application process. So, let's dive in and discover how to steer clear of these common missteps and create a standout cover letter that gets you noticed by potential employers.

- Not personalizing the cover letter to the company or position

- Including irrelevant information

- Not proofreading for spelling and grammar errors

- Not making the letter concise and to the point

- Not demonstrating knowledge of the company

- Not describing relevant experience and skills

- Not providing enough details about past accomplishments

- Not using a professional tone

- Not expressing enthusiasm for the position

- Not asking for an interview

Key Takeaways For a Claim Specialist Cover Letter

- Strong organizational and communication skills

- Ability to work independently and in a team environment

- Proficient in claim processing and data entry techniques

- Detail-oriented and highly organized

- Knowledge of insurance regulations and procedures

- Experienced in customer service and problem-solving

- Knowledge of computer systems and software

Home » Letters » Insurance Letters » Health Insurance Claim Application Letter – Sample Application Letter for Medical Claim

Health Insurance Claim Application Letter – Sample Application Letter for Medical Claim

Table of Contents:

- Sample Letter

Live Editing Assistance

How to use live assistant, additional template options, download options, share via email, share via whatsapp, copy to clipboard, print letter, sample application letter for medical claim.

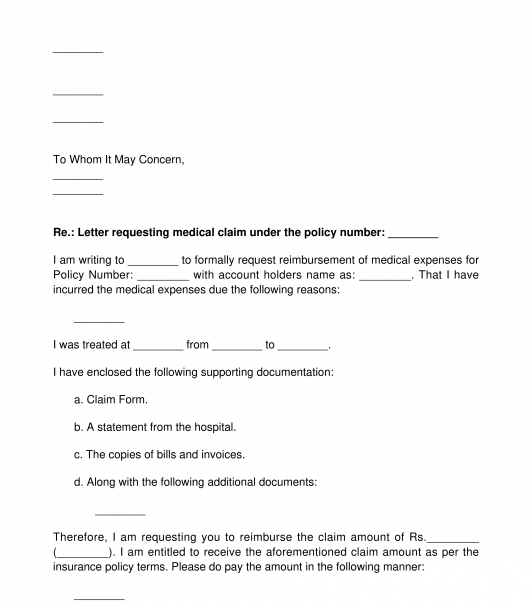

To, The ______________ (Concerned Authority), ________________ (Insurance Company Name), ________________ (Address)

Date: __/__/____ (Date)

Subject: Application for claim approval of policy no. __________ (policy number)

Respected Sir/Madam,

I am _______________ (Name) a policy holder in your company bearing policy number _______________ (Policy Number). Policy name is ________________ (Policy Name – If applicable) and my permanent residential address is ______________ (Address).

I am writing this letter to request you regarding approval of the claim for a total amount of Rs. __________ (Amount). The patient is hospitalized in ____________ (hospital Name), in ___________ (Room type) due to the reason (Reason Of Hospitalization).

The following are the details of the patient:

Name: _______________ Gender: _______________ Address: _______________

I am hereby attaching ____________ (a copy of bill/ ID Proof/ Address Proof/ Application Form/ Form duely filled attested by hospital/ Any other document Required).

I shall be highly obliged if you take this as genuine and pass the claim as early as possible.

Thanking you, ______________ (Signature) ______________ (Name), ______________ (Contact Number)

Live Preview

The Live Assistant feature is represented by a real-time preview functionality. Here’s how to use it:

- Start Typing: Enter your letter content in the "Letter Input" textarea.

- Live Preview: As you type, the content of your letter will be displayed in the "Live Preview" section below the textarea. This feature converts newline characters in the textarea into <br> tags in HTML for better readability.

The letter writing editor allows you to start with predefined templates for drafting your letters:

- Choose a Template: Click one of the template buttons ("Start with Sample Template 1", "Start with Sample Template 2", or "Start with Sample Template 3").

- Auto-Fill Textarea: The chosen template's content will automatically fill the textarea, which you can then modify or use as is.

Click the "Download Letter" button after composing your letter. This triggers a download of a file containing the content of your letter.

Click the "Share via Email" button after composing your letter. Your default email client will open a new message window with the subject "Sharing My Draft Letter" and the content of your letter in the body.

Click the "Share via WhatsApp" button after you've composed your letter. Your default browser will open a new tab prompting you to send the letter as a message to a contact on WhatsApp.

If you want to copy the text of your letter to the clipboard:

- Copy to Clipboard: Click the "Copy to Clipboard" button after composing your letter.

- Paste Anywhere: You can then paste the copied text anywhere you need, such as into another application or document.

For printing the letter directly from the browser:

- Print Letter: Click the "Print Letter" button after composing your letter.

- Print Preview: A new browser window will open showing your letter formatted for printing.

- Print: Use the print dialog in the browser to complete printing.

- A: Attachments may include copies of bills, ID proofs, address proofs, application forms, or any other documents required by the insurance company.

- A: Processing times vary depending on the insurance company's procedures, but claims are usually processed within a few weeks.

- A: It's preferable to type the application for clarity, but handwritten applications are generally acceptable as long as they are legible.

- A: If your claim is denied, you can appeal the decision by providing additional documentation or contacting the insurance company for further clarification.

- A: The number of claims you can make within a year may vary depending on your policy terms and conditions. Check your policy documents or contact your insurance provider for clarification.

Incoming Search Terms:

- letter to the health insurance company for claim approval

- sample letter for health insurance claim approval

By lettersdadmin

Related post, request letter for change of life insurance policy ownership – sample letter requesting change of life insurance policy ownership due to death of previous policy holder, request letter for changing beneficiary on insurance policy – sample letter to insurance company for changing beneficiary, inquiry letter about package insurance options – sample letter inquiring about package insurance options.

Application for Changing Stream in Class 12 – Sample Letter to School Principal for Changing Stream in Class 12

Request letter to principal for organizing science fair – sample letter requesting for organization of science fair, request letter for participation in cultural event – sample letter requesting for participation in cultural event, request letter for changing optional subject – sample letter to school principal requesting for change of optional subject, privacy overview.

Letter Templates & Example

Crafting an Effective Covering Letter for Medical Insurance Claim: Tips and Tricks

Are you feeling overwhelmed and unsure about how to write a covering letter for your medical insurance claim? Don’t worry, we’ve got you covered! Writing a covering letter for your medical insurance claim doesn’t have to be a daunting task. With a few helpful tips and examples, you’ll be able to draft a professional letter that will increase the chances of your claim being approved. In this article, we’ll provide you with everything you need to know to write a strong covering letter that will help expedite the claims process. Plus, we’ve included some sample letters that you can use as a guide and customize to fit your unique situation. So, what are you waiting for? Let’s get started!

The Best Structure for a Medical Insurance Claim Covering Letter

When it comes to filing a medical insurance claim, the way you present your information can make a big difference in whether or not it gets processed smoothly. One key element is the covering letter that you include along with your claim forms and other paperwork. Here are some tips on how to structure your letter in a way that is clear, concise, and effective.

First and foremost, make sure your letter includes all the necessary information. This should include your name and account number, the date of service for which you are submitting the claim, and a brief explanation of the nature of your medical issue or procedure. Be as specific as possible, but avoid rambling or including extraneous information.

Next, explain why you believe the treatment or services you received should be covered by your insurance provider. Provide any relevant details about your insurance policy, including any deductibles or copays that may apply. You may also want to include a copy of your insurance policy or a relevant section of it to support your claim.

If there were any complications or unusual circumstances surrounding your treatment, be sure to mention these as well. For example, if your doctor prescribed a medication that is not on your insurance company’s approved list, or if you received care from an out-of-network provider, provide an explanation for why you made these choices and why you believe your insurance should cover them.

Finally, be sure to thank the reader for their attention to your claim. A polite tone can go a long way in getting your claim processed quickly and efficiently. You may also want to include your contact information, in case the reader has any questions or needs additional information.

In summary, a good medical insurance claim covering letter should be clear, concise, and informative, including all relevant details about your medical issue and why you believe it should be covered by your insurance. By following these tips, you can help ensure that your claim gets processed smoothly and that you receive the coverage you are entitled to.

Seven Sample Cover Letter for Medical Insurance Claim

Claim for medication costs under prescription coverage.

Dear Sir/Madam,

I am writing to request reimbursement for the medication costs I incurred during my recent medical condition. As per my health insurance plan, I have prescription coverage that offers me financial aid for prescribed medicines.

The prescribed medication was medically necessary, and I had no other alternative to treat my condition. I have attached all the necessary documents, including the prescription and the invoices, to support my claim. I hope that you will consider my request and process it as soon as possible. Please let me know if you require any further information.

Thank you for your time and cooperation.

Yours sincerely,

[Your Name]

Claim for Hospitalization Expenses under Critical Illness Coverage

I am writing to request reimbursement for the hospitalization expenses that I incurred during my recent critical illness. My health insurance policy includes critical illness coverage that covers the cost of hospitalization and other medical expenses.

I was diagnosed with [Illness] in [Month/Year], and I was hospitalized for [Number of Days] days. The hospitalization cost included room rent, medicines, nursing care, and other medical procedures. I have attached all the relevant documents, including the hospital bills and discharge summary, to support my claim.

Kindly process my request for the reimbursement of the hospitalization expenses as soon as possible. I will be grateful for your help in this regard.

Thank you for your understanding.

Claim for Surgery Costs under Surgical Coverage

I am making a claim for the cover of surgical expenses as declared under my health insurance policy. I underwent [Surgery] on [Date], and my physician recommended the surgery as a necessary treatment for my medical condition.

I have attached all the relevant documents, including the doctor’s recommendation for the surgery, surgical bills, and other related documents. I request you to process my claim at the earliest convenience, and I look forward to receiving a positive response from you.

Thank you for your attention.

Best Regards,

Claim for Maternity Expenses under Maternity Cover

I am writing to submit a claim for maternity expenses, which are covered under my health insurance policy. I gave birth to my child on [Date], and I incurred various expenses during the delivery and postpartum period.

I have enclosed all the relevant documents required for the claim, including the medical bills, invoices, and the discharge summary from the hospital. I request you to process my claim as soon as possible and reimburse the amount at your earliest convenience.

Thank you for your support.

With best regards,

Claim for Dental Treatment under Dental Coverage

I am making a claim for reimbursement of dental treatment expenses that are covered under my health insurance plan. I visited the dentist last month for a root canal treatment, and the dentist recommended the procedure to prevent an infection from spreading.

The bill for the dental treatment is attached to this claim, along with the dentist’s recommendation and prescription. I am hoping for a speedy settlement of my claim and your kind assistance in processing the claim as soon as possible.

Thank you for your cooperation.

Claim for Optical Expenses under Vision Care Coverage

I am writing to request reimbursement for my optical expenses that come under my health insurance policy’s vision care coverage. I recently got my eyes examined and ordered a pair of prescription glasses.

Please find enclosed all the required documentation, including the prescription from the optometrist and the bill from the optical store. I would appreciate your prompt assistance in processing my claim as soon as possible, and I hope to receive your favorable response soon.

Claim for Physiotherapy Expenses under Rehabilitation Coverage

I am writing to request reimbursement of my physiotherapy expenses covered under my health insurance policy’s rehabilitation coverage. I recently underwent a back injury and underwent physiotherapy sessions as part of my treatment.

I have attached all the necessary documents, including the recommendation from my physician for the physiotherapy sessions and the bills for the sessions, to support my claim. I hope that my claim will be processed quickly and efficiently, and I look forward to a positive response from you regarding my request.

Tips for Writing a Strong Covering Letter for Medical Insurance Claim

When it comes to filing a medical insurance claim, writing a covering letter can be a crucial part of the process. A well-written covering letter can make it easier for the insurer to understand the nature of the claim and to process it more quickly. If you are preparing to write a covering letter for a medical insurance claim, consider the following tips to ensure that your letter is effective and professional:

Be Clear and Concise

When writing your covering letter, it is important to be clear and concise. State the purpose of the letter in the first few sentences and provide all necessary details related to the claim without including any unnecessary information. Use bullet points to make the letter more organized and easier to read, if necessary.

Provide Relevant Medical Records

If you are filing a medical insurance claim, it is important to provide relevant medical records related to the claim. This may include medical diagnoses, lab reports, and treatment plans. Make sure to include all medical records that support your claim to ensure that the insurer has all the necessary information to assess the claim.

Provide All Necessary Details About the Claim

It is important to include all necessary details about the claim, including the date of service, the name of the medical provider, and the reason for the claim. Be sure to include any information that may impact the claim, such as pre-existing conditions or prior treatment for the same issue. Providing all the important details in the covering letter will help the insurer to fully understand the nature of the claim and to process the claim more quickly.

Keep It Professional

When writing your covering letter, it is important to keep it professional. Use a formal tone and avoid using slang or overly casual language. Make sure to proofread the letter for grammar and spelling errors to ensure that it is polished and professional. A well-written and professional covering letter can go a long way in ensuring that your medical insurance claim is processed effectively.

Honesty is always the best policy when it comes to filing a medical insurance claim. Make sure to include all relevant information and do not exaggerate or downplay the severity of the medical issue. Providing accurate or misleading information can result in the claim being denied. Being honest and transparent will help to ensure that your claim is processed fairly and that you receive the coverage that you are entitled to.

Writing a covering letter for a medical insurance claim may seem like a daunting task, but with these tips in mind, you can increase the chances of your claim being approved and processed more quickly.

FAQs related to Covering Letter for Medical Insurance Claim What is a covering letter for a medical insurance claim?

A covering letter for a medical insurance claim is a letter that explains the details of a medical claim and the reasons for seeking reimbursement from an insurance company. It may also include supporting documents, such as medical bills, reports, and prescriptions.

Why is a covering letter required for a medical insurance claim?

A covering letter is required to provide the insurance company with all the necessary information they need to process a claim correctly. It also allows the insurance company to understand the reasons for the claim and verifies that the treatment or test for which the reimbursement is being sought was a medical necessity.

What information should be included in a covering letter for a medical insurance claim?

The information to include in a covering letter for a medical insurance claim includes the policy number, date and nature of the treatment, the doctor’s name, and the cost of the procedure. The letter should also outline the reasons for seeking reimbursement and any additional supporting documents.

Can a covering letter be submitted digitally?

Yes, a covering letter can be submitted digitally. With the advent of technology, insurers have made it possible to register claims online, including uploading electronic copies of the documents such as covering letters. However, check with your insurer’s website or customer service to ensure the availability of the feature.

How long does it take to receive a response to a covering letter for a medical insurance claim?

The time it takes to receive a response to a covering letter for a medical insurance claim varies from one insurer to the other. A response to a claim can take from a few days to weeks, depending on the complexity of the claim and the insurer’s internal filing processes.

What should be done if the claim is denied?

If a claim is denied, the first step is to review the reasons for the denial, which will be communicated to the policyholder with the decision. If it is still unclear, contact the insurer customer service for assistance. If the claim was denied due to insufficient information, follow up with the doctor’s office to submit additional documentation and resubmit the claim.

What can be done if the insurer delays payment or doesn’t respond?

If the insurer delays payment or doesn’t respond to the claim, it may be a result of internal filing issues. Try to resolve the delay with the insurer by following up politely and persistently until the claim is settled. In case the delay persists, you can escalate the matter to the relevant insurance regulatory authority.

Thanks for Reading!

I hope this article has been helpful in understanding how to write a covering letter for a medical insurance claim. Remember to always include all necessary information and submit your claim within the required timeframe. If you have any additional questions or topics you’d like us to cover, feel free to leave a comment below. Don’t forget to check back here for more informative articles in the future!

Crafting the Perfect Cover Letter for Insurance Advisor Positions Top Sample Letter of Interest for Insurance Provider Templates to Land Your Ideal Coverage 5 Examples of Great Insurance Agent Thank You Letters to Clients Thank You Letter from Insurance Agent to Client: Expressing Gratitude and Building Strong Relationships Sample Insurance Rate Increase Letter: A Guide to Understanding and Responding Writing an Effective Letter to Patients Regarding Insurance: Tips and Samples

How does it work?

1. choose this template.

Start by clicking on "Fill out the template"

2. Complete the document

Answer a few questions and your document is created automatically.

3. Save - Print

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

Letter to Claim from Health Insurance

This Letter to Claim from Medical Insurance can be sent to an insurance provider in order to request coverage of any medical treatment or reimbursement for any medical treatment that has already occurred.

How to use this document?

This letter includes all of the relevant information that an insurer is likely to need in order to process a claim, such as the name of the patient , the name of the health care provider , and the date the treatment was received. There are also additional documents that can be enclosed with this letter, such as a letter from a health care provider explaining the nature of the medical procedure and why it was provided. The insurer might also have their own claim form that must be completed. If this is the case, the insurer's claim form should be completely filled out and sent in along with this letter.

Once this letter is done, it should be sent by registered post or courier so that the sender has a record that the letter was received by the insurer. The sender of this letter should also keep a copy of the letter, in case of a future dispute.

Applicable Law

There are no laws that specifically dictate what must be contained in a Letter to Claim from Medical Insurance. However, if a person is deliberately dishonest in an insurance claim, this is likely to constitute fraud, which is a crime under the criminal laws of India.

Regarding the contract of insurance between the insured person and the insurer, general principles of contract law , as provided by the common law, may be relevant.

The insurer may also require particular information to be included in order for a claim to be processed and approved. Before sending this letter, the individual making the claim should check the insurer's website or customer service to be sure this letter includes all of the necessary information.

How to modify the template?

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

A guide to help you: How to Send a Letter?

Letter to Claim from Health Insurance - Template

Country: India

Daily Life - Other downloadable templates of legal documents

- General Power of Attorney for Property

- Change of Address Letter

- Vehicle Sale Agreement

- Offer Letter for Campus Ambassador

- Hypothecation Deed

- Dog Walking Agreement

- Letter to Neighbour about Nuisance

- Child Healthcare Consent Form

- Letter Demanding Debt Payment

- General Power of Attorney

- Power of Attorney Termination Letter by Principal

- Parking Lease Agreement

- Campus Ambassador Agreement

- Power of Attorney Resignation Letter

- Other downloadable templates of legal documents

Powerful Email to Health Insurance Company for Claim Samples

Through this article, I’ll guide you step-by-step on how to craft an effective email to your health insurance provider, sharing tips from my personal experience to help you streamline your claim process.

Key Takeaways

- Understand Your Policy: Know your coverage details, including what is and isn’t covered.

- Gather Necessary Information: Compile all relevant medical records, bills, and policy details.

- Be Clear and Concise: Use simple language and get straight to the point.

- Follow Up: Keep track of your claim’s progress and follow up as needed.

- Personal Experience Tips: Leverage real-life examples to enhance your claim’s clarity and urgency.

Step 1: Understand Your Policy

Before drafting your email, ensure you have a thorough understanding of your health insurance policy. Know what is covered, the extent of your coverage, and any specific procedures for filing a claim.

This knowledge will help you articulate your situation clearly and align your claim with the policy’s stipulations.

Step 2: Gather Necessary Information

Compile all relevant documents and information before writing your email. This includes your policy number, the details of the claim (dates, medical procedures, etc.), and any supporting documents like medical reports or bills.

Having all this information at hand will make your email more comprehensive and easier for the insurance company to process.

Step 3: Write a Clear Subject Line

Your email’s subject line should be straightforward and informative. For example, “Claim Submission – [Your Policy Number].”

This helps the insurance company’s staff quickly identify the purpose of your email and route it to the appropriate department.

Trending Now: Find Out Why!

Step 4: structure your email properly.

Start with a formal greeting, followed by a brief introduction stating your purpose. Then, detail your claim, providing all necessary information in a structured and clear manner.

Conclude with a polite closing, expressing your readiness to provide additional information if needed.

Sample Email To Health Insurance Company For Claim Template:

Subject: Claim Submission – [Your Policy Number]

Dear [Insurance Company’s Name],

I am writing to submit a claim under my health insurance policy, [Your Policy Number]. Below are the details of my claim:

– Date of Service: [Date] – Description of Service: [Description] – Provider: [Provider’s Name] – Claim Amount: [Amount]

Attached are the relevant medical reports and bills supporting my claim.

Please let me know if you require any further information or documentation to process this claim. I look forward to your timely response.

Thank you for your attention to this matter.

Sincerely, [Your Name] [Your Contact Information]

Step 5: Attach Supporting Documents

Ensure you attach all necessary documents to your email. This might include medical reports, bills, and any other relevant paperwork. Clearly label each attachment to facilitate easy reference.

Step 6: Review and Send

Before sending your email, review it to ensure all information is accurate and clearly presented. Check for any grammatical errors or typos, as a well-written email reflects your seriousness and attention to detail.

Personal Experience Tips:

- Follow Up: Don’t hesitate to follow up if you haven’t received a response within the expected timeframe. A polite follow-up email can expedite the process.

- Be Patient: Claims processing can take time. Patience and polite communication are key.

- Document Everything: Keep a record of all communications and documents sent. This can be crucial if there are any disputes or delays.

Final Thoughts

Writing an effective email to your health insurance company for a claim doesn’t have to be daunting.

By following these steps and utilizing the provided template, you can communicate your needs clearly and efficiently, increasing the likelihood of a favorable outcome.

Claim Documentation Checklist

Checklist summary, frequently asked questions (faqs), q: how do i start the process of filing a health insurance claim via email.

Answer: From my experience, the first step is to gather all necessary documents related to your medical treatment. These typically include detailed medical bills, diagnosis reports, and any relevant prescriptions.

In the email, clearly state your intention to file a claim, provide your policy number, and attach all these documents. It’s also helpful to give a brief description of the medical issue and treatment received.

Q: What Information Should I Include in My Claim Email?

Answer: In my claim email, I made sure to include my full name, policy number, date of the medical service, and a brief description of the treatment. It’s important to attach all relevant medical documents, such as itemized bills, diagnostic reports, and prescriptions.

Additionally, I mentioned any previous communications or reference numbers related to the claim for easier tracking.

Q: How Detailed Should My Email Be When Describing Medical Treatment?

Answer: Based on my experience, while you should provide a clear and concise description of the medical treatment in your email, there’s no need for overly technical details.

Focus on the dates of treatment, type of medical service received, and the reason for the treatment. The attached medical documents will provide the detailed specifics needed by the insurance company.

Q: Can I Ask About the Claim Process Timeline in My Email?

Answer: Absolutely, it’s a good idea to inquire about the timeline. In my email, I politely asked for an estimated time frame for the claim processing and settlement.

This helps set your expectations and also shows the insurance company that you are keeping track of your claim’s progress.

Q: Should I Follow Up If I Don’t Hear Back Regarding My Claim?

Answer: Yes, following up is important. In my case, I waited for about two weeks before sending a follow-up email. In the follow-up, reference your original email, the date it was sent, and reiterate the importance of the claim. It’s also useful to ask if they require any additional information from your side.

Q: Is It Necessary to Keep a Record of All Communications?

Answer: Definitely. I always keep a record of all email communications regarding my health insurance claims. This includes saving copies of the emails sent and received and any relevant documents attached. These records can be crucial if there are any disputes or delays with your claim.

MORE FOR YOU

Free car insurance claim appeal letter sample.

In this guide, I’ll share my personal experiences, tips, and three unique templates to help you craft a compelling appeal letter that increases your chances…

Read More »

Urgent: Health Insurance Cancellation Letter (Template Included)

Over the years, I’ve had to write numerous health insurance cancellation letters for myself, friends, and clients. Through this experience, I’ve learned the nuances of…

Gap Insurance Cancellation Letter Sample: Free & Effective

In this guide, I’ll walk you through how to write a gap insurance cancellation letter, provide a customizable template, and share some tips from my…

Pet Insurance Cancellation Letter Template: Free & Effective

Easily cancel your pet insurance with our free, customizable template. Quick, hassle-free, and ready to download. Get started now!

Get Your Flood Claim Approved: Perfect Sample Letter for Damaged Goods

In this article, I will share a detailed, step-by-step guide to writing a flood insurance claim letter for damaged goods, including three unique templates you…

Urgent Alert: Auto Insurance Cancellation Letter Template

When it comes to writing an auto insurance cancellation letter, having the right approach ensures a smooth transition without unnecessary issues. I have written countless…

Leave a Comment Cancel Reply

Your email address will not be published. Required fields are marked *

IMAGES

VIDEO

COMMENTS

If you’re submitting an insurance claim, a cover letter can be a powerful tool to help support your case. A well-crafted cover letter demonstrates that you understand your policy, have collected all necessary supporting documents, and are committed to resolving the issue as quickly as possible. Below are some tips to …

In today's competitive job market, a well-tailored cover letter can make all the difference when applying for a claims specialist position. As a claims specialist, your role …

A Claim Specialist cover letter is essential when applying for a job in the insurance claims industry. It serves as a way to introduce yourself to the employer and to explain why you are the best candidate for the position.

When writing an application letter for a health insurance claim, clarity and politeness are essential. Clearly state your name, policy number, and residential address. Provide details of the patient, including name, gender, and …

You should use a sample letter for health insurance claim when you need to submit a claim for medical expenses that are covered by your insurance policy. What should I …

A claims representative cover letter is a document that candidates include with a job application to explain their skills and qualifications for insurance claims jobs. In a cover …

A covering letter for a medical insurance claim is a letter that explains the details of a medical claim and the reasons for seeking reimbursement from an insurance …

This Letter to Claim from Medical Insurance can be sent to an insurance provider in order to request coverage of any medical treatment or reimbursement for any medical treatment that has already occurred.

Powerful Email to Health Insurance Company for Claim Samples. Through this article, I’ll guide you step-by-step on how to craft an effective email to your health insurance provider, sharing tips from my …

If you're having trouble creating your Health Insurance cover letter, our examples can help you. Find excellent cover letter examples in Greatsamplesresume.