From Concept to Bestseller: How Product Research Helps

Table of content.

- What is Product Research?

- Product Research Methods

- The Role of Product Research in Different Stages of Product Development

- Technological Trends Shaping the Future of Product Research

- Benefits of Product Research

- Overcoming Challenges in Product Research

- Quick Guide – Developing Your Own Product Research

Product research is a critical element in the world of business, functioning as the guiding star in the journey of product development. It demystifies the market’s complexities, unveils consumers’ needs and behaviors, and unravels the competitive landscape. By providing in-depth insights and data-driven understanding, product research is an indispensable tool for businesses striving to design, develop, and deliver successful products that resonate with their target audience .

In the rapidly evolving business ecosystem, where consumer preferences shift swiftly and competition intensifies, the role of product research has never been more crucial. It is through the lens of product research that businesses can anticipate and adapt to changing market trends, fine-tune their offerings, and carve out a unique position in the marketplace.

Product research, a fundamental component of the product development process, refers to a systematic examination of a product’s viability, market potential, and the competitive landscape. It encompasses a broad spectrum of activities designed to collect and analyze data regarding the prospective product, its intended consumer, and the market into which it’s being launched. Understanding product research begins with an appreciation of its place in the broader product development process. This journey starts with an idea and ends with a product ready for commercialization.

The process of product research is multifaceted and can take many forms. For example, a company might conduct in-depth interviews with potential customers to understand their needs, preferences, and purchasing habits. They might distribute surveys to a broader audience to gather quantitative data about a product’s potential appeal. They could also carry out competitor analysis to see where their product fits within the existing market. No matter the method, the aim remains consistent: to gather as much relevant information as possible to ensure the product’s success.

While the types of research provide the ‘what,’ the methods of product research provide the ‘how.’ They are the techniques businesses use to collect and analyze data about their product, their potential customers, and the market.

Survey questions are an efficient way to collect data from a large group of people. They can be conducted online, over the phone, or in-person. Surveys are particularly effective when businesses need quantitative data to help make informed decisions about their product.

One-on-one interviews provide in-depth qualitative data. They are an excellent way to delve deeper into individual experiences, preferences, and needs. While they are time-consuming, the richness of the data gathered often justifies the effort.

Focus Groups

Focus groups involve a moderated discussion among a small group of individuals. They can provide insights into how a group reacts to a product or an idea, and the discussions can reveal the reasons behind certain consumer behaviors.

Online Research

In the digital age, online research is becoming increasingly popular. It includes analyzing online reviews, social media conversations, and search engine data. It can help businesses understand public sentiment around their product or similar products.

Product Testing

This involves providing potential customers with a version of the product and gathering feedback on its performance, usability, and appeal. This is a crucial step in identifying and correcting issues before the product hits the market.

These methods can be used individually or in combination, depending on the nature of the product, the information needed, and the resources available.

Maximize your product research potential with our platform!

Discover the importance of product research and take it to the next level with our comprehensive platform. Gain valuable insights, understand your customers’ needs, and stay ahead of the competition. Find various ways to use our product survey tool on our solutions page.

Product research plays a critical role in each stage of product development, from the initial idea generation to the final commercialization. It aids in refining concepts, testing assumptions, and ensuring that the product truly resonates with its target audience.

Idea Generation

The very first stage of product development begins with idea generation. It is at this juncture where product research proves invaluable. Market research provides insights into industry trends, emerging markets, and changing consumer behaviors, helping businesses identify promising opportunities and inspiring innovative product ideas. User research further assists in understanding the unmet needs or problems of potential customers, often serving as a springboard for ideation. Competitor research aids in assessing what’s already available in the market, thereby guiding businesses towards product ideas that offer unique value or differentiate them from competitors.

Concept Development and Testing

Once a product idea is conceived, the next step is to refine and test this concept. Here, product research is employed to validate the product idea and shape its development. User research can help ascertain whether the concept is appealing to potential customers and meets their needs. Feedback gathered from focus groups, varios types of surveys , or interviews can be instrumental in refining the product concept, guiding features selection, and even influencing the product’s design. At the same time, competitor research provides insights into how similar products are performing in the market, which can inform the unique selling proposition (USP) of the new product.

Business Analysis

In the business analysis stage, product research assists in evaluating the potential profitability and feasibility of the product. Market research offers data on the size of the potential market, growth prospects, and segmentation, which can inform revenue projections. Similarly, insights from competitor research can provide a sense of the market share that the new product could potentially capture. User research, on the other hand, can help estimate the price potential customers are willing to pay for the product, informing pricing strategy.

Product Development

As the product begins to take shape during the product development phase, user research plays an increasingly important role. User testing allows businesses to gather feedback on the product’s functionality, usability, and overall user experience. This feedback can be used to iteratively improve the product, ensuring it not only functions as intended but also delivers a satisfying user experience. Additionally, competitor research can inform the product’s positioning, helping to differentiate it from similar products on the market.

Test Marketing

In the test marketing stage, a prototype or limited launch of the product is tested in a small segment of the market. Product research here can help evaluate the product’s reception, the effectiveness of the marketing strategy, and even the logistics of distribution. Feedback from users can provide valuable insights into any potential issues or improvements, allowing the business to fine-tune the product or strategy before the full-scale launch.

Commercialization

The final stage of product development is commercialization, where the product is launched in the market. Product research continues to play a crucial role even after the product’s launch. Post-launch market research can help assess the product’s performance in the market and monitor changing trends. User research, in the form of customer feedback and reviews, can offer insights into the product’s strengths and areas for improvement. Furthermore, ongoing competitor research can assist businesses in staying competitive, identifying opportunities for product upgrades, and even inspiring new product ideas for the future.

Product research is constantly evolving, driven by technological innovations. Companies now have access to modern tools and methods that make the research process more efficient and accurate. Here are some of the key trends:

- Artificial Intelligence (AI) and Machine Learning: AI assists in analyzing large datasets and identifying patterns that traditional methods might miss. This enables companies to respond to market trends more quickly and accurately. Discover resonio’s AI Survey Features Now!

- Automated Surveys: Advances in automation make it possible to create and analyze surveys in real-time. This allows companies to respond faster to customer feedback and make necessary adjustments.

- Virtual and Augmented Reality (VR/AR): VR and AR allow products to be tested in simulated environments before they hit the market. This simplifies prototype development and enhances the user experience.

- Big Data and Data Analytics: Utilizing big data provides detailed insights into customer behavior. Companies can develop targeted marketing strategies and optimize product features.

- Mobile Market Research: Mobile devices make it easy to conduct surveys directly on smartphones or tablets, increasing reach and enabling faster feedback from consumers worldwide.

A well-conducted product research process can provide a plethora of benefits for businesses. These advantages go beyond merely understanding the product’s potential market, user preferences, or competitive landscape. Here are some significant benefits:

- Minimizes Risk of Product Failure – One of the primary purposes of product research is to mitigate the risk of product failure. By thoroughly understanding the needs of the market, the desires of the customers, and the product’s functionality through research, a company can confidently launch a product that has a higher chance of being successful.

- Identifies Market Opportunities – Market research can reveal gaps in the market or evolving trends that a company could exploit. By staying abreast of these changes and opportunities, businesses can develop innovative products that meet untapped customer needs.

- Helps in Creating Effective Marketing Strategies – A good understanding of the target audience’s behaviors, needs, and preferences can shape an effective marketing strategy. With detailed insights about what motivates potential customers, businesses can create persuasive messages that resonate with their audience.

- Provides a Deep Understanding of Customer Needs and Behaviors – Through user research, businesses can delve into the psyche of their potential customers. Knowing why customers behave in certain ways can be incredibly valuable in designing a product that not only meets their needs but also provides a satisfying user experience.

- Informs About Competition – By researching the competition, businesses can understand where their product fits within the marketplace. They can learn from their competitors’ successes and failures and design a product that stands out in the crowd.

- Supports Decision Making – The data and insights gathered from product research provide a solid basis for decision-making throughout the product development process. Whether it’s about the product’s design, pricing, distribution, or marketing strategies, well-researched information helps businesses make informed decisions.

- Enhances the Overall Value Proposition – Ultimately, product research can enhance a product’s overall value proposition. It ensures that the product not only meets customer needs but exceeds their expectations, leading to increased customer satisfaction and loyalty.

While product research provides undeniable benefits, it can also present certain challenges that businesses must navigate. Here are some common hurdles and suggested strategies for overcoming them:

Limited Resources

Not all companies, especially startups and small businesses, have abundant resources to dedicate to comprehensive product research. In these cases, they might focus on the most essential types of research that could have the biggest impact. Online surveys, interviews, and competitor analysis are relatively low-cost methods that can still provide valuable insights.

Bias in Data Collection

There can be a risk of bias in data collection, which could skew the results and lead to inaccurate conclusions. To mitigate this risk, businesses should strive for objectivity in their research methods. This could include using a diverse sample for surveys and interviews, asking neutral and unbiased questions, and cross-verifying data from multiple sources.

Recommended Reading: Avoiding Bias and Distortion in Questionnaire Design

Interpretation of Results

Sometimes, the data gathered from product research can be complex and challenging to interpret. Here, businesses may consider using data analysis tools or hiring experts to assist in data interpretation. This ensures that the conclusions drawn from the research are accurate and insightful.

These challenges, while potentially daunting, are surmountable. By recognizing and addressing these issues upfront, businesses can ensure that their product research efforts yield accurate and actionable insights.

Case Studies of Successful Product Research

An understanding of the value of this research is enhanced by observing its application in real-world situations. In this chapter, we will examine two case studies where product research significantly contributed to the success of a product launch.

Case Study 1 – Fitness Company

Imagine a fitness company intending to expand its product line by introducing a new home workout device. Before diving into product development, the company invested in comprehensive market and user research. They discovered a niche of busy professionals who sought effective workout solutions that could be used at home, with minimum space requirements.

Through user interviews, they learned about the pain points these potential customers faced with current products – cumbersome equipment, complex setups, and lack of personalization. The company used these insights to design a compact, easy-to-set-up device with personalized workout plans. The product became a success, hitting the sweet spot between consumer need and a gap in the market.

Case Study 2 – Gardening App

Consider a tech startup planning to launch an innovative gardening app. The app’s concept was unique – using augmented reality to let users visualize different plants in their gardens. However, before jumping into the complex development process, they decided to conduct user research.

These case studies highlight the importance and efficacy of this research in successfully developing and launching a product. The insights derived from different types of product research can shape the product’s design, its features, the marketing strategy, and ultimately, its success in the market.

Quick Guide – Developing Your Own Product Research with Online Surveys

If you want to conduct your own product research, follow these steps to achieve meaningful results:

- Define Your Goal: Clearly identify the questions your research should answer. Consider what information you need to make informed decisions and focus on specific aspects of the product or market.

- Identify the Right Panel: Carefully select survey participants that match your target audience. Use criteria such as age, gender, interests, or geographic location to ensure that your results are representative and relevant.

- Develop the Survey: Create precise and easy-to-understand questions that provide the information you need. Ensure that the questions are neutrally worded and do not lead respondents. Use various question types (e.g., multiple-choice , open-ended questions ) to gain detailed insights. Recommended Reading: How to Create the Perfect Product Research Questionnaire

- Implement the Results: Carefully analyze the data you’ve collected and turn it into actionable insights. Consider how you can use the findings to improve your product, optimize your marketing strategy, or identify new market opportunities.

Product Research: Your Path to Success

Product research is essential for understanding markets, customers, and competitors. It provides valuable insights that help companies develop products that meet customer needs and succeed in the market. Despite challenges such as limited resources or data interpretation, well-planned research is indispensable. Technological trends and innovative methods are shaping the future of product research, enabling companies to adapt flexibly and strategically to changes.

Practical examples show that investing in product research minimizes the risk of failure, reveals market opportunities, and supports informed decision-making. Companies that actively engage in research gain a clear competitive edge and create products that delight customers.

In a highly competitive world, product research remains the compass that guides the way to success.

Ready to start your own product research and gain valuable insights?

Sign up for free, create targeted surveys, and get reliable results quickly!

FAQ on Product Research

Why is product research important.

Product research is crucial because it helps businesses understand their market, customers, and competitors. It provides essential insights that can shape the development, marketing, and launch of a product. It minimizes risk, identifies market opportunities, supports decision making, and enhances the product's overall value proposition.

What are the types of product research?

The three main types of product research are market research, user research, and competitor research. Market research provides a broad understanding of the economic climate, customer base, and demographics. User research focuses on understanding potential users or customers, their needs, and preferences. Competitor research helps businesses understand their competitive landscape.

What are the challenges in product research?

Some common challenges in product research include limited resources, especially for small businesses and startups, bias in data collection that could skew results, and difficulties in interpreting complex data. However, these challenges can be addressed through cost-effective research methods, objective data collection practices, and the use of data analysis tools or experts.

How is technology changing the future of product research?

Technology is revolutionizing product research in numerous ways. Artificial Intelligence can analyze customer sentiment on social media, Virtual Reality can be used for product testing, and big data analytics can provide deeper insights into customer behavior and market trends.

How does product research impact the different stages of product development?

Product research guides each stage of product development, from idea generation to commercialization. It provides insights and data that inform decision making, help design a product that meets customer needs, develop effective marketing strategies, and assess the product's performance in the market.

Hajrudin Krdzic

Whether designing intricate skyscrapers or delving deep into search algorithms, Hajrudin effortlessly bridges the world of architectural elegance with the ever-evolving realm of technology. Merging an architect's precision with a flair for tech, SEO, and content creation, he shapes the physical and digital worlds with equal passion.

- Privacy Overview

- Strictly Necessary Cookies

- Additional Cookies

This website uses cookies to provide you with the best user experience possible. Cookies are small text files that are cached when you visit a website to make the user experience more efficient. We are allowed to store cookies on your device if they are absolutely necessary for the operation of the site. For all other cookies we need your consent.

You can at any time change or withdraw your consent from the Cookie Declaration on our website. Find the link to your settings in our footer.

Find out more in our privacy policy about our use of cookies and how we process personal data.

Necessary cookies help make a website usable by enabling basic functions like page navigation and access to secure areas of the website. The website cannot properly without these cookies.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.

Any cookies that may not be particularly necessary for the website to function and is used specifically to collect user personal data via analytics, ads, other embedded contents are termed as additional cookies.

Please enable Strictly Necessary Cookies first so that we can save your preferences!

- Home > Publications > How to Use Product Development Research to Innovate Successfully

How to Use Product Development Research to Innovate Successfully

“New” is one of the strongest words in marketing. “New” invokes the belief that something is moving forward, that it is different, modern or improved. People are attracted to new products like a magnet. Introducing new products and services on a constant basis is the best way to get attention and is invaluable publicity for a business. “New” positions a company as being dynamic and forward looking. Companies such as 3M and Sony have held this slot for periods of time but it is difficult to stay there. In 2021, companies such as Apple and Samsung are at the forefront of bringing new products to market on a regular basis. Innovation is hard work and the road is paved with failures.

Introduction: The Importance Of “New”

This white paper shows how market research, when used correctly in product development research, will minimize the risk of failure. It also explains that market research does not always give a clear-cut answer – considerable insights and experience are required by the market research analyst to interpret the data and visualize the opportunity.

The word “new” is sometimes over-played in marketing because it is so frequently used for everything from conceptually new products through to old wine in new bottles. The main types of product development are as follows:

- New concepts – completely new products that have arisen as a result of innovation and which can sometimes create new markets.

- Additions to existing product lines – new products that supplement established product lines. For example, a supplier of industrial gases may introduce a new, smaller cylinder to include in an existing product line, aimed at serving customers who require smaller amounts of gas.

- Modifications of existing products – existing products that are modified in order to better meet customer needs, such as improved performance.

90% of new product research is focused on product ‘additions’ and ‘modifications’ rather than on the concepts. There is nothing wrong with this. Product improvements are obvious developments and are much more easily accepted than conceptually new products.

In fact, the more conceptually new the product, the riskier it can be. FedEx lost $340 million on its new Zap mail and DuPont lost an estimated $100 million on a new synthetic leather product called Corfam. With this in mind, many companies turn to disciplined market research as a form of insurance, i.e. as a means of reducing business risk. The next section looks at how market research is used in product development – not only as insurance, but also as a tool to establish needs and to obtain intelligence on market potential.

Product Development Research Across the Product Life Cycle

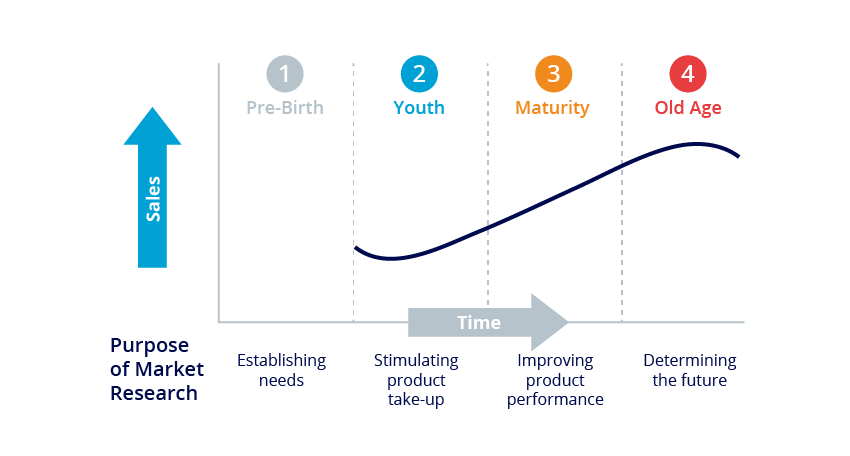

Product development research can be used at all stages in the product life cycle, as illustrated in Figure 1 and explained in the following sections on applications for market research.

Figure 1 – Applications For Market Research

Pre-Birth – Establishing Needs

Many companies recognize the importance of “new” and for this reason they allocate substantial sums to research and development. Electronics companies may have an R&D budget equal to 15% of their sales, but this is required in order to cope with the rapid pace of change in their sector. For most companies, the expenditure on R&D is somewhere between 2% and 5% of sales – still huge sums for the likes of Boeing, Honda or Siemens.

Over 90% of all innovations that are successful start in the wrong direction [ref 1] , and are not the outcome of good market research. In fact, many new and successful products arise by accident and not as a result of hours and hours of focused R&D or significant financial investment. Indeed the telephone, X-rays, bubble gum, Velcro, Viagra and Post-it notes – to name but a few examples – were all invented by accident. In the case of Post-it notes, for instance, a researcher at 3M was eager to create the world’s best glue, but actually ended up creating one of the worst glues ever – one that didn’t stick – which nevertheless ended up as one of 3M’s most successful products: that of the ubiquitous Post-it notes.

Not all new products arise by accident, however, and product development research can play a role in determining the need for most new products. Drucker (1993) tells the story of William Conner, a medical salesman, who decided he wanted to set up his own company. Conner sought new product opportunities by visiting surgeons and asking them about the challenges they faced in their work. In these interviews, Conner learned that the process for cataract surgery involved a difficult task for physicians, in that they had to cut a ligament which was an unpleasant and risky move. Conner then discovered an enzyme which could dissolve this ligament (thus eliminating the requirement to cut the ligament), as well as a means through which the enzyme could be preserved until it was required in surgery. The innovation was a success, which led to Conner patenting his compound and meeting an unmet need in the industry – all thanks to market research which played an instrumental role in discovering and unleashing the market opportunity.

In the case of the cataract surgery, market research provided invaluable insights into unmet needs and a thorough understanding of the environment in which the new product would be sold. However, caution should be taken in terms of the expectations of market research, for it cannot be assumed that conducting research with the market will uncover sizeable opportunities and lead to the conception and launch of new products. It is the role and responsibility of the researcher to use the understanding of the needs of the market to find applications for new products that will satisfy these needs. The market cannot be expected to announce what the new product should be, and market research respondents cannot play the role of R&D Director!

Furthermore, it cannot be assumed that market research is an exact science, as it would be unrealistic and unreasonable to expect market researchers to predict the precise demand for a new concept, given that there are numerous variables that can impact demand outside of the market researchers’ remit. It takes years to get a product to the commercialization stage, let alone to get it well established in a marketplace.

Market research should be regarded as an experiment which may fail if it is not conducted in the right conditions. For example, Xerox commissioned three independent consultants to explore the opportunity for a copier. Two consultants advised against the launch and the third consultant forecast sales of 8,000 units over 6 years. Xerox chose to ignore the recommendations of the consultants, launched the copier and installed 80,000 machines within just 3 years. The market research had underestimated demand as respondents were unable to provide their views on a new product that they had never experienced.

Indeed, innovations that require potential users to try something new (which is likely to involve a change in mental attitudes) are difficult to research, given that potential buyers or users – when asked in an interview or focus group – cannot be expected to imagine using a product and to then state how likely they would be to buy it, or to state how much they would pay for it, without sufficient time to fully consider the product, or possibly trial it in the environment in which the product would be used. Imagine asking people prior to the launch of the Sony Walkman what they thought of the concept of a transportable music player that they could listen to on the move. Since people would have difficulty conceiving the notion, it could have received the thumbs down.

Nevertheless, market research can explore the underlying needs of the market and make a judgement as to how well a new product meets these needs. Hence it is the researcher, and not necessarily the potential buyer or user, who makes the connection between the unmet needs and the new product development opportunities.

Key questions that should be asked in any concept screening research include the following:

- Is the purpose of the concept clear and can potential users be persuaded of the product’s benefits? (This will show the clarity and purpose of the offering.)

- Does the product meet a need? What is the specific nature of potential users’ requirements? (This will assess the demand for the product.)

- How are existing products used, i.e. for how long, how frequently, precisely what for etc.? (This will show the behavior of people buying existing products.)

- What challenges do people face in using existing products and what requirements are not being met? To what extent are users of current products satisfied with these products and their suppliers? (This will identify any gaps in the market.)

- Is the price reasonable in light of the concept’s perceived benefits? (This will show if people are prepared to pay an appropriate price for the new product.)

- How likely are potential users to buy the product? (This will show purchase intent, i.e. how many people are likely to buy the new product – at least at face value as this will certainly be affected by the promotional push.)

Companies can be guilty of claiming they already know all the answers. This appeared to be the case with Sony, which had not conducted enough market research prior to commercializing its e-Villa Internet appliance. This new product was intended to enable consumers to have internet access from their kitchens, but the product failed as it was simply too heavy to lift at nearly 32 pounds and 16 inches. Consequently, the product was withdrawn after just three months. However, had Sony conducted more market research, it could have potentially saved a considerable amount of money in terms of the financial and human resources that were required in the product development and commercialization process.

A further point to consider in the pre-birth stage is that it is not just the product that needs to be right prior to commercialization; it is everything surrounding the product, such as the packaging, services (e.g. technical service) and marketing. The design, coordination and commercialization of all of these aspects can take many years, especially in the case of industrial innovations, which have been known to take decades. Carbon fibers, for instance, were discovered in 1965 and produced in the 1970s, but it was 20 years until they had a significant impact. Indeed it takes time for people to not only learn about a new product, but to be persuaded about the product’s benefits and to use it.

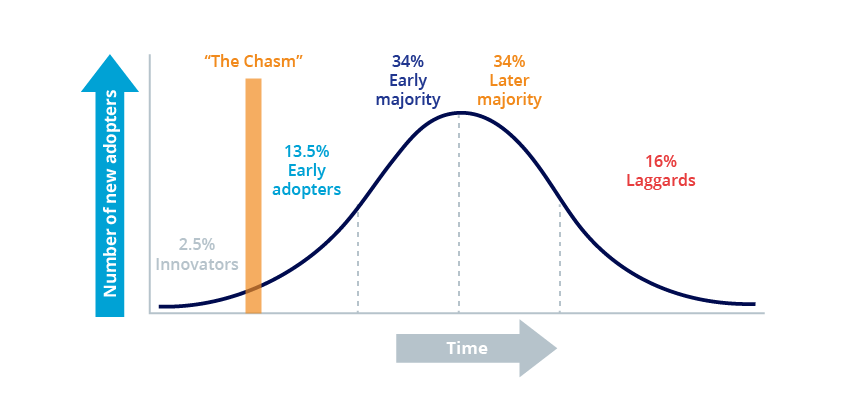

The innovation adoption curve (Rogers, 1995) illustrated in Figure 2 shows the change in the number of new adopters of a product over time, at different stages of the product lifecycle. The innovators are the earliest users of the product who welcome change, followed by the early adopters who are also willing to try new ideas but who tend to be more conservative. The early majority then take up the new product (and accept the change sooner than the average), followed by the sceptical, later majority which will use new ideas or products only when the majority is doing so. Finally, the traditionalist laggards are critical of new ideas and tend to only accept new products once they are mainstream.

Figure 2 – The Innovation Adoption Curve (Rogers)

In order to penetrate a market and achieve adoption, it is vital to educate the market about the product. It is necessary to jump “the chasm” and find sufficient momentum to take the innovation forward. For example, the largest wine producer in the world, E&J Gallo Winery, once sought to introduce a new wine-based drink to the market, which would be mixed with an ingredient to keep the alcohol content down below 5%. At the time of the conception, it was uncertain as to what ingredient this would be, but it was anticipated that it could be sparkling water, tonic or fruit juice. Market research costing in excess of $100,000 (a huge sum at the time) was conducted and led to an extremely clear result: consumers hated the product as they assumed that it contained the worst quality wine and they couldn’t really understand the purpose of diluting a fine wine with water or something else. This inability to communicate the benefits of the new product put the wine drink in jeopardy.

Not only did E&J Gallo fail; it was also humiliated as the concept was being worked on at the same time elsewhere by two young men who believed they had understood the changing market and people’s (especially women’s) interest in a lighter, less alcoholic drink. They developed a bottled “spritzer” product that was almost the same as the one that E&J Gallo’s research had claimed would bomb. On a shoe string budget they launched their product in California and soon it was a multi-million dollar business that they very shortly sold to US distiller Brown Foreman. E&J Gallo made the mistake of thinking that market research would give them a green or red light on their conceptually new product, rather than help them understand if there was an unmet need that they could stratify in some way.

In summary, the most effective types of market research studies for product development at this stage of the life cycle are needs assessment research studies (in which the usage of existing products are examined and unmet needs are explored), and concept screening (in which a new concept can be shown to the target audience for feedback on the product, but only if the product is presented to the users properly and if they are given sufficient time to understand the product’s benefits).

Youth – Stimulating Product Take-Up

In getting a product off the ground, there are three crucial questions that need to be answered:

- Where does the product/company stand at this point in time?

- Where does it wish to go?

- How can it achieve its goals?

Market research is highly effective in providing answers to all of these questions through product development research. It can provide an assessment of the size of the market, its growth prospects, the distribution routes, the market segments, and factors influencing the purchasing decision, plus suppliers used and their perceived strengths and weaknesses. It can guide product design, price points, packaging design, promotions and service (i.e. all elements of the marketing mix).

Some companies conduct market research in-house to answer these questions, but this can result in internal, political conflict, and can end up delaying the adoption of the new product. Using an independent market research supplier will speed up the process and, as Kotler and Keller (2006) argue, “Being early can pay off”, so much so that research has revealed how “products that came out six months late – but on budget – earned an average of 33% less profit in their first five years, [whereas] products that came out on time but 50% over budget cut their profits by only 4%”.

In summary, typical market research studies conducted at this stage of the product life cycle include needs assessment research (or market opportunity research ), b2b pricing strategy research and ad testing market research or communications testing .

Maturity – Improving Product Performance

The applications for market research at this stage of the product life cycle echo the applications appropriate for earlier stages in the life cycle. For instance, market research can be used here for exploring optimum price points, for determining market share and market size , and for gauging attitudes towards the consumption of the product. In addition, views on the product in question can be compared to the perceived strengths and weaknesses of competitors’ offerings used, and along with unmet needs, the research can uncover potential product development opportunities even at this stage of the product life cycle.

It is vital not to neglect products at this stage in the life cycle, for continual product improvement is required in order to retain customer satisfaction. Most companies lose 45% to 50% of their customers every five years, and winning new customers can be up to 20 times more expensive than retaining existing customers. Product development research indicates to customers not only that a company is listening to the market’s needs, but seeking to respond to these needs and to improve its offering.

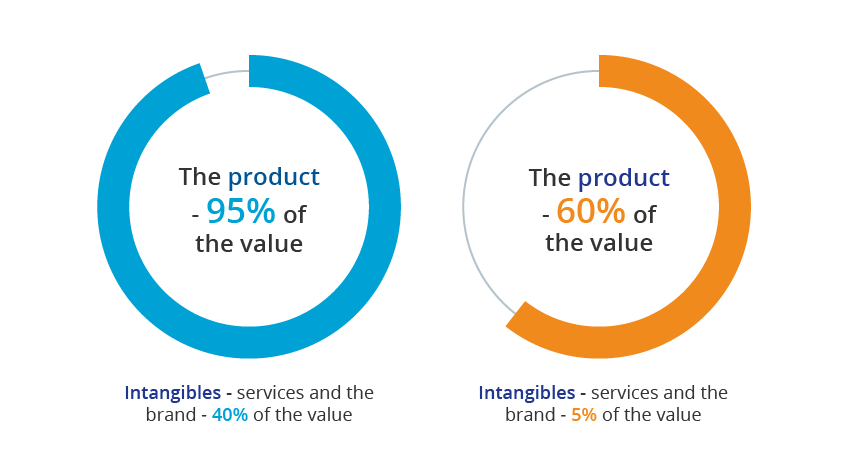

For example, a supplier of office furniture, “Supplier X”, could be regarded as just an average supplier in an industry in which all manufacturers’ products are viewed as similar. In this case, Supplier X’s furniture – the product – comprises 95% of the value, as illustrated in the left diagram in Figure 3 overleaf. If market research were conducted and revealed that companies purchasing office furniture actually had specific unmet needs around the product, such as the ability to customize furniture, assistance with interior design and delivery of furniture after 5pm, then Supplier X would need to build value around other parts of its offering, as illustrated in the right diagram in Figure 3. Thus by researching the product in its widest context, market research can be instrumental in rejuvenating a product, even at this late stage of its life cycle.

Figure 3 – Improving The Customer Value Proposition

In summary, typical market research studies conducted at this mature stage of the product life cycle include customer satisfaction research (in order to retain existing customers and hopefully attract potential customers), b2b market segmentation research (to determine how to tailor an offering to meet the needs of different segments) and pricing strategy research (to determine optimal price points so as to achieve maximum profits).

Old Age – Determining The Future

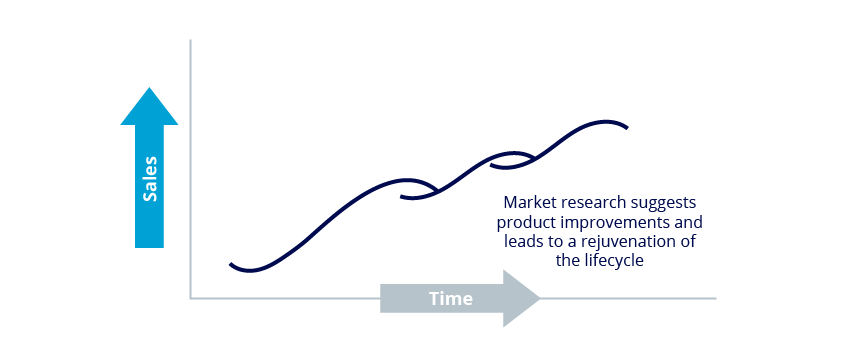

The final stage in a product’s life cycle comprises the product’s decline, with substitutes (often cheaper or more efficient) and new innovations gradually eclipsing the product as its sales wane and its profits are squeezed. Not all products necessarily die though as there are often opportunities for modifications and improvements which can result in a rejuvenation of the life cycle, as illustrated in Figure 4. Such opportunities for revitalizing a product can be uncovered through product development research.

Figure 4 – Rejuvenation Of The Product Life Cycle (Hague 2002)

Market research can help a company seek new markets for its aging products. Car plants have been sold by Fiat and Renault to Russia and China to produce models that are perfectly acceptable in these developing markets but which were seen as out-dated at home. Companies making ski poles and hitting mature and static markets can find new outlets by developing new products such as walking poles.

In summary, typical market research studies conducted at this aging stage of the product life cycle include needs-based assessment studies (in order to determine any unmet needs and to uncover potential product development opportunities), and market assessment studies (to gather market intelligence and to determine market potential in a new or an export market).

Determining The Type Of Market Research Required

New product development research almost certainly will require a mixture of qualitative and quantitative research.

Qualitative research is necessary to obtain a deep understanding of issues such as requirements and unmet needs. It allows more freedom in exploration depending on respondents’ areas of interest. The principal research tools of qualitative research are focus groups or depth interviews, which allow questioning and probing far below the skin of the subject.

Once the needs have been understood and it is clear that there is a market for a new product, some means is required of measuring the size of demand, usage habits, attitudes to products and the likelihood of up-take of the new product. Quantitative research now takes over and a relatively large number of structured interviews are required to provide a robust and statistically valid result. Such quantitative research studies tend to be conducted either by telephone or online.

Market research can cost anything from $20,000 (for a couple of focus groups, for example) to $150,000 or more (for a wide ranging study incorporating focus groups and quantitative research).

Example Of Product Development Research In Action

Envirotainer are the global market leader in secure cold chain solutions for air transport of pharmaceuticals. To remain at the forefront of innovation, they approached B2B International to help understand how they could differentiate a new container solution in the market based on customer needs.

Envirotainer wanted to understand which features of the new container would be most important to customers and how this would affect their willingness to pay. They also wanted to gain an understanding on which features to prioritize in their marketing once it was ready to take to market.

To read in detail how multiple types of primary research, including customer journey mapping workshops, in-depth interviews and a large-scale quantitative survey were used to develop and successfully launch the new container solution, check out the full case study .

Product development research is used at all stages of the product life cycle, from the conceptual stage through to maturity. It serves a host of purposes, such as establishing (unmet) needs, estimating likely demand, setting prices, shaping the specification of the product or determining optimal price points, to name but a few examples. What’s more, market research can unleash potential opportunities for new products, as well as rejuvenate existing products, perhaps by incorporating new features or finding new markets. Given the costs involved in innovation, research and development, and commercialization, as well as the costs incurred in maintaining an aging weak product, product development research provides a high return on investment.

This paper has shown that product development research does not just examine the product alone; it explores everything surrounding the product such as packaging, service, brand and company reputation. Product research should encompass the whole customer value proposition, and improvements to packaging, delivery, or any aspect of service support could have just as big an impact as improvements to the physical product itself.

Finally, it is important to acknowledge that people’s tastes change slowly; they gradually see and acknowledge the adoption of products by others; and over time they are influenced by regular exposure to promotions. An initial rejection of a new product in a market research study may shortly become an enthusiastic embrace as attitudes change. Hence market research cannot be expected to give definitive and direct answers to new product questions; rather it should be used to provide a backdrop of understanding to the needs and unmet needs of the market. It is the researcher’s task to use these insights in order to assess the new product’s potential. New product research needs more intuition and judgment from the researcher than any other tool in the market researcher’s tool kit.

Bibliography

DRUCKER, P.F (1993) Innovation and Entrepreneurship. Collins

HAGUE, P (2002) Market Research. (3rd Edition) Kogan Page

KOTLER, P (1999) Marketing Management: Millennium Edition. (10th Edition) Prentice Hall

KOTLER, P., KELLER K.L. (2006) Marketing Management 12e. Pearson Prentice Hall

LEVITT, T (1969) The Marketing Mode. New York: McGraw-Hill

ROGERS, E.M (1995) Diffusion Of Innovations. (4th Edition) New York: The Free Press

Other References

According to Clayton Christensen, a Harvard Business School professor, in an interview with MIT Sloan Management Review, published in the Wall Street Journal December 15th 2008: How Hard Times Can Drive Innovation

Readers of this white paper also viewed:

Visit our product and proposition research page >

To learn how our product development research can help your business

Contact Us >

To find out more on how our market research expertise can help your business

Speak to an expert...

- Keep up to date with our latest research

- First name *

- Last name *

- Company name *

- By subscribing to this newsletter, you are opting in to our marketing communications. Read our privacy policy for more information.

- Name This field is for validation purposes and should be left unchanged.

Privacy Overview

IMAGES

VIDEO