Find the right market research agencies, suppliers, platforms, and facilities by exploring the services and solutions that best match your needs

list of top MR Specialties

Browse all specialties

Browse Companies and Platforms

by Specialty

by Location

Browse Focus Group Facilities

Manage your listing

Follow a step-by-step guide with online chat support to create or manage your listing.

About Greenbook Directory

IIEX Conferences

Discover the future of insights at the Insight Innovation Exchange (IIEX) event closest to you

IIEX Virtual Events

Explore important trends, best practices, and innovative use cases without leaving your desk

Insights Tech Showcase

See the latest research tech in action during curated demos from top vendors

Discover solutions to your insights challenges and uncover new opportunities

Latest on Insights

Editor's Choice

Greenbook Podcast

The Exchange

Lenny Murphy and Karen Lynch debate current news - live on Linkedln and YouTube every Friday

See more on YouTube | LinkedIn

Greenbook Future list

An esteemed awards program that supports and encourages the voices of emerging leaders in the insight community.

Insight Innovation Competition

Submit your innovation that could impact the insights and market research industry for the better.

Find your next position in the world's largest database of market research and data analytics jobs.

For Suppliers

Directory: Renew your listing

Directory: Create a listing

Event sponsorship

Get Recommended Program

Digital Ads

Content marketing

Ads in Reports

Podcasts sponsorship

Run your Webinar

Host a Tech Showcase

Future List Partnership

All services

Dana Stanley

Greenbook’s Chief Revenue Officer

Research Methodologies

June 5, 2024

Primary Market Research Explained: WHY and How to Do It

Discover the power of primary market research for your business strategies. Uncover valuable insights into consumer behavior, market trends, and opportunities.

by Ashley Shedlock

Content Coordinator at Greenbook

Primary market research is essential for business strategies, offering direct insights into customers, markets, and competitors, unlike secondary research that relies on existing data. This hands-on approach gathers new data tailored to specific needs, providing fresh, current, and specific information not available through secondary research.

Methods like surveys, interviews, and observational research offer valuable insights into consumer behavior, market trends, and opportunities, helping businesses make informed strategic decisions. Embracing primary research methods allows businesses to understand customer needs, preferences, and behaviors better, align their offerings with market demands, and drive business growth through targeted marketing efforts.

Primary Market Research Explained

In the world of business, primary market research serves as a powerful tool for steering growth and success. By implementing the findings derived from thorough primary research, companies can strategically position themselves in the market to capitalize on opportunities and overcome challenges effectively. It is not enough to conduct research; the real value lies in the strategic implementation of the insights garnered.

Continuous improvement is at the heart of every successful business, and primary market research plays a pivotal role in this process. By consistently engaging in research activities, companies can stay ahead of industry trends, consumer preferences, and competitive landscapes. This ongoing cycle of gathering, analyzing, and implementing data ensures that businesses remain agile, adaptable, and relevant in a dynamic marketplace.

It is essential to emphasize the significance of primary market research as a cornerstone of informed decision-making. Every data point, every insight, and every analysis contributes to a comprehensive understanding of market dynamics, customer behaviors, and emerging opportunities. By investing in primary research, businesses equip themselves with the knowledge needed to make strategic, data-driven decisions that lead to sustainable growth and long-term success.

Why is Primary Market Research Essential?

To excel in primary market research, one must adopt a customer-centric approach that goes beyond surface-level interactions. By delving deep into understanding customer needs, businesses can tailor their products and services to precisely meet those requirements. This approach not only fosters customer loyalty but also cultivates a deeper connection with the target audience, leading to long-term success.

Secondary Should Always Come Before Primary

When conducting primary market research, identifying market trends is instrumental in staying ahead of the curve. By analyzing patterns and shifts in consumer behavior, businesses can proactively adapt their strategies to capitalize on emerging opportunities and mitigate potential risks. This proactive stance demonstrates market responsiveness and positions the company as an industry leader poised for sustainable growth.

Uncovering consumer behavior patterns is like unraveling the DNA of a market. By closely examining how consumers interact with products or services, businesses can gain profound insights into purchase decisions. This knowledge empowers companies to fine-tune their marketing efforts, optimize their offerings, and create a seamless customer experience that resonates with the target demographic.

The true essence of primary market research lies in gaining valuable insights that transcend mere data points. These insights serve as the cornerstone of informed decision-making, guiding businesses towards strategic moves that drive sustainable success. By leveraging primary research findings, companies can uncover hidden opportunities, address underlying challenges, and pivot their operations to achieve a competitive advantage in the marketplace.

Primary market research is essential for businesses to succeed in today's ever-changing landscape. It is more than just collecting data - it is a strategic necessity. By embracing a customer-centric ethos, responding nimbly to market trends, understanding the intricacies of consumer behavior, and harnessing valuable insights, organizations can forge a path towards sustained growth and industry leadership. The competitive advantage derived from such deep-rooted insights is unparalleled, positioning businesses for success not just in the short term, but for years to come.

Different Types of Primary Research

Primary market research encompasses various types, each offering unique insights crucial for informed decision-making.

- Surveys: Which involve gathering feedback directly from individuals to understand their preferences, behaviors, and needs. Researchers can conduct surveys through online platforms, emails, or in-person interviews, gathering valuable data for analyzing trends and customer satisfaction.

- In-depth Interviews: Unlike surveys that rely on structured questions, interviews are a primary research method that offers a more personalized approach, allowing researchers to delve deeper into respondents' thoughts, emotions, and experiences. This qualitative method is particularly useful for gaining in-depth insights into consumer behavior, motivations, and perceptions.

- Focus groups: A valuable primary research method where a small group discusses specific topics or products, allowing researchers to gather insights into consumer opinions and preferences through group dynamics. This approach yields qualitative data not easily obtained through individual interviews or surveys.

- Observational Research: Involves directly observing and recording consumer behaviors in real-world settings. This method is particularly useful for studying consumer habits, preferences, and interactions with products or services in their natural environment. By observing without interference, researchers can gain valuable insights into how consumers behave without relying on self-reported data.

- Experimental Research: The manipulating variables to observe the effects on consumer behavior. This method allows researchers to control and test specific factors to understand their impact on consumer preferences and decision-making. By conducting experiments, researchers can draw valuable conclusions about causality and make informed predictions about consumer reactions to different stimuli.

Using a variety of research methods can help understand consumer behavior, market trends, and customer preferences more fully. Each type offers unique advantages in collecting data, analyzing consumer insights , and making informed decisions to drive business strategy and product development. Businesses can gain an advantage by using different types of primary research to understand their target market's needs and preferences.

How to Do Primary Market Research

When conducting primary market research, it is crucial to begin by setting clear and specific research objectives. This initial step lays the foundation for the entire research process, guiding the focus and scope of your study. By defining these goals from the outset, you establish a roadmap that shapes all subsequent decisions and actions.

In designing and implementing your research, it is essential to carefully consider the most appropriate research design for your objectives. Choosing the right research approach, whether exploratory, descriptive, or causal, helps you collect accurate data to answer your research questions effectively. The design stage creates the blueprint for your study, outlining the methodologies and procedures to follow.

When it comes to data collection methods, the key is to leverage a mix of techniques that best suit your research goals. Surveys, interviews, focus groups, observations, and experiments are just a few methods at your disposal. Each method offers unique advantages and insights, so choosing the right combination can provide a comprehensive view of your target market and its preferences. Variety in data collection approaches helps ensure the robustness and depth of your findings.

Analyzing research findings is a critical step that transforms raw data into actionable insights. This process involves interpreting the collected data, identifying patterns, trends, and relationships within the information. By delving deep into the analysis, you can uncover valuable nuggets of information that lead to informed decision-making. The ability to draw meaningful conclusions from your research findings is what ultimately drives strategic business initiatives and shapes future success.

Conducting primary market research involves a systematic approach that starts with defining clear research goals and progresses through thoughtful design, diverse data collection methods, and insightful analysis. By following these steps diligently, businesses can unlock a wealth of knowledge about their target market, consumer behavior, and industry trends, enabling them to make informed decisions and stay ahead in today's competitive landscape.

What is the Difference Between Primary and Secondary Market Research?

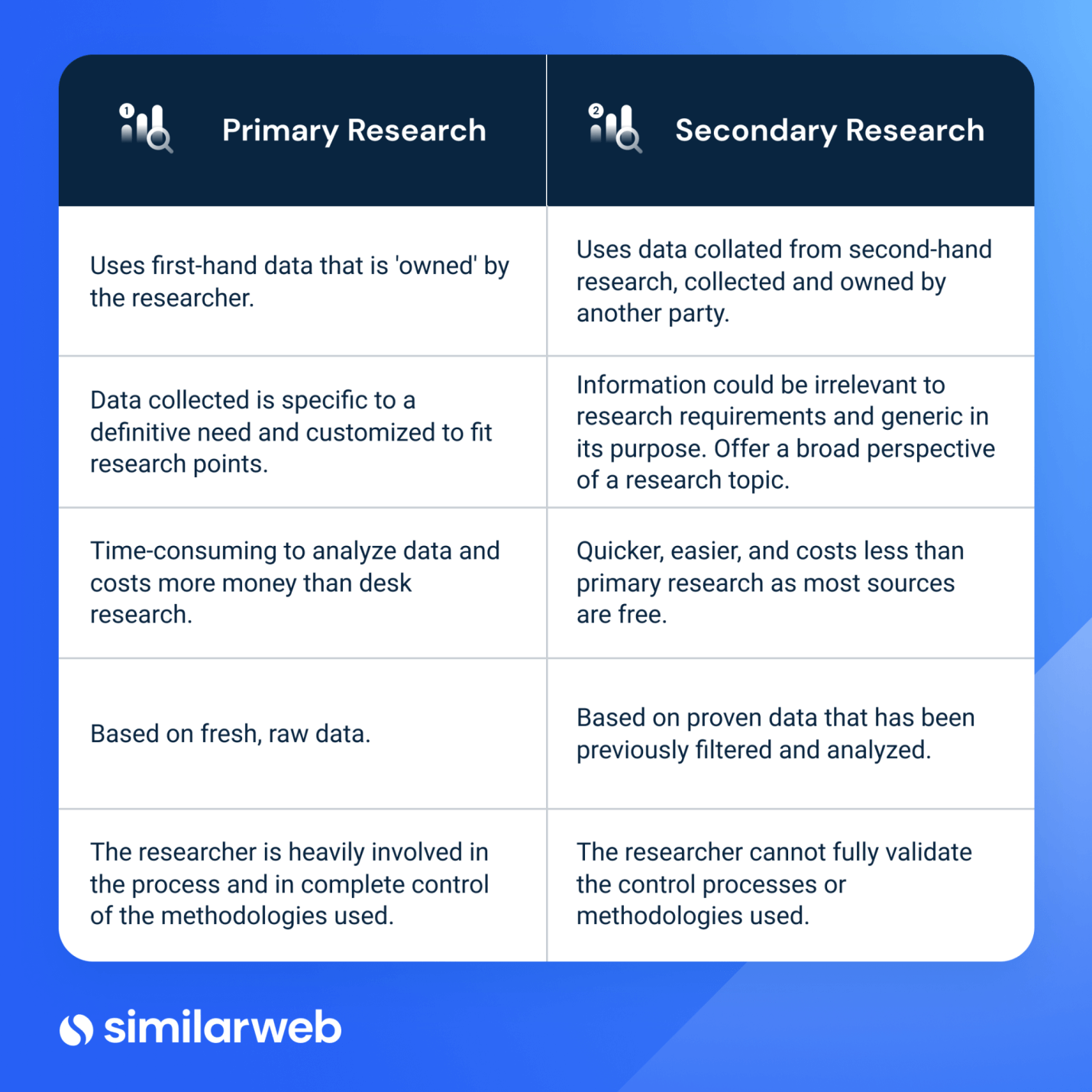

Primary market research and secondary market research serve distinct purposes in the world of business analysis. While secondary research involves gathering information from existing sources like reports, articles, and studies, primary research entails collecting original data directly from the source. Imagine secondary research as reading a book about a place, while primary research is like visiting that place yourself to experience it firsthand.

Primary research allows businesses to ask specific questions and get current information directly from their target audience or market. This method enables companies to delve deeper into a particular issue, gaining a more nuanced understanding compared to secondary research findings. By engaging in primary research, businesses can gather unique insights and data that are relevant and timely for their decision-making processes.

On the other hand, secondary research is valuable for providing background information, industry trends, and competitor analysis. It offers a broad overview of the market landscape, serving as a foundation for further exploration through primary research. While secondary research is efficient and cost-effective, it may not always address the specific needs or nuances that primary research can uncover.

The primary vs. secondary research debate boils down to depth versus breadth. Primary research offers depth by allowing businesses to customize their approach and dive deeply into specific issues, whereas secondary research provides breadth by offering a wide range of existing data and insights. Each type of research has its place in informing business decisions, with primary research being essential for uncovering firsthand insights tailored to the unique needs of a company.

What are the Key Challenges in Collecting Primary Market Research Data?

Collecting primary market research data presents various challenges that researchers need to navigate effectively.

- Researchers must focus on designing methodologies that reduce biases and errors to ensure the reliability and validity of the data collected for primary market research.

- Conducting primary market research is resource-intensive due to the costs and time involved. It requires investments in manpower, technology, and research tools, demanding wise budgeting of time and financial resources for efficient data collection and valuable insights.

- Accessing the target population in primary market research can be challenging due to issues like respondent fatigue, privacy concerns, and hesitancy to participate. Establishing trust and rapport with participants is crucial to boost their involvement and obtain genuine feedback.

- In primary market research, it is essential to choose participants that mirror the target market's diversity accurately to ensure a representative sample. Failure to do so can result in biased results and compromise the research's validity.

- In primary market research, staying current with evolving market trends and changing consumer preferences is crucial. Researchers must adjust methodologies to capture valuable insights amidst the dynamic nature of markets and consumer behavior.

Addressing these challenges requires meticulous planning, strategic decision-making, and a deep understanding of research principles. By recognizing and proactively mitigating these challenges, researchers can enhance the quality and reliability of their primary market research data, leading to meaningful and actionable insights that drive informed business decisions.

Comments are moderated to ensure respect towards the author and to prevent spam or self-promotion. Your comment may be edited, rejected, or approved based on these criteria. By commenting, you accept these terms and take responsibility for your contributions.

Ashley Shedlock

23 articles

The views, opinions, data, and methodologies expressed above are those of the contributor(s) and do not necessarily reflect or represent the official policies, positions, or beliefs of Greenbook.

More from Ashley Shedlock

IIEX LATAM Recap: Exploring the Intersection of Tech, Culture, and Insights

October 17, 2024

Play Episode

Packing Smarter: AI, Research, and the Evolution of Away’s Soft Side Luggage

October 10, 2024

How Much Do Mystery Shopping Companies Charge?

Discover how mystery shopping companies charge with diverse fee structures. Evaluate costs, quality, and reputation for optimal business enhancement.

October 9, 2024

Read article

Data Quality, Privacy, and Ethics

How Poor Sample and Fraudulent Actors Degrade Research Quality and Credibility

Learn the importance of sample size and fraud prevention in research. How optimal sampling enhances data reliability and fraud mitigation maintains in...

October 2, 2024

Data Science

What is Syndicated Market Research Data and How Is it Different From Custom Research?

Syndicated data provides a broad overview of trends, whereas custom research delivers tailored insights that drive specific business decisions.

September 27, 2024

How Does Mystery Shopping Work?

Enhance your business with mystery shopping. Gain valuable insights on service quality and customer experience to boost satisfaction and loyalty effec...

September 18, 2024

Chatbot and Virtual Assistants: Research Partners that Work 24/7 and Never Get Tired

AI-powered chatbots & virtual assistants optimize customer experience with personalized support & round-the-clock assistance for brand loyalty & effic...

September 17, 2024

Are the Hopes & Dreams of Your Business Hidden in Unstructured Data?

Unlock AI for business growth with image, video, voice, and text analysis. Gain insights in healthcare, e-commerce & more. Enhance customer understand...

August 29, 2024

What is In-Home Product Testing?

In-home product testing: Shape new products from home, enhance features, and influence design with genuine user feedback. Empower consumer-driven inno...

August 28, 2024

Qualitative vs. Quantitative Market Research: Why Not Both?

Discover the benefits of qualitative and quantitative methods. Learn how to leverage both approaches for insights into consumer behavior and industry ...

August 14, 2024

Brand Strategy

Brand Tracking Tech 101

Gain valuable insights into consumer preferences and behaviors with brand tracking. Stay ahead of the competition by monitoring key brand metrics cons...

July 31, 2024

How to Use Automation in Research

Discover the power of automation in research. Streamline processes and enhance efficiency. Transform data collection and analysis for speed and scalab...

July 26, 2024

Customer Experience (CX)

How to Use Mystery Shopping Research to Improve the Customer Experience

Discover the power of mystery shopping research in improving customer experience. Uncover service strengths and exceed customer expectations to boost ...

July 25, 2024

Is Now The Time For Synthetic Sample?

Explore the world of synthetic data for decision-making. Fuel research with experiments and simulations while maintaining privacy and statistical prop...

July 16, 2024

Qualitative Research

8 Examples of Qualitative Research

Unveil the depth of human behavior with qualitative research. Dive into narratives and interpretations to find hidden meanings in market research and ...

June 28, 2024

Consumer Packaged Goods (CPG)

Market Research For CPG Companies: The Best Methods

Gain a competitive edge in the consumer goods industry with effective market research strategies. Understand consumer behavior and how to use data ana...

May 15, 2024

5 Secrets to Effective Competitor Research

Gain valuable insights with competitor research. Understand trends, customer preferences, and industry opportunities. Stay ahead in the competitive la...

March 27, 2024

Is Walmart the Future of Market Research?

Editor’s Note: Earlier this year, we had Linda Lomelino on our podcast to discuss how Walmart is now leveraging shopper data and serving commercial cu...

December 1, 2022

Top in Quantitative Research

Moving Away from a Narcissistic Market Research Model

Why are we still measuring brand loyalty? It isn’t something that naturally comes up with consumers, who rarely think about brand first, if at all. Ma...

Devora Rogers

Chief Strategy Officer at Alter Agents

May 31, 2023

Sign Up for Updates

Get content that matters, written by top insights industry experts, delivered right to your inbox.

67k+ subscribers

Weekly Newsletter

Event Updates

I agree to receive emails with insights-related content from Greenbook. I understand that I can manage my email preferences or unsubscribe at any time and that Greenbook protects my privacy under the General Data Protection Regulation.*

Get the latest updates from top market research, insights, and analytics experts delivered weekly to your inbox

Your guide for all things market research and consumer insights

Create a New Listing

Manage My Listing

Find Companies

Find Focus Group Facilities

Tech Showcases

GRIT Report

Expert Channels

Get in touch

Marketing Services

Future List

Publish With Us

Privacy policy

Cookie policy

Terms of use

Copyright © 2024 New York AMA Communication Services, Inc. All rights reserved. 234 5th Avenue, 2nd Floor, New York, NY 10001 | Phone: (212) 849-2752

Primary Market Research: Guide & Examples

Free Website Traffic Checker

Discover your competitors' strengths and leverage them to achieve your own success

Primary market research gives you the direct feedback you need, from those who matter most to your business.

By knowing what makes people tick, and what ticks them off – you can tailor your positioning, messaging, and approach.

Ready to find out more about the what, why, when, and how to do primary market research right?

Then let’s begin:

What is primary market research?

Primary market research is direct, first-hand data collection by an individual or organization. The most popular form of primary research is market research surveys . But, other primary research methods like focus groups, interviews, and observational research deliver vital insights that can shape and determine critical strategies for efficient growth.

Why is primary market research important?

Primary market research helps organizations:

- Predict future trends

- Understand industry challenges

- Optimize offerings

- Create impactful messaging

- Answer specific questions that shape strategies, marketing, products, operations, and more.

Pros and cons of primary market research

As with all types of market research , there are pros and cons to consider before choosing which route is best.

Let’s take a look at them now.

Benefits of primary market research

- Control With primary market research, you control how you collect data and how it will be used.

- Relevance As data is collected first-hand, you can ensure the questions are relevant to your area of interest.

- Ownership The data belongs to you, and it’s information your rivals won’t be able to access.

- Deep insights By listening to the thoughts and opinions of an audience, you obtain a depth of insight that no other form of research alone can uncover.

- Accuracy and timeliness You have confidence that responses are relevant to the present-day consumer and market conditions.

Disadvantages of primary market research

Primary market research does have some limitations. Here are three to consider.

- Cost Most types of primary market research cost more than secondary research methods. From the design and set-up to collating results ready for analysis, it all comes at a cost.

- Time Primary market research takes longer to plan, do, and review than secondary research . If a large sample size is required, this adds to the time needed.

- Bias In some situations, an individual might be biased based on previous experience. Or, they might not fully understand the questions being asked. This can happen a lot with surveys, so consideration should to be given to inaccuracies.

11 Ways to do Primary Research

Knowing which type of primary research is right for you will depend on the problem you’re trying to solve and the questions you want to answer.

Here are 11 of the most popular primary market research methods being used today.

Telephone Interviews

These are useful with customers or prospects, and they’re also fairly easy to arrange and conduct. When creating interview questions, ask open-ended questions to get unrestricted answers.

In-depth Interviews (IDIs)

These are focused interviews with people of strategic importance, and follow a structured or unstructured format. You can either follow a specific set of questions or conduct a free-flowing interview that allows for greater flexibility. An IDI usually lasts for between 20-30 minutes.

Pro Tip: Beware of bias

Ethnographic research

This focuses on following individuals, one at a time. A trained observer will immerse themselves in an environment (think a store or home), and observe how people behave and interact with the things around them. Brand marketers, product developers, and designers then benefit from seeing and understanding these interactions. It requires more time and money compared to other methods.

- Observational research

Observational research is often favored by smaller businesses and startups and monitors numerous people in a single location. Here, one person gathers insights from a large group in a single session or day, making it cost-efficient. The researcher focuses on how people stop outside a store, if there are specific things they seem drawn to in a display, and the direction they take when heading inside.

Minimum Viable Testing (MVP) testing

Involves testing a product or new feature before it’s taken to market. The goal is to gauge a market’s reaction and gain feedback to improve or adapt future features. There are two ways to do this.

- Prototyping – where you create numerous product variants that a smaller group of people evaluate to determine which would best meet their needs.

- Post-product launch – this is designed to measure the general reaction of a target audience and helps organizations know which direction is best to move in.

Product/Field trials

Doing trials is a great way to get feedback about the product or their experiences. This can be particularly useful for product development and marketing. In field trials, variables and hypotheses can be tested in a controlled environment or in the field.

Although lots of companies use free trials as a conversion path, it’s also an incredibly valuable way to get feedback from users about the things they like or dislike, as well as potential features they’d like to see in the future.

- Hypothesis testing

Used with existing products through either multivariate or A/B testing . This type of research can help with things like pricing evaluation across different audiences or markets. It can also look into web page specifics, conversion effectiveness, and more. By taking an experimental approach, it helps organizations establish optimal strategies for product, pricing, positioning, and core messaging.

In a primary market research context, Market research surveys capture numerical data for a relatively low cost. Online surveys are quick to set up and easily sent to both existing and prospective customers. When used in primary market research, it’s important to get the length just right. Go too long; boredom creeps in they’ll give up. Too short, and you risk not getting enough viable data for a complete picture.

Pro Tip: If you’re targeting an important group of people with a survey, consider an incentive.

Why? The National Center for Biotechnology Information ( NCBI ) conducted almost 50 separate studies on the topic; their findings confirmed that monetary incentives doubled the number of completed responses. From charitable donations and gift cards to PayPal credits, people are more likely to complete surveys when there’s something in it for them.

- Intercept surveys

If you’ve ever spotted a tablet asking you to rate the service or experience you had in a store/facility; then you’ve experienced intercept surveys at work!

One of the biggest advantages of intercept surveys is they target all visitors. Unlike traditional survey formats that require an email address, this style of survey can reach all demographics, and give you instant feedback. What’s more, they’re easy to organize and analyze.

- Online focus groups

These days, most organizations tend to favor online focus groups. Organizing and expending is far easier as there’s no need to factor in travel, venue hire, and sustenance costs. It’s also far easier to get people to commit to a quick video focus group compared to in-person set-ups.

- In-person focus groups

Physical focus groups are still strong, and people prefer them for many reasons. Body language is far easier to interpret when people are in the same location, and there’s the added benefit of stronger in-group dynamics too. So, while they cost more, take a little longer to organize, and you have the added burden of knowing whether or not participants will show up, there are still plenty of reasons to use them. Convenience isn’t always king.

The difference between primary and secondary research

3 primary market research examples

There are many methods of primary market research at a company’s disposal. Finding the right type for your research goal, budget, and time considerations is key to unlocking success. Here are three examples of primary market research in action, to give you a touch of inspiration.

1. Ethnographic research

I spoke directly with Umair Syed of Bizitron, he explained how his digital market agency favors ethnographic research for uncovering key consumer insights for big brands.

2. Customer satisfaction survey – low-cost example of primary research

This is a great primary market research example in action using an online survey format. Customers are asked if they’d like a receipt emailed: if they do, they receive a survey after their visit. Key questions provide the organization with clear ratings around their experience. Open-text boxes are also used to gather specifics if a score is particularly good or bad.

3. Focus groups & interviews

Another widely used primary market research method is the interview. Here’s a sample of some of the focus group questions we use at Similarweb. The biggest advantage of using this format is that any audience can be reached and interviewed remotely. Costs are low, and you can reach a wide and varying audience with granular feedback.

While it takes time to conduct this type of primary market research, it gives organizations the ability to pick and choose who they want to speak with and opens up the floor to ask them very specific, open-ended questions that have the power to deliver insights you might not be able to get from other primary research methods.

Primary market research questions

If you run a trial or release an MVP, you can use a survey for primary market research questions like these:

- What was your most favorite feature of the product?

- If you could improve one thing about the product, what would it be and why?

- How much money would you pay for this product?

- How frequently did you use the product during the trial?

- Did you use the product during the morning, afternoon, or evening most?

- Would you recommend this product? If yes or no, why?

- Did anything occur during the trial that would prevent you from using the product in the future?

If you want to conduct an interview, here are some examples of the typical types of primary research questions you might ask.

- Can you tell me your role?

- What are your responsibilities? What are your main challenges?

- Do you have KPIs? If so, what are they?

- Who do you report to?

- How often do you use our product?

- In which context? What are you trying to achieve?

- How do you perceive our product as a tool for market research ?

- Do others in your team use this product? For what reasons? What is the structure of your team?

- What other tools do you use to perform your job? Why?

- Can you explain your main challenges with this product?

- What are the features you use most often? Why?

- Which features do you use least often? Why?

- What would make your workflow easier?

- Is there anything else on your wishlist?

How to do primary market research

- Determine what the subject or aim of the research is.

- Use secondary research first to validate the subject.

- Set out a clear problem statement or research question to be answered.

- Set objectives, and decide what you’d like to achieve.

- Outline timeframes and set relevant deadlines.

- Pick the right primary market research methods to help you get the information you need.

- Decide on your sample size – large or small.

- Consider whether you’ll use qualitative or quantitative research (a little of both is best practice).

- Outline the structure for your plan, then review it to validate if it supports your research question. Consider, whether it will give you the information needed to make decisions about the next steps.

- Test to ensure it works and delivers the right type of insights.

- Collate and analyze the results.

Discover a better way to get similar results in less time

Similarweb Research Intelligence gives you instant access to data that shows you things like audience insights , search interests, overlap , loyalty , and demographics .

Let’s say you’re planning to expand into a new category, and want to research the market to capture a new audience or understand consumer demand before you spend time and resources on product development.

For example, launching a new urban e-bike service. You’ll want to reach a new audience but the problem is you don’t know what their interests are and how to approach them.

You’ll want to find out:

- Who is your target audience?

- How are your competitors approaching them?

- Which channels work best for your audience?

- When is the right time to engage with them?

Step 1: Identify the audience and categorize based on search interests

The first step is to identify the ideal customer profile of your target audience that you want to capture, so this could be various attributes. For the e-bike example, you’ll want to be engaging with people who are fit to cycle or have a need. For instance, they commute to work by bike or enjoy cycling as a hobby outside of work.

- Fit to cycle

- Need to cycle (i.e., cycle to work)

- Like to cycle (outdoors lovers)

- Are interested in a healthy lifestyle (eat well, lose weight, exercise, work-life balance)

Other criteria could be around lifestyle i.e., they want to live a balanced and healthy life. You can identify your audience through different ways, such as what they search for online or what they post on social media. For this example, we’ll dive into the healthy lifestyle audience cohort and build a profile around the search term “healthy snacks”.

Using search terms such as ‘healthy snacks’ you can build a list of keywords. And group these keywords to essentially build a profile of your audience.

With this list, you can identify the types of sites that engage with your target audience, and establish the total addressable market based on search volume and trends over time.

Here we can see the volume of searches for healthy snacks has a monthly average of 77,000 in the UK, along with the key players who capture traffic from this search term.

Step 2: Qualify your audience

The next step is to identify sites and mobile apps targeting your audience i.e., people searching for “healthy snack” and find sites based on relevant criteria such as age, gender, or type of site. Then you can expand your list by identifying other sites visited by the same audience and discover which of your competitors (in this case, similar cycle makers) are working with them.

Here you can qualify the audience based on the sites that also target the “healthy snack” consumers, for example, Women’s Health, and dive into the demographics of that publication to see the gender split and age distribution.

You can also expand this list by looking at Women’s Health readers and seeing which similar sites they cross-browse to build a richer view of their online media consumption and habits.

You can also further deepen your knowledge of each publication that attracts the “healthy snack” audience and see how your competitors, in this case, other cycle makers, work with the publication.

Either by identifying other sports and fitness sites that send traffic to Women’s Health or a list of advertisers that typically promote their products.

Step 3: Monitor your audience to track ongoing changes

The final step is to build a dashboard with key metrics that include all the main audience profiles such as search interests, demographics, other visited sites partners, and advertisers so you can monitor trends and changes over time.

This can be repeated for each audience cohort you create, so you can build a holistic overview of audience behavior online and discover consumer demand within minutes, not weeks or months.

Wrapping up… Primary market research takes time. Once you’ve done the initial planning, coordination, and data collection, only then can you start to collate and analyze your findings. In some cases, it’s exactly what you need to power up your growth. On the other hand, you may need to work faster than primary market research permits. Whether it be to stay ahead of your rivals, keep up with shifting markets, or a change in consumer behavior .

If you need to quickly see what’s happening, Similarweb Digital Research Intelligence is the best tool for the job.

Take it for a trial run (for free) today.

Stop Guessing, Start Analyzing

Get actionable insights for market research here

What is primary market research used for? Primary market research helps organizations obtain direct feedback from a market that’s relevant, up to date, and usually focused on a specific theme or subject. It’s more controlled compared to secondary research and delivers more objective findings.

What is the difference between primary market research and secondary market research? Primary market research is the first-hand collection of data, that’s later analyzed and used to inform strategic decisions. The purpose of secondary research is largely the same, but this type of research takes pre-existing information, which costs less and is usually quicker to obtain.

What are primary market research examples? The most popular primary market research methods include:

- Telephone interviews

- In-depth interviews

- Ethnographical research

- MVP testing

- Product and field trials

- Online surveys

What technology is used in primary market research? Modern primary market research involves using artificial intelligence, machine learning, and data analysis tools to collect and analyze data more quickly and accurately than ever. Automated survey tools and virtual reality simulations may also be employed.

How can Similarweb help with primary market research? Similarweb can provide helpful insights into primary market research. It can provide data on website traffic , user engagement metrics , and competitors’ performance . This data can be used to make more informed decisions about product development and marketing strategies. In addition, Similarweb can provide market insights and help identify potential target audiences.

by Liz March

Digital Research Specialist

Liz March has 15 years of experience in content creation. She enjoys the outdoors, F1, and reading, and is pursuing a BSc in Environmental Science.

Related Posts

Competitive Matrix Types: Which Is Right For You?

Nail Your Market Positioning: A Go-To Guide for Standing Out

Ecommerce Market Research: Your Secret Weapon for Online Success

A Guide to Market Research Terminology For Beginners

Consumer Profiling: Targeting Your Ideal Customer

Market Opportunities: How to Identify and Analyze Them

Wondering what similarweb can do for your business.

Give it a try or talk to our insights team — don’t worry, it’s free!

What you need to know about primary market research

Last updated

3 April 2024

Reviewed by

Cathy Heath

Market analysis template

Save time, highlight crucial insights, and drive strategic decision-making

- What is primary market research?

Focus groups

Primary market research not only allows you to work out how to sell your product or service more effectively but also helps you see the types of consumers that are not your target market.

It can be qualitative or quantitative data , or a combination of both to help your business gain insight into the market.

These valuable marketing insights will save you time and money and enable you to use your resources much more effectively.

- Why use primary market research?

While secondary research can give you a more generalized look at overall trends and markets, primary research focuses on a specific, customized aspect.

Secondary market research may be easier and faster, but primary research is more tailored, and you get data ownership of the results.

- Primary vs. secondary market research: what's the difference?

Secondary market research has already been gathered and can be used where relevant. Reports and surveys by other businesses or government agencies are a form of secondary market research.

Primary market research is carried out by you with your customers or clients, so it is more focused on your direct business. It may take longer and cost more than secondary research, but it is more targeted.

Secondary market research is more general and may not focus solely on things that affect your business and goals.

- Primary market research: research approaches

There are five main primary market research approaches:

Observational research

Survey research, experimental research.

Observational research is used to watch customers in their natural setting and is used extensively in marketing. There is little control over the components of the research; the aim is to observe the interaction between the consumer and the product or service.

There are two forms of observational research:

Strict observation: the researcher can only watch the consumer and make notes. This is one of the best ways to get raw data without any outside interference.

Slight interaction: the researcher may interact with the customer but not influence or sway the research in any way

Surveys extract data from existing customers or potential customers who have consented to receive marketing material and given their contact information. You can gather feedback , explore customer experience of your service or product, and analyze business hypotheses.

Decide on the target market to give the survey to; the more survey respondents, the more reliable the result.

Surveys are good for getting quantitative data such as:

Household income

Purchasing patterns

Price research

These surveys can be in person or via phone, email, or online questionnaire . Alternatively, you could use the "old-school" method of sending out a direct mail form.

Experimental research, also known as field research , is a quantitative approach to getting consumer information. Experiments are performed in an uncontrolled setting to test certain variables and answer questions on how consumers use your product or service and what their buying habits are.

While conducting these experiments, you can talk with people in the natural retail setting to see their true-to-life interaction with the product or service.

Experimental research provides accurate data without moderation and can give you insight into the product or service, levels of customer satisfaction , and your business and brand in general.

Interviews are more like a one-to-one focus group scenario in which you question one person instead of a group. Structured but open-ended questions are used so you can discover preferences and behavior as well as consumer experience with your product or service.

Interviews are ideal when testing a soft or new launch or to get customer perceptions of your marketing campaign.

These interviews get high response rates which are more truthful than other methods, as there is no peer pressure or influence from a group setting. Follow-up questions can help refine the data further.

Focus groups are great for discovering a specific demographic's opinions. They are best suited to collecting qualitative research.

This research method allows businesses to obtain data and analyze it from a specific market segment, with in-depth answers. This is helpful for decision-making and fine-tuning a product or service.

Many companies use focus groups to play through "what if" scenarios before implementing them in real life or for A/B testing on marketing material.

- When to use primary vs. secondary market research

The decision of whether to use primary or secondary market research is up to each business. Primary research is mainly done when the business needs recent data for a specific context. They want to look at a particular research aspect.

Secondary research is chosen when existing data can be insightful without the need for customized data or specifics. It can be gathered for the core of research projects .

What are the four types of secondary market research?

The four main types of secondary market research are:

Government or organizational agencies

Commercial and trade reports

Market research intelligence tools

Competitor websites

These all are sources of existing data about target groups that may benefit your business.

Why are interviews used in market research?

A form of primary research, interviews allow direct feedback from customers and clients to help inform a business about its consumers’ needs.

The researcher can use client responses from interviews to come up with more customized questions. They can extract more research information and more comprehensive answers than from other research methods.

Should you be using a customer insights hub?

Do you want to discover previous research faster?

Do you share your research findings with others?

Do you analyze research data?

Start for free today, add your research, and get to key insights faster

Editor’s picks

Last updated: 3 April 2024

Last updated: 17 October 2024

Last updated: 13 May 2024

Last updated: 22 July 2023

Last updated: 23 July 2024

Last updated: 2 October 2024

Last updated: 12 September 2024

Last updated: 22 February 2024

Latest articles

Related topics, decide what to build next, log in or sign up.

Get started for free

- Media Center

- E-Books & White Papers

Primary Market Research: An Informative Guide

by Sarah Schmidt , on May 8, 2024

Unlike secondary research, which relies on existing data, primary market research gathers original data directly from customers, prospects, or industry participants to offer more tailored and actionable research.

This article draws on insights from The Freedonia Group's Research Manager Jennifer Christ to explain the differences between primary and secondary market research, various types of primary market research, and the key benefits of primary market research for strategic decision-making.

Primary vs. Secondary Market Research

- Primary market research solicits new information from sources directly, such as customers in a specific target market. Primary research includes in-depth interviews, consumer surveys, and focus groups. This research can provide both quantitative and qualitative insights about specific market segments as well as changing consumer trends, motivations, and purchasing patterns.

- Secondary market research includes previously published information that has been compiled by outside organizations such as government agencies, industry associations, and trade publications. Secondary data can be relatively inexpensive and is often publicly available. However, secondary market research tends to be broad, so if you are interested in a niche market or an emerging technology, you may not be able to find secondary data that is relevant to your needs.

Key Benefits of Primary Market Research

More targeted data.

Secondary research provides a solid foundation for understanding a market at a high level, but primary research can help fill in the gaps and offer a richer, more nuanced perspective, according to Jennifer.

By engaging directly with industry participants through in-depth interviews, for example, primary research allows you to validate market size estimates and growth outlooks and gain detailed insights into specific industry developments or drivers.

“It’s important to evaluate a market from multiple angles, and primary research enables you to explore other viewpoints that might get less coverage in industry, business, or the general media,” Jennifer explains. “It also lets you ask questions and learn about trends and issues that might not be mentioned in other sources.”

Primary data and analysis can give you a more complete view of the market to ensure you are not missing key pieces of information that could impact your strategy.

Unbiased View of the Market

In addition, primary market research allows you to see beyond the hype and get a reality check on hot trends. “For instance, a supplier of an innovation or technology may think it’s going to be market changing, but by interviewing potential end users, we might learn that end users are satisfied with what they are using, the new tech doesn’t solve an existing problem, or they think the cost to change outweighs potential benefits, so they are far less enthused,” Jennifer says.

By providing unbiased information directly from the source, primary research can help companies make smart investments and understand the potential implications of disruptive technologies and trends more clearly.

Deeper Consumer Insights

Primary research based on consumer survey data can also shed light on consumer attitudes, their decision-making process, and the reasons why they make certain purchases. Analysts can break down this survey data based on demographic information such as age, region, gender, income levels, family size, living situation, whether they work from home, and other relevant attributes, so you can understand different target consumers on a more granular level.

Using survey data to understand different types of consumers and the motivations that drive them can help companies build more effective marketing and product development strategies.

Understanding Primary Market Research Methods

Primary research can be conducted through a variety of methods, but these approaches often require a high level of expertise to produce accurate, meaningful results. Here are some tips and best practices to keep in mind when conducting consumer surveys or in-depth interviews with industry participants.

Consumer Surveys

Consumer survey data can be gathered through online and booklet-based surveys. It’s important to screen for quality and use an appropriate sample size that is representative of the overall target population. Once the data is collected, the information must be put into context and evaluated based on historical trends and other key factors.

Experienced market research analysts can help you gather the data and interpret it correctly. You may want to consider working with a third-party market research firm if you do not have this expertise in-house, or if your research team has limited bandwidth.

In-Depth Interviews

Individual or group interviews can unearth valuable information that you can’t find anywhere else, but there is an art and a science to this research method as well.

To conduct interviews with industry participants, you need a strong network of contacts within specific industry sectors, such as end-users, manufacturers, retailers and distributors, or material suppliers. It’s also a good idea to speak with up-and-coming participants, as well as established players and market leaders, according to Jennifer.

To gather relevant information, you will need to engage the right people within these organizations. Depending on your goals, you may want to target:

- Managers or VPs who work in marketing or sales who are aware of a company’s performance, pain points, and positioning in the industry

- Internal insights or customer analysis team who understand the ins and outs of the industry

- People working in research and development who can answer more technical questions

To engage busy senior-level managers in primary research, it's also crucial to build strong rapport and strive for a mutually beneficial conversation. “I like to keep it as conversational as much as possible,” Jennifer says. “Not only are people more comfortable in that mode, but it is more likely to bring up things I might not have thought of. Also, I think it’s important for the person I’m talking to to feel like they learned something from our chat as well. They are more likely to think that talking with us is worth their valuable time.”

Working with a reputable third-party market research firm can open doors and allow you to gather valuable insights from industry leaders and companies you may be unable to reach or engage on your own.

Turn to the Experts

There's no doubt primary market research involves extra legwork, skill, and dedication, but it also provides a "boots on the ground" level of industry knowledge that's difficult to achieve through any other approach.

If you need primary market research services, don’t hesitate to speak to a research specialist at MarketResearch.com . With more than 20 years of experience in the market research industry, MarketResearch.com is the go-to source for both secondary and primary research. Our knowledgeable team can point you in the right direction and help you obtain the information you need, whether that's in the form of a syndicated market research or a custom market research project.

Contact MarketResearch.com's research specialists at [email protected] or call 800.298.5699 (U.S.) or +1.240.747.3004 (international).

Related Articles

- Primary Data vs. Secondary Data: Market Research Methods

- Which Market Research Report: Primary or Secondary?

About This Blog

Our goal is to help you better understand your customer, market, and competition in order to help drive your business growth.

Popular Posts

- A CEO’s Perspective on Harnessing AI for Market Research Excellence

- 7 Key Advantages of Outsourcing Market Research Services

- How to Use Market Research for Onboarding and Training Employees

- 10 Global Industries That Will Boom in the Next 5 Years

Recent Posts

Posts by topic.

- Industry Insights (860)

- Market Research Strategy (274)

- Food & Beverage (135)

- Healthcare (129)

- The Freedonia Group (121)

- How To's (110)

- Market Research Provider (98)

- Manufacturing & Construction (83)

- Pharmaceuticals (83)

- Packaged Facts (78)

- Telecommunications & Wireless (71)

- Heavy Industry (70)

- Retail (59)

- Marketing (58)

- Profound (57)

- Software & Enterprise Computing (57)

- Transportation & Shipping (54)

- House & Home (51)

- Medical Devices (51)

- Materials & Chemicals (49)

- Consumer Electronics (46)

- Energy & Resources (44)

- Public Sector (40)

- Biotechnology (38)

- Business Services & Administration (37)

- Demographics (37)

- E-commerce & IT Outsourcing (37)

- Education (36)

- Custom Market Research (35)

- Diagnostics (35)

- Travel & Leisure (34)

- Academic (33)

- Financial Services (29)

- Computer Hardware & Networking (28)

- Simba Information (24)

- Kalorama Information (21)

- Cosmetics & Personal Care (19)

- Knowledge Centers (19)

- Apparel (18)

- Market Research Subscription (16)

- Social Media (16)

- Advertising (14)

- Big Data (14)

- Holiday (11)

- Emerging Markets (8)

- Associations (1)

- Religion (1)

MarketResearch.com 6116 Executive Blvd Suite 550 Rockville, MD 20852 800.298.5699 (U.S.) +1.240.747.3093 (International) [email protected]

From Our Blog

Subscribe to blog, connect with us.

IMAGES

VIDEO