Variable Cost

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on November 28, 2023

Fact Checked

Why Trust Finance Strategists?

Table of Contents

Variable costs definition.

A variable cost is any corporate expense that changes along with changes in production volume. As production increases, these costs rise and as production decreases, they fall. Common examples include raw materials, direct labor, and packaging.

While variable costs are generally thought of as physical items, such as raw materials, variable costs include all expenses which increase incrementally with each additional unit produced.

Sales commissions, for example, are also considered variable because the size of a commission is tied to the volume of products sold by an employee.

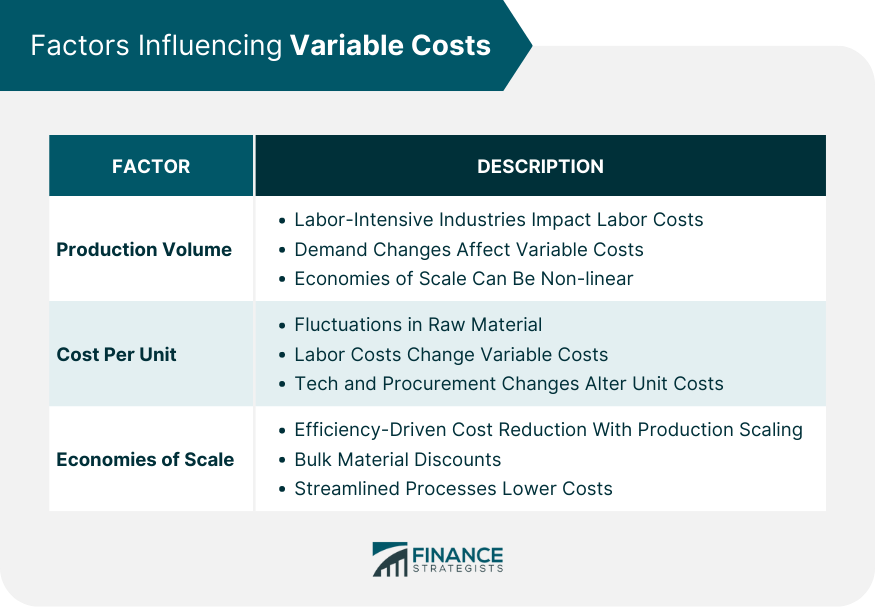

Factors Influencing Variable Costs

A myriad of factors influence variable costs. Understanding these factors can help businesses strategize better and maintain optimal operations.

Production Volume

In industries where production is labor-intensive, hiring more workers during peak periods can lead to higher direct labor costs.

On the other hand, when there's a decline in demand, production might decrease, leading to a reduction in variable costs as fewer resources are consumed.

However, it's important to note that variable costs do not always rise or fall in a perfectly linear fashion. There might be instances where economies of scale come into play, affecting the proportionality of these costs.

Cost Per Unit

The cost per unit is the amount it takes to produce a single item. This can fluctuate based on various factors such as the price of raw materials or changes in labor costs.

For example, if a spike in demand for a particular raw material occurs due to global shortages, the cost to purchase that material will increase.

This, in turn, will raise the cost per unit, leading to higher variable costs for businesses reliant on that material.

Alternatively, advancements in technology or improved procurement strategies might lower the cost per unit, resulting in reduced variable costs. Regularly monitoring and adjusting to these shifts is crucial for maintaining profitability.

Economies of Scale

Economies of scale refer to the cost advantage that companies achieve when production becomes efficient, leading to a reduction in the cost per unit as production volume increases.

For instance, purchasing raw materials in bulk might result in discounts, thereby reducing the cost per unit. Similarly, streamlining production processes can also lead to decreased costs per item.

However, it's essential to recognize that economies of scale can plateau. After reaching a certain production level, the benefits might diminish, and variable costs may not decrease at the same rate.

How to Find Variable Cost

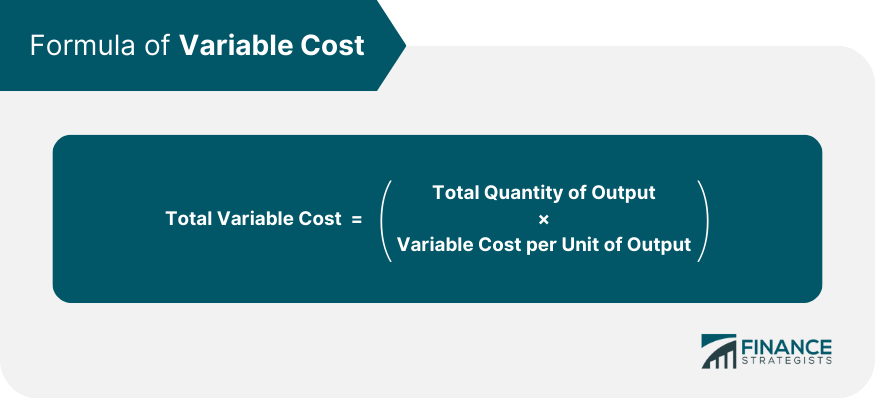

Because Variable Costs are tied to production, they are usually thought of as a constant amount expensed per unit produced.

For example, if a lemonade manufacturer increases production from 100,000 bottles a week to 250,000, the cost per bottle remains the same, but the total variable cost increases proportionately to the increase in production volume.

To determine total variable cost, simply multiply the cost per unit with the number of units produced.

It's worth mentioning that firms may reduce the cost per unit by benefiting from Economies of Scale , which allows for decreased variable costs due to increased efficiency and bargaining power from higher volume.

Variable costs stand in contrast with fixed costs since fixed costs do not change directly based on production volume.

Examples of fixed costs are employee wages, building costs, and insurance.

Between variable and fixed costs are semi-variable costs (also known as semi-fixed or mixed costs).

These costs have a mix of costs tied to each unit of production and a fixed cost which will be incurred regardless of production volume.

For example, the cost of deliveries includes the fixed costs of insurance , depreciation , and loan payments on a fleet of delivery vehicles, but the cost of gasoline is variable depending on the number of deliveries.

An increase in the number of deliveries being made will increase the expense of gasoline, but not the cost of the insurance, depreciation, or loans.

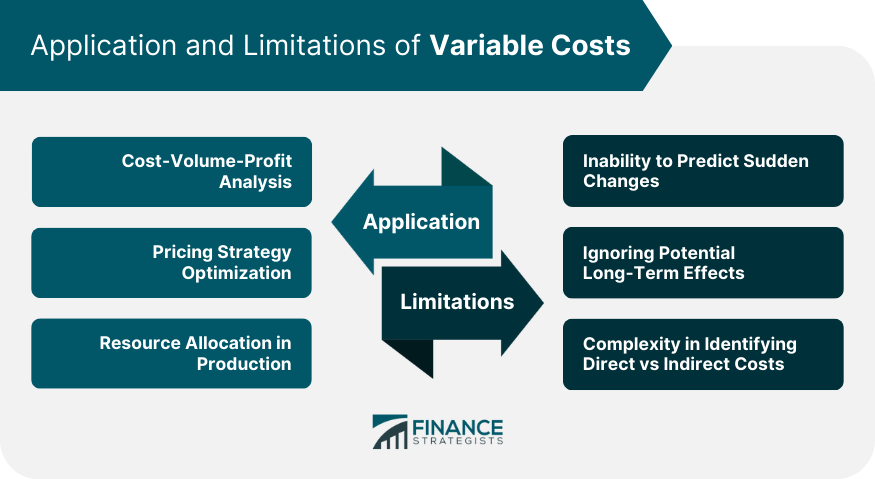

Application of Variable Costs

Implementing knowledge of variable costs can lead to improved decision-making and better business strategies.

Cost-Volume-Profit Analysis

Cost-Volume-Profit (CVP) analysis is a financial tool that businesses use to determine how changes in costs and sales volume can affect profits .

Through CVP analysis, companies can identify the break-even point —the level of sales at which total revenues equal total costs.

Knowing this point can help businesses set sales targets, plan production volumes, and strategize pricing.

Moreover, understanding how changes in variable costs can impact profitability allows companies to make informed decisions about scaling up or down.

Pricing Strategy Optimization

For businesses, setting the right price for products or services is a balancing act.

With a thorough understanding of variable costs, companies can set prices that cover these costs and also account for fixed costs, ensuring profitability.

By analyzing variable costs, businesses can also identify opportunities for discounts, promotions, or premium pricing, depending on market dynamics and cost structures.

Resource Allocation in Production

Variable costs can guide businesses in determining how to allocate resources optimally.

For instance, if a particular product has a high variable cost but generates low revenue , it might be more beneficial to divert resources to another product with a better profit margin .

By constantly evaluating and adjusting resource allocation based on variable cost data, businesses can ensure they're operating efficiently and maximizing returns.

Limitations of Variable Costs

While understanding variable costs is vital, it's equally essential to be aware of their limitations.

Inability to Predict Sudden Changes

One of the primary limitations of variable costs is the difficulty in predicting sudden shifts.

For instance, sudden spikes in raw material prices or unforeseen changes in labor costs can significantly impact the variable costs of a business, affecting profitability.

Ignoring Potential Long-Term Effects

Focusing solely on variable costs might lead businesses to overlook longer-term strategic considerations.

Cutting costs by sourcing lower-quality raw materials can reduce variable costs in the short term but might harm the brand's reputation and customer trust in the long run.

Complexity in Identifying Cost Types

Determining what constitutes a direct variable cost can sometimes be challenging. Electricity used in a production process might increase with production volume, but it's hard to attribute a specific amount to each unit produced.

Such complexities can sometimes obscure the true variable costs, leading to misinformed decisions.

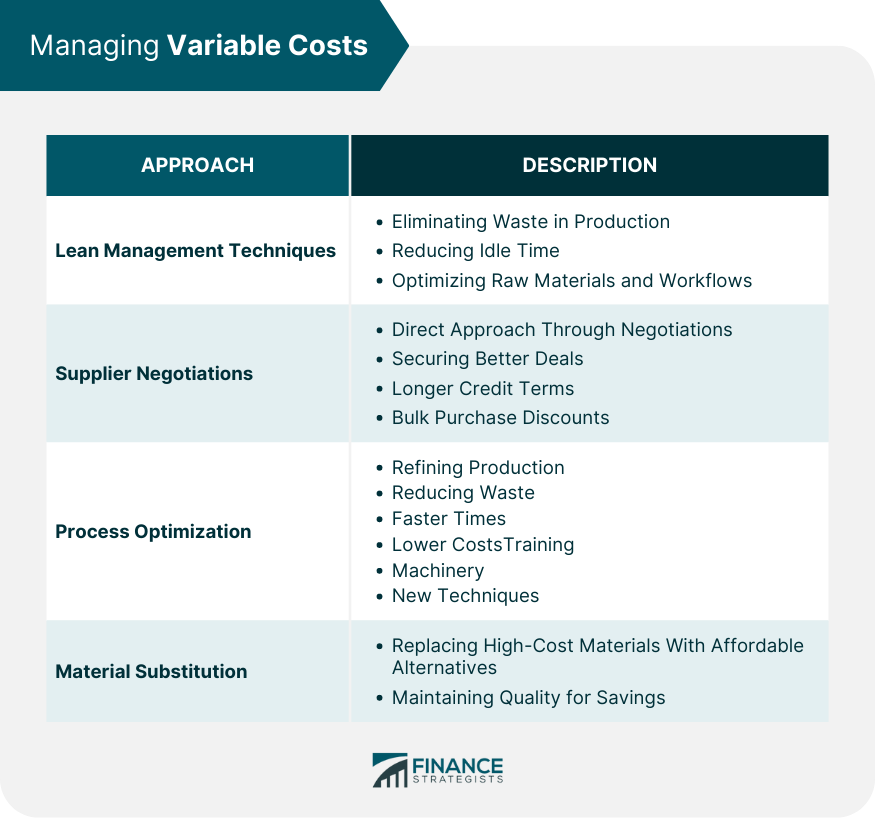

Managing Variable Costs

Efficient management of variable costs is a cornerstone of successful business operations.

Lean Management Techniques

Lean management focuses on eliminating waste in all forms from the production process.

This might mean reducing idle time, optimizing the use of raw materials, or improving production workflows.

By embracing lean techniques, businesses can effectively reduce their variable costs and improve overall efficiency.

Supplier Negotiations

One direct approach to manage variable costs is through negotiations with suppliers.

By securing better deals, longer credit terms, or bulk purchase discounts, companies can achieve significant reductions in their material costs , which constitute a large part of variable costs for many businesses.

Process Optimization

Refining and optimizing production processes can lead to reduced waste, faster production times, and ultimately, lower variable costs.

This might involve training employees, investing in advanced machinery, or adopting new production techniques.

Material Substitution

Sometimes, replacing a high-cost material with a more affordable alternative without compromising on quality can lead to substantial savings.

Material substitution, when done right, can be a strategic move to manage variable costs effectively.

Variable costs are the expenses that change in direct proportion to the volume of goods or services a company produces.

These costs, which change with production volume, encompass a wide range of expenses beyond just physical items.

Factors like production volume, cost per unit, and economies of scale influence variable costs, impacting profitability.

By understanding variable costs, businesses can conduct cost-volume-profit analysis, optimize pricing strategies, and allocate resources efficiently.

However, variable costs have limitations, such as their unpredictability during sudden changes and potential neglect of long-term effects.

Effective management involves implementing lean techniques, negotiating with suppliers, optimizing processes, and considering material substitution.

Balancing these strategies while addressing complexities in cost identification ensures businesses make informed choices, optimizing their performance and sustaining success.

Variable Cost FAQs

What is a variable cost.

A variable cost is any corporate expense that changes along with changes in production volume.

How are Variable Costs calculated?

To determine the total variable cost, simply multiply the cost per unit with the number of units produced.

What is an example of Variable Costs?

If a lemonade manufacturer increases production from 100,000 bottles a week to 250,000, the cost per bottle remains the same, but the total variable cost increases proportionately to the increase in production volume.

Are Variable Costs unit-based?

Because variable costs are tied to production, they are usually thought of as a constant amount of expense per unit produced.

What other types of costs can be incurred?

Variable costs stand in contrast with fixed costs, since fixed costs do not change directly based on production volume. Between variable and fixed costs are semi-variable costs (also known as semi-fixed or mixed costs).

About the Author

True Tamplin, BSc, CEPF®

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide , a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University , where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon , Nasdaq and Forbes .

Our Services

- Financial Advisor

- Estate Planning Lawyer

- Insurance Broker

- Mortgage Broker

- Retirement Planning

- Tax Services

- Wealth Management

Ask a Financial Professional Any Question

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

They regularly contribute to top tier financial publications, such as The Wall Street Journal, U.S. News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet.com, Motley Fool, CNBC, and many others.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Why You Can Trust Finance Strategists

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

How It Works

Step 1 of 3, ask any financial question.

Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify.

Step 2 of 3

Our team will connect you with a vetted, trusted professional.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Step 3 of 3

Get your questions answered and book a free call if necessary.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Where Should We Send Your Answer?

Just a Few More Details

We need just a bit more info from you to direct your question to the right person.

Tell Us More About Yourself

Is there any other context you can provide.

Pro tip: Professionals are more likely to answer questions when background and context is given. The more details you provide, the faster and more thorough reply you'll receive.

What is your age?

Are you married, do you own your home.

- Owned outright

- Owned with a mortgage

Do you have any children under 18?

- Yes, 3 or more

What is the approximate value of your cash savings and other investments?

- $50k - $250k

- $250k - $1m

Pro tip: A portfolio often becomes more complicated when it has more investable assets. Please answer this question to help us connect you with the right professional.

Would you prefer to work with a financial professional remotely or in-person?

- I would prefer remote (video call, etc.)

- I would prefer in-person

- I don't mind, either are fine

What's your zip code?

- I'm not in the U.S.

Submit to get your question answered.

A financial professional will be in touch to help you shortly.

Part 1: Tell Us More About Yourself

Do you own a business, which activity is most important to you during retirement.

- Giving back / charity

- Spending time with family and friends

- Pursuing hobbies

Part 2: Your Current Nest Egg

Part 3: confidence going into retirement, how comfortable are you with investing.

- Very comfortable

- Somewhat comfortable

- Not comfortable at all

How confident are you in your long term financial plan?

- Very confident

- Somewhat confident

- Not confident / I don't have a plan

What is your risk tolerance?

How much are you saving for retirement each month.

- None currently

- Minimal: $50 - $200

- Steady Saver: $200 - $500

- Serious Planner: $500 - $1,000

- Aggressive Saver: $1,000+

How much will you need each month during retirement?

- Bare Necessities: $1,500 - $2,500

- Moderate Comfort: $2,500 - $3,500

- Comfortable Lifestyle: $3,500 - $5,500

- Affluent Living: $5,500 - $8,000

- Luxury Lifestyle: $8,000+

Part 4: Getting Your Retirement Ready

What is your current financial priority.

- Getting out of debt

- Growing my wealth

- Protecting my wealth

Do you already work with a financial advisor?

Which of these is most important for your financial advisor to have.

- Tax planning expertise

- Investment management expertise

- Estate planning expertise

- None of the above

Where should we send your answer?

Submit to get your retirement-readiness report., get in touch with, great the financial professional will get back to you soon., where should we send the downloadable file, great hit “submit” and an advisor will send you the guide shortly., create a free account and ask any financial question, learn at your own pace with our free courses.

Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

Get Started

To ensure one vote per person, please include the following info, great thank you for voting., get in touch with a financial advisor, submit your info below and someone will get back to you shortly..

- Search Search Please fill out this field.

- Building Your Business

- Operations & Success

The Fixed and Variable Costs of a Small Business

Learn the Difference Between Fixed and Variable Costs

What Are Fixed Costs?

What are variable costs, semi-variable costs.

- Difference - Costs and Expenses

Costs, Sales Volume, and Profit

The Balance/Marina Li

When you operate a small business, you have two types of costs - fixed costs and variable costs.

Fixed costs do not change with the amount of the product that you produce and sell, but variable costs do.

A change in your fixed or variable costs affects your net income. It also affects your company's breakeven point.

Fixed costs are the costs associated with your business's products or services that must be paid regardless of the volume you sell. One example of a fixed cost is overhead. Overhead may include rent for the space your company occupies, such as your office space or your factory space. Here are the top five fixed costs in most businesses:

- Depreciation - the gradual deduction of an asset's decline in value. A physical asset is gradually expensed over time down to a value of $0.

- Amortization - the allocation of the cost of an intangible asset over a period of time. It is usually used to expense a mortgage loan down to $0.

- Insurance - the liability insurance you hold on your business.

- Rent - the rent you pay on your office, factory, and storage space.

- Utilities - electricity, water, and other utilities.

Reducing certain fixed costs to improve your cash flow is possible, but may require decisions like moving to a less expensive workplace or reducing the number of employees. Other fixed costs, like depreciation, on the other hand, won't improve your cash flow but may improve your balance sheet.

if you're applying for a bank loan, for example, adjusting the depreciation schedule can improve your balance sheet. If you decide to change your depreciation schedule, be aware that:

- Slowing down the depreciation rate reduces your expenses on paper, but as a result, your IRS tax return will show an increase in profit. In other words, slowing down the depreciation rate will probably raise your taxes.

- You'll almost always need to get IRS approval to change an existing depreciation schedule. To do this, file Internal Revenue Service (IRS) Form 3115 Change in Accounting Method.

Variable costs are directly related to sales volume. As sales go up, so do variable costs. As sales go down, variable costs go down. Variable costs are the costs of labor or raw materials because these items change with sales. One way for a company to save money is to reduce its variable costs.

Here are some examples of variable costs:

- Direct Materials - the raw materials that go into the production of your product

- Production Supplies - the supplies that are necessary for the machinery that help produce your product, such as supplies that help maintain your equipment

- Sales Commissions - the part of a worker's salary that is based purely on the sales they make

- Credit Card Fees - the fees that the merchant has to pay in order to offer credit card services to their customers

Other examples of variable costs are delivery charges, shipping charges, salaries, and wages. Performance bonuses to employees are also considered variable costs. In many instances, reducing variable costs are easier to manage without major disruptions than changing fixed costs.

Some costs have components that are fixed and some that are variable. One example is wages for your sales force. A portion of the wage for a salesperson may be a fixed salary and the rest may be sales commission. When calculating your fixed and variable costs, you should allocate the fixed portion to fixed costs and the variable portion to variable costs.

What is the Difference Between Costs and Expenses?

Costs are expenditures. Your company has expended resources to acquire an asset that it has not yet consumed. Examples are prepaid expenses, inventory, and fixed assets. An expense is a cost whose utility has been used up. For example, if you buy a van to use in your business, you depreciate it over time. When it is depreciated to zero dollars, it is fully expensed.

The same is true for amortization. If your business has a mortgage loan, it amortizes it over time until the loan is paid off and the principal and interest are down to zero dollars. At that time, it is fully expensed.

A change in any of your costs affects your net profit .

A change in sales volume always affects net profit as well because variable costs, such as materials costs and employee wages, inevitably rise with sales volume.

On the other hand, even though your variable costs rise with sales volume increases, your unit costs may decline. If, for instance, you're buying production materials in greater volume you may be able to buy them at lower price points.

Breakeven analysis shows the relationship between the price of the product you sell, the volume of the product you sell, and your costs. Price, which is one of the variables you use in breakeven analysis, can be determined by further dividing up fixed and variable costs into direct and indirect costs . Direct costs are costs associated with the production of goods, such as hourly labor or materials. Indirect costs refer to costs that are not directly associated with the production of goods, such as rent and insurance.

Oeconomica. Variable and Fixed Costs in Company Management , page 1. Accessed April 26, 2020.

Key Differences. Difference Between Fixed Cost and Variable Cost . Accessed April 26, 2020.

Business know-how. Break-even Analysis . Accessed April 27, 2020

Offer extended: Fall in love with FreshBooks 🍂 50% o ff for 6 months. Buy Now & Save

50% off for 6 months Buy Now & Save

Wow clients with professional invoices that take seconds to create

Quick and easy online, recurring, and invoice-free payment options

Automated, to accurately track time and easily log billable hours

Reports and tools to track money in and out, so you know where you stand

Easily log expenses and receipts to ensure your books are always tax-time ready

Tax time and business health reports keep you informed and tax-time ready

Automatically track your mileage and never miss a mileage deduction again

Time-saving all-in-one bookkeeping that your business can count on

Track project status and collaborate with clients and team members

Organized and professional, helping you stand out and win new clients

Set clear expectations with clients and organize your plans for each project

Client management made easy, with client info all in one place

Pay your employees and keep accurate books with Payroll software integrations

- Team Management

FreshBooks integrates with over 100 partners to help you simplify your workflows

Send invoices, track time, manage payments, and more…from anywhere.

- Freelancers

- Self-Employed Professionals

- Businesses With Employees

- Businesses With Contractors

- Marketing & Agencies

- Construction & Trades

- IT & Technology

- Business & Prof. Services

- Accounting Partner Program

- Collaborative Accounting™

- Accountant Hub

- Reports Library

- FreshBooks vs QuickBooks

- FreshBooks vs HoneyBook

- FreshBooks vs Harvest

- FreshBooks vs Wave

- FreshBooks vs Xero

- Partners Hub

- Help Center

- 1-888-674-3175

- All Articles

- Productivity

- Project Management

- Bookkeeping

Variable Cost: Definition, Formula, and Examples

A variable cost is a type of corporate expense that changes depending on how much (or how little) your company produces or sells. Depending on how your sales or production rates are going, your variable costs can rise or fall—hence the name.

So what do you need to know about budgeting for these fluctuating costs? How do variable costs impact your bottom line? What are some examples of variable costs, and how should you consider them in your business strategy? What’s the difference between variable and fixed costs? In this guide, we’ll break down everything you need to know about variable costs.

Key Takeaways

- Variable costs are any expense that increases or decreases with your production output.

- Examples of variable costs include direct labor, direct materials, commissions, and utility costs.

- Variable costs differ from fixed costs, which don’t fluctuate depending on production output or revenue generated.

- Variable cost analysis can help you set prices, budget for future expansions, and gauge the financial success of your business.

- Accounting software can be useful for tracking and managing your variable costs.

Table of Contents

What Is a Variable Cost?

Variable cost formula, types of variable costs, variable cost examples, importance of variable cost, what is the difference between a variable cost and a fixed cost.

- Frequently Asked Questions

A variable cost is a recurring cost that changes in value according to the rise and fall of a company’s revenue and output level. Variable costs are the sum of all labor and materials needed to produce units for sale or run your business.

What does this mean for businesses? Even though the amount it costs to produce a single unit of your product is fixed, the overall cost is variable, since the total amount will change depending on how many units you’re producing. This differs from fixed costs like rent or insurance, which will remain the same regardless of your company’s activity.

Understanding your variable costs is essential for small and mid-sized businesses. The higher your variable costs, the lower your profit margin, meaning your business makes less money. Different industries tend to have more fixed or variable costs, depending on the nature of the service or product they provide.

For instance, airlines have high fixed costs, such as paying for their aircraft. This means they have huge startup costs, but are much less vulnerable to competition once they’re up and running.

Restaurants, on the other hand, tend to have much higher variable costs, since they depend so heavily on labor. This means that service industry businesses are more vulnerable to competition since startup costs are much lower than other types of businesses.

Variable costs have three main components that need to be considered:

Variable Cost Per Unit

Variable cost per unit refers to the total cost of producing a single unit of your business’ product. It encompasses all necessary resources, including labor, materials, marketing, and anything else needed to sell the product. Let’s say your business sells chairs for $80 each, but it costs you $25 in labor and $25 in materials to make them, for a total production cost of $50 per unit. Your variable cost per unit would be $50.

Total Variable Cost

Your total variable cost lets you calculate how much you’ve spent to create a certain number of product units. So if you’ve built 60 chairs to sell, you would multiply the variable cost per unit by the total number of units produced, like so:

$50 (cost per unit for one chair)

x 60 (total number of units produced)

= $3,000 (total variable cost)

Average Variable Cost

Calculate your average variable cost to find out how much you spend to create a single unit of your product on average. Returning to the example of the chair company, the formula would look like this:

$3,000 (total variable cost)

/ 60 (total output of units produced)

= $50 (average variable cost per unit)

In this example, the average variable cost formula simply works backward to arrive at our original cost per unit.

Where average variable cost is most useful, however, is when you’re trying to calculate your average costs while accounting for multiple products with different variable costs per unit. If our chair company also produced a second type of chair that cost $40 to produce and sold for $65, you would use this formula to find your average variable cost for all types of chairs produced, not just for one or the other.

The formula to calculate your total variable cost is:

Total Variable Cost = Total Quantity of Output x Variable Cost Per Unit of Output

For example, the chair company gets an order for 30 chairs for a total selling price of $2,400. To find variable cost per unit, we add the cost per unit in materials ($25) and direct labor costs ($25), and multiply it by our total quantity of output (how many chairs are produced for the order).

30 x ($25 + $25) = $1,500

The total variable cost for this order of 30 chairs would be $1,500, meaning the chair company’s gross profit for the order would be $900 ($2,400 – $1,500).

Different industries have all kinds of different variable costs to consider. While labor and materials are the most common, you may have to account for other fluctuating expenses. Common variable costs include:

Direct Materials

Direct materials refer to any materials that are used in the production of a unit that makes it into the product itself. For example, wood is a direct material for the chair company, since the final chair is made of it. Wood is considered a variable cost because the price of it can change over time.

An example of an indirect material would be sandpaper, which is necessary for creating the chairs, but doesn’t make it into the final product.

Production Equipment

Production supplies and equipment refers to any necessary supplies or equipment that fluctuate with your output level. For the chair company, an example would be oil for machines involved in the woodworking process. If the company makes more chairs, they’ll need more machine oil, making this a variable cost.

Direct Labor

Direct labor is sometimes a variable cost depending on how you staff your production area. Odds are, your production area needs a minimum amount of staff to operate regardless of how many units you produce—this is a fixed cost. But if you need more staff (or need staff to work more hours) to fulfill an order, paying wages for these labor increases would be considered a variable cost.

Commissions

If your company offers commissions (a percentage of a sale’s proceeds granted to staff or the company as an incentive), these will be variable costs. This is because your commission expenses depend entirely on how many sales you make. This differs from paying an employee’s salary, which is a fixed cost.

Transaction Fees

If your company accepts credit card payments from customers, you’ll have to pay transaction fees on each sale. This is a variable cost since it depends on how many sales you make (and what methods your customers use to pay).

Utility Costs

The longer your production facility is actively operating, the more power and water it’s likely to use. Utilities are a variable cost because they usually increase and decrease alongside your production.

Packaging and Shipping Costs

If your company offers shipping to customers, you’ll need to consider packaging and shipping among your other variable costs. Since you’ll only need to pay for packaging and shipping if/when you make a sale for delivery, it’s considered a variable cost—even if the price of shipping remains the same over time.

To better explain this concept and differentiate variable and fixed costs, we’ll use a few examples to help you understand how they may apply to your industry.

We’ll once again use the example of the chair company. As we mentioned, it costs $25 in direct labor and $25 in direct materials to produce a single chair, for a total variable cost per unit of $50. They have fixed costs of $500 for the equipment they need to produce chairs. Here’s how we’d break down variable costs for the chair company:

Note how the total variable cost rises with the number of chairs produced, while the fixed cost remains the same regardless of production output.

Variable costs don’t just apply to manufacturing industries. They can also apply to service-based businesses. For example, a business consultant takes on a new 1-month contract. The contract will pay a total of $8,500. But to complete the contract, the consultant has to incur several variable costs, including:

- Paying for market research ($450)

- Travel out of state to work with the client ($600 for a plane ticket, $40 for cab fare)

- Renting temporary office space for one month ($800)

- Hiring a temporary assistant specifically for the contract ($25 per hour for 30 hours of work = $750)

This is a simple equation for a single contract. We would simply add up the above expenses to get the total variable cost for completing the contract:

$450 + $600 + $40 + $800 + $750 = $2,640 (total variable costs)

The consultant would then subtract the total variable cost from the project pay to get their net profit (before paying any fixed expenses):

$8,500 – $2,640 = $5,860 (profit after variable costs)

This can get more complicated if the client takes on another 1-month contract with the same client the next year, and has to incur all the same expenses again. For the sake of the example, we’ll say the consultant has $500 in monthly fixed costs (in equipment leases and a fixed-rate phone plan), whether they have a contract that month or not. Here’s how we’d break it down:

Notice how the total variable cost goes up according to the number of contracts, much like in the previous example.

The data you gather from calculating your variable costs can be valuable for your business. It’s an essential tool when analyzing your expenses , setting prices, and generally gauging the profitability of your business. Here’s a breakdown of the importance of knowing your total variable cost:

Determine Pricing

One of the most common uses for variable expense info is to set prices for your products or services.

If the chair company knows it costs $50 per unit in variable costs to produce a single chair, it wouldn’t make sense to price the chair any lower than $51, since you would lose money on each sale. You’ll also need to charge enough to cover fixed costs.

Of course, you don’t want to charge too much and risk losing business to better-priced competition. Using the variable cost formula will help you find the sweet spot between charging too much and too little, ensuring profitability for your business.

Determine Break-Even Point

Your company’s break-even point is the number of units you need to sell in order to break even on your total expenses. Both your fixed and variable costs are essential for calculating your break-even point . It’s done like so:

Fixed Costs / (Revenue – Variable Costs) = Break-Even Point

Better Budgeting and Planning

Naturally, you’re taking steps to grow and expand your business in the future. If you’re looking to double your output next year, remember that variable costs increase as well. Calculating your variable costs from the very beginning will make it easier to create budgets and expansion plans later on.

Calculate Margins and Net Income

When you calculate your gross margin, net income, and net profit margin , you’ll need to factor your variable and fixed expenses into the formulas. Good variable expense analysis ensures you can calculate how scaling production up or down will impact the company’s bottom line.

Choosing Expense Structure

Lastly, variable cost analysis is useful when determining your company’s expense structure. The chair company could buy an essential piece of production machinery outright for $10,000 (this would make it a fixed cost), or could choose to pay $0.10 for every unit they produce with that machine, making it a variable cost. You’ll need variable cost data to make the right decision in this scenario, which will greatly impact profitability and leverage.

Understanding variable vs. fixed costs is essential for businesses looking to scale production while still remaining profitable. So what’s the difference?

Simply put, variable costs change. This refers to any expenses that fluctuate relative to the number of units the company produces, such as direct materials, direct labor, commissions, or utility costs. Fixed costs refer to expenses that do not change with production output, such as rent for your offices or salaries for permanent employees.

Variable costs can add a layer of unpredictability to running your business. But with a firm grasp of the variable cost formula and how to calculate variable costs for your business, you can plan ahead, keep costs under control, and ensure that you’re setting your business up for growth and success.

If you’re looking for support with tracking all the costs that go into making your business possible, FreshBooks accounting software can help. With in-depth expense tracking, powerful reporting features, and around-the-clock support, we can support your business as it scales up and reaches new heights. Try FreshBooks free today.

FAQs About Variable Cost

Do you still have questions about variable costs and how they affect your business profitability? Read on for some frequently asked questions on the topic.

Is salary a fixed or variable cost?

Salaries are fixed costs because they don’t vary based on production or revenue. They are a regular, recurring expense and the amount paid out is set. However, if you pay commissions for every unit sold on top of a salary, they would be variable costs.

Is labor a variable cost?

Non-salaried labor can be a variable cost. If you pay based on billable hours, commissions, or piece-rate labor rates (when workers are paid based on how many units they produce), these would be considered variable costs. The same goes for staffing more hourly wage workers (or having them work more hours) to meet increased production goals.

What is an example of a variable cost per unit?

An example of a variable cost per unit would be if a company makes chairs. Each chair costs $25 in direct labor and $25 in direct materials to produce. This would mean the total variable cost per unit of a single chair would be $50.

Does variable cost increase per unit?

Yes, your total variable costs will increase as you produce more units. This is because variable costs are tied to the total quantity of units you produce. For example, if you produce 1 chair with a variable cost per unit of $50, your total variable costs would increase to $500 if you produced 10 chairs.

Is variable cost good or bad?

Variable costs are not inherently good or bad—they are a reality of providing any kind of product or service to your customers. You should strive to keep variable cost per unit as low as possible since this will result in more profit per unit. But if your total variable costs are rising, you are producing more units—hopefully at a net profit.

Kristen Slavin, CPA

About the author

Kristen Slavin is a CPA with 16 years of experience, specializing in accounting, bookkeeping, and tax services for small businesses. A member of the CPA Association of BC, she also holds a Master’s Degree in Business Administration from Simon Fraser University. In her spare time, Kristen enjoys camping, hiking, and road tripping with her husband and two children. In 2022 Kristen founded K10 Accounting. The firm offers bookkeeping and accounting services for business and personal needs, as well as ERP consulting and audit assistance.

RELATED ARTICLES

IMAGES

VIDEO