- Bankruptcy Basics

- Chapter 11 Bankruptcy

- Chapter 13 Bankruptcy

- Chapter 7 Bankruptcy

- Debt Collectors and Consumer Rights

- Divorce and Bankruptcy

- Going to Court

- Property & Exemptions

- Student Loans

- Taxes and Bankruptcy

- Wage Garnishment

Understanding the Assignment of Mortgages: What You Need To Know

3 minute read • Upsolve is a nonprofit that helps you get out of debt with education and free debt relief tools, like our bankruptcy filing tool. Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we'll never ask you for a credit card. Explore our free tool

A mortgage is a legally binding agreement between a home buyer and a lender that dictates a borrower's ability to pay off a loan. Every mortgage has an interest rate, a term length, and specific fees attached to it.

Written by Attorney Todd Carney . Updated November 26, 2021

If you’re like most people who want to purchase a home, you’ll start by going to a bank or other lender to get a mortgage loan. Though you can choose your lender, after the mortgage loan is processed, your mortgage may be transferred to a different mortgage servicer . A transfer is also called an assignment of the mortgage.

No matter what it’s called, this change of hands may also change who you’re supposed to make your house payments to and how the foreclosure process works if you default on your loan. That’s why if you’re a homeowner, it’s important to know how this process works. This article will provide an in-depth look at what an assignment of a mortgage entails and what impact it can have on homeownership.

Assignment of Mortgage – The Basics

When your original lender transfers your mortgage account and their interests in it to a new lender, that’s called an assignment of mortgage. To do this, your lender must use an assignment of mortgage document. This document ensures the loan is legally transferred to the new owner. It’s common for mortgage lenders to sell the mortgages to other lenders. Most lenders assign the mortgages they originate to other lenders or mortgage buyers.

Home Loan Documents

When you get a loan for a home or real estate, there will usually be two mortgage documents. The first is a mortgage or, less commonly, a deed of trust . The other is a promissory note. The mortgage or deed of trust will state that the mortgaged property provides the security interest for the loan. This basically means that your home is serving as collateral for the loan. It also gives the loan servicer the right to foreclose if you don’t make your monthly payments. The promissory note provides proof of the debt and your promise to pay it.

When a lender assigns your mortgage, your interests as the mortgagor are given to another mortgagee or servicer. Mortgages and deeds of trust are usually recorded in the county recorder’s office. This office also keeps a record of any transfers. When a mortgage is transferred so is the promissory note. The note will be endorsed or signed over to the loan’s new owner. In some situations, a note will be endorsed in blank, which turns it into a bearer instrument. This means whoever holds the note is the presumed owner.

Using MERS To Track Transfers

Banks have collectively established the Mortgage Electronic Registration System , Inc. (MERS), which keeps track of who owns which loans. With MERS, lenders are no longer required to do a separate assignment every time a loan is transferred. That’s because MERS keeps track of the transfers. It’s crucial for MERS to maintain a record of assignments and endorsements because these land records can tell who actually owns the debt and has a legal right to start the foreclosure process.

Upsolve Member Experiences

Assignment of Mortgage Requirements and Effects

The assignment of mortgage needs to include the following:

The original information regarding the mortgage. Alternatively, it can include the county recorder office’s identification numbers.

The borrower’s name.

The mortgage loan’s original amount.

The date of the mortgage and when it was recorded.

Usually, there will also need to be a legal description of the real property the mortgage secures, but this is determined by state law and differs by state.

Notice Requirements

The original lender doesn’t need to provide notice to or get permission from the homeowner prior to assigning the mortgage. But the new lender (sometimes called the assignee) has to send the homeowner some form of notice of the loan assignment. The document will typically provide a disclaimer about who the new lender is, the lender’s contact information, and information about how to make your mortgage payment. You should make sure you have this information so you can avoid foreclosure.

Mortgage Terms

When an assignment occurs your loan is transferred, but the initial terms of your mortgage will stay the same. This means you’ll have the same interest rate, overall loan amount, monthly payment, and payment due date. If there are changes or adjustments to the escrow account, the new lender must do them under the terms of the original escrow agreement. The new lender can make some changes if you request them and the lender approves. For example, you may request your new lender to provide more payment methods.

Taxes and Insurance

If you have an escrow account and your mortgage is transferred, you may be worried about making sure your property taxes and homeowners insurance get paid. Though you can always verify the information, the original loan servicer is responsible for giving your local tax authority the new loan servicer’s address for tax billing purposes. The original lender is required to do this after the assignment is recorded. The servicer will also reach out to your property insurance company for this reason.

If you’ve received notice that your mortgage loan has been assigned, it’s a good idea to reach out to your loan servicer and verify this information. Verifying that all your mortgage information is correct, that you know who to contact if you have questions about your mortgage, and that you know how to make payments to the new servicer will help you avoid being scammed or making payments incorrectly.

Let's Summarize…

In a mortgage assignment, your original lender or servicer transfers your mortgage account to another loan servicer. When this occurs, the original mortgagee or lender’s interests go to the next lender. Even if your mortgage gets transferred or assigned, your mortgage’s terms should remain the same. Your interest rate, loan amount, monthly payment, and payment schedule shouldn’t change.

Your original lender isn’t required to notify you or get your permission prior to assigning your mortgage. But you should receive correspondence from the new lender after the assignment. It’s important to verify any change in assignment with your original loan servicer before you make your next mortgage payment, so you don’t fall victim to a scam.

Attorney Todd Carney

Attorney Todd Carney is a writer and graduate of Harvard Law School. While in law school, Todd worked in a clinic that helped pro-bono clients file for bankruptcy. Todd also studied several aspects of how the law impacts consumers. Todd has written over 40 articles for sites such... read more about Attorney Todd Carney

Continue reading and learning!

It's easy to get debt help

Choose one of the options below to get assistance with your debt:

Considering Bankruptcy?

Our free tool has helped 14,480+ families file bankruptcy on their own. We're funded by Harvard University and will never ask you for a credit card or payment.

Private Attorney

Get a free evaluation from an independent law firm.

Learning Center

Research and understand your options with our articles and guides.

Already an Upsolve user?

Bankruptcy Basics ➜

- What Is Bankruptcy?

- Every Type of Bankruptcy Explained

- How To File Bankruptcy for Free: A 10-Step Guide

- Can I File for Bankruptcy Online?

Chapter 7 Bankruptcy ➜

- What Are the Pros and Cons of Filing Chapter 7 Bankruptcy?

- What Is Chapter 7 Bankruptcy & When Should I File?

- Chapter 7 Means Test Calculator

Wage Garnishment ➜

- How To Stop Wage Garnishment Immediately

Property & Exemptions ➜

- What Are Bankruptcy Exemptions?

- Chapter 7 Bankruptcy: What Can You Keep?

- Yes! You Can Get a Mortgage After Bankruptcy

- How Long After Filing Bankruptcy Can I Buy a House?

- Can I Keep My Car If I File Chapter 7 Bankruptcy?

- Can I Buy a Car After Bankruptcy?

- Should I File for Bankruptcy for Credit Card Debt?

- How Much Debt Do I Need To File for Chapter 7 Bankruptcy?

- Can I Get Rid of my Medical Bills in Bankruptcy?

Student Loans ➜

- Can You File Bankruptcy on Student Loans?

- Can I Discharge Private Student Loans in Bankruptcy?

- Navigating Financial Aid During and After Bankruptcy: A Step-by-Step Guide

- Filing Bankruptcy to Deal With Your Student Loan Debt? Here Are 3 Things You Should Know!

Debt Collectors and Consumer Rights ➜

- 3 Steps To Take if a Debt Collector Sues You

- How To Deal With Debt Collectors (When You Can’t Pay)

Taxes and Bankruptcy ➜

- What Happens to My IRS Tax Debt if I File Bankruptcy?

- What Happens to Your Tax Refund in Bankruptcy

Chapter 13 Bankruptcy ➜

- Chapter 7 vs. Chapter 13 Bankruptcy: What’s the Difference?

- Why is Chapter 13 Probably A Bad Idea?

- How To File Chapter 13 Bankruptcy: A Step-by-Step Guide

- What Happens When a Chapter 13 Case Is Dismissed?

Going to Court ➜

- Do You Have to Go To Court to File Bankruptcy?

- Telephonic Hearings in Bankruptcy Court

Divorce and Bankruptcy ➜

- How to File Bankruptcy After a Divorce

- Chapter 13 and Divorce

Chapter 11 Bankruptcy ➜

- Chapter 7 vs. Chapter 11 Bankruptcy

- Reorganizing Your Debt? Chapter 11 or Chapter 13 Bankruptcy Can Help!

State Guides ➜

- Connecticut

- District Of Columbia

- Massachusetts

- Mississippi

- New Hampshire

- North Carolina

- North Dakota

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- West Virginia

Upsolve is a 501(c)(3) nonprofit that started in 2016. Our mission is to help low-income families resolve their debt and fix their credit using free software tools. Our team includes debt experts and engineers who care deeply about making the financial system accessible to everyone. We have world-class funders that include the U.S. government, former Google CEO Eric Schmidt, and leading foundations.

To learn more, read why we started Upsolve in 2016, our reviews from past users, and our press coverage from places like the New York Times and Wall Street Journal.

Choose Your Legal Category:

- Online Law Library

- Bankruptcy Law

- Business Law

- Civil Law

- Criminal Law

- Employment Law

- Family Law

- Finance Law

- Government Law

- Immigration Law

- Insurance Law

- Intellectual Property Law

- Personal Injury Law

- Products & Services Law

- Real Estate Law

- Wills, Trusts & Estates Law

- Attorney Referral Services

- Top 10 Most Popular Articles

- Legal Dictionary

- How It Works - Clients

- Legal Center

- About LegalMatch

- Consumer Satisfaction

- Editorial Policy

- Attorneys Market Your Law Practice Attorney Login Schedule a Demo Now Did LegalMatch Call You Recently? How It Works - Attorneys Attorney Resources Attorney Success Stories Attorney Success Story Videos Compare Legal Marketing Services Cases Heatmap View Cases

- Find a Lawyer

- Legal Topics

- Real Estate Law

Mortgage Assignment Laws and Definition

(This may not be the same place you live)

What is a Mortgage Assignment?

A mortgage is a legal agreement. Under this agreement, a bank or other lending institution provides a loan to an individual seeking to finance a home purchase. The lender is referred to as a creditor. The person who finances the home owes money to the bank, and is referred to as the debtor.

To make money, the bank charges interest on the loan. To ensure the debtor pays the loan, the bank takes a security interest in what the loan is financing — the home itself. If the buyer fails to pay the loan, the bank can take the property through a foreclosure proceeding.

There are two main documents involved in a mortgage agreement. The document setting the financial terms and conditions of repayment is known as the mortgage note. The bank is the owner of the note. The note is secured by the mortgage. This means if the debtor does not make payment on the note, the bank may foreclose on the home.

The document describing the mortgaged property is called the mortgage agreement. In the mortgage agreement, the debtor agrees to make payments under the note, and agrees that if payment is not made, the bank may institute foreclosure proceedings and take the home as collateral .

An assignment of a mortgage refers to an assignment of the note and assignment of the mortgage agreement. Both the note and the mortgage can be assigned. To assign the note and mortgage is to transfer ownership of the note and mortgage. Once the note is assigned, the person to whom it is assigned, the assignee, can collect payment under the note.

Assignment of the mortgage agreement occurs when the mortgagee (the bank or lender) transfers its rights under the agreement to another party. That party is referred to as the assignee, and receives the right to enforce the agreement’s terms against the assignor, or debtor (also called the “mortgagor”).

What are the Requirements for Executing a Mortgage Assignment?

What are some of the benefits and drawbacks of mortgage assignments, are there any defenses to mortgage assignments, do i need to hire an attorney for help with a mortgage assignment.

For a mortgage to be validly assigned, the assignment document (the document formally assigning ownership from one person to another) must contain:

- The current assignor name.

- The name of the assignee.

- The current borrower or borrowers’ names.

- A description of the mortgage, including date of execution of the mortgage agreement, the amount of the loan that remains, and a reference to where the mortgage was initially recorded. A mortgage is recorded in the office of a county clerk, in an index, typically bearing a volume or page number. The reference to where the mortgage was recorded should include the date of recording, volume, page number, and county of recording.

- A description of the property. The description must be a legal description that unambiguously and completely describes the boundaries of the property.

There are several types of assignments of mortgage. These include a corrective assignment of mortgage, a corporate assignment of mortgage, and a mers assignment of mortgage. A corrective assignment corrects or amends a defect or mistake in the original assignment. A corporate assignment is an assignment of the mortgage from one corporation to another.

A mers assignment involves the Mortgage Electronic Registration System (MERS). Mortgages often designate MERS as a nominee (agent for) the lender. When the lender assigns a mortgage to MERS, MERS does not actually receive ownership of the note or mortgage agreement. Instead, MERS tracks the mortgage as the mortgage is assigned from bank to bank.

An advantage of a mortgage assignment is that the assignment permits buyers interested in purchasing a home, to do so without having to obtain a loan from a financial institution. The buyer, through an assignment from the current homeowner, assumes the rights and responsibilities under the mortgage.

A disadvantage of a mortgage assignment is the consequences of failing to record it. Under most state laws, an entity seeking to institute foreclosure proceedings must record the assignment before it can do so. If a mortgage is not recorded, the judge will dismiss the foreclosure proceeding.

Failure to observe mortgage assignment procedure can be used as a defense by a homeowner in a foreclosure proceeding. Before a bank can institute a foreclosure proceeding, the bank must record the assignment of the note. The bank must also be in actual possession of the note.

If the bank fails to “produce the note,” that is, cannot demonstrate that the note was assigned to it, the bank cannot demonstrate it owns the note. Therefore, it lacks legal standing to commence a foreclosure proceeding.

If you need help with preparing an assignment of mortgage, you should contact a mortgage lawyer . An experienced mortgage lawyer near you can assist you with preparing and recording the document.

Save Time and Money - Speak With a Lawyer Right Away

- Buy one 30-minute consultation call or subscribe for unlimited calls

- Subscription includes access to unlimited consultation calls at a reduced price

- Receive quick expert feedback or review your DIY legal documents

- Have peace of mind without a long wait or industry standard retainer

- Get the right guidance - Schedule a call with a lawyer today!

Need a Mortgage Lawyer in your Area?

- Connecticut

- Massachusetts

- Mississippi

- New Hampshire

- North Carolina

- North Dakota

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- West Virginia

Daniel Lebovic

LegalMatch Legal Writer

Original Author

Prior to joining LegalMatch, Daniel worked as a legal editor for a large HR Compliance firm, focusing on employer compliance in numerous areas of the law including workplace safety law, health care law, wage and hour law, and cybersecurity. Prior to that, Daniel served as a litigator for several small law firms, handling a diverse caseload that included cases in Real Estate Law (property ownership rights, residential landlord/tenant disputes, foreclosures), Employment Law (minimum wage and overtime claims, discrimination, workers’ compensation, labor-management relations), Construction Law, and Commercial Law (consumer protection law and contracts). Daniel holds a J.D. from the Emory University School of Law and a B.S. in Biological Sciences from Cornell University. He is admitted to practice law in the State of New York and before the State Bar of Georgia. Daniel is also admitted to practice before the United States Courts of Appeals for both the 2nd and 11th Circuits. You can learn more about Daniel by checking out his Linkedin profile and his personal page. Read More

Jose Rivera, J.D.

Managing Editor

Preparing for Your Case

- What to Do to Have a Strong Mortgage Law Case

- Top 5 Types of Documents/Evidence to Gather for Your Mortgages Case

Related Articles

- Assumable Mortgages

- Loan Modification Laws

- Behind on Mortgage Payments Lawyers

- Home Improvement Loan Disputes

- Reverse Mortgages for Senior Citizens

- Mortgage Settlement Scams

- Short Sale Fraud Schemes

- Deed of Trust or a Mortgage, What's the Difference?

- Owner Carryback Mortgages

- Contract for Deed Lawyers Near Me

- Mortgage Subrogation

- Property Lien Waivers and Releases

- Different Types of Promissory Notes

- Repayment Schedules for Promissory Notes

- Ft. Lauderdale Condos and Special Approval Loans

- Special Approval Loans for Miami Condos

- Removing a Lien on Property

- Mortgage Loan Fraud

- Subprime Mortgage Lawsuits

- Property Flipping and Mortgage Loan Fraud

- Avoid Being a Victim of Mortgage Fraud

- Second Mortgage Lawyers

- Settlement Statement Lawyers

- Loan Approval / Commitment Lawyers

- Broker Agreement Lawyers

- Truth in Lending Disclosure Statement (TILA)

- Housing and Urban Development (HUD) Info Lawyers

- Good Faith Estimate Lawyers

- Mortgage Loan Documents

Discover the Trustworthy LegalMatch Advantage

- No fee to present your case

- Choose from lawyers in your area

- A 100% confidential service

How does LegalMatch work?

Law Library Disclaimer

16 people have successfully posted their cases

- Assignment of Mortgage

Get free proposals from vetted lawyers in our marketplace.

Real Estate Terms Glossary

- Annual Percentage Rate

- Application Fee

- Appreciation

- Assessed Value

- Assumable Mortgage

- Assumption Fee

- Automated Underwriting

- Balance Sheet

- Balloon Mortgage

- Balloon Payment

- Before-tax Income

- Biweekly Payment Mortgage

- Bridge Loan

- Building Code

What is an Assignment of Mortgage?

In real estate, an assignment of mortgage is the transfer of a mortgage, or mortgage note , to another party which typically happens on the servicing side or lender side. This is commonly seen one when lender sells or transfers your mortgage to another lender. Lenders typically have the right to to sell mortgages and assign them to new parties, but don’t typically allow borrowers to do the same. When a borrower transfers their mortgage obligation to a new party, this is called an assumed mortgage.

Assignment of Mortgage Examples

Examples where you will find assignment of mortgages include:

- Example 1. A lender selling your mortgage to another lender for servicing.

Here’s Property Shark’s definition of assignment of mortgage .

ContractsCounsel is not a law firm, and this post should not be considered and does not contain legal advice. To ensure the information and advice in this post are correct, sufficient, and appropriate for your situation, please consult a licensed attorney. Also, using or accessing ContractsCounsel's site does not create an attorney-client relationship between you and ContractsCounsel.

Meet some of our Real Estate Lawyers

General practitioner since 2005, general practice; civil disputes, torts.... logo Call us: (410) 878-7006 Menu Services Maryland Mobile Last Will & Testament Services All Maryland Legal Services Susan C. Trimble Attorney at Law WHAT WE ARE ABOUT Susan C. Trimble, is an established attorney in the Maryland area. Her work is infused with commitment to her community and family. is tailored to your wants and needs. Here you will find an approachable, personable and conscientious advocate. EDUCATION: Juris Doctorate (JD). University of Baltimore School of Law, Baltimore, Maryland, USA. 2006. Bachelor of Science (BS), English Literature. Towson University, 1989. Associate in Claims, (AIC) certification. Fraud Claims Law Associate, (FCLS) certification.

I have been practicing law since 2018. I used to be a litigator at a nationwide practice before going in-house at a fintech company. I have experience drafting NDAs, SaaS contracts, service agreements, and stock purchase agreements.

Bradford T.

I have been practicing law for almost 23 years.

My name is Deborah Schwab, and I am an experienced attorney with a background in real estate, contract negotiation, and corporate governance. Currently, I am a transactional counsel with Priscott Legal, LLC, the partner law firm of Ontra.ai. In this remote role, I represent private equity and VC firms and negotiate a high volume of non-disclosure agreements, joinders, and other legal contracts. Prior to this, I served as legal counsel for PennTex Ventures, LLC, where I was responsible for negotiating, drafting, and reviewing contracts and agreements for sales and acquisition of real estate, lease negotiation, and resolving issues involving ancillary transactions. As the first in-house counsel for PTV, I was responsible for all legal and compliance matters and managed outside legal counsel. Before joining PennTex Ventures, I worked as real estate counsel for 84 Lumber & Nemacolin Woodlands, Inc., where I acquired eleven properties with a portfolio value in excess of $15 million. Prior to this, I spent several years as an attorney and supervisor at CNX/Consol Energy, where I worked as a title attorney, trained and managed a team of title attorneys/analysts, conducted due diligence for large land transactions, and identified business/legal risk exposure for multi-state projects. I received my Juris Doctor from Duquesne University and hold a Post Baccalaureate Paralegal Certificate from the same institution. Additionally, I earned a Bachelor of Arts from the University of Pittsburgh. I am also a court-appointed special advocate working as a volunteer with children who are in the foster care system. Thank you for taking the time to view my profile. I am always open to new opportunities and would be happy to connect with you.

Education: Georgetown Law (83), Yale (75- BA in Economics), Hotchkiss School (1970). Practice areas have included commercial litigation, individual litigation, and securities litigation and arbitration.

V. Yvette S.

I am a highly skilled attorney, fluent in English and Spanish with 20 years of legal experience and 8 additional years of real estate, project finance, banking, financial, securities, and start-up company experience. I worked 6 years with 2 international law firms and handled extremely complex work for all types of clients, 3 years with a Federal Government Regulator, and 5 years in various compliance management positions at national and international financial institutions. I am licensed in New York and North Carolina. I will handle federal litigation on a non-contingency basis. I also practice Appellate Advocacy for constitutional, employment, consumer, and corporate laws. I am skilled in many different NY and NC laws. I have successfully represented clients with state and federal regulatory investigations. I can help you with the FDA, SEC, OCC, CFPB, FDIC, FR and certain state regulators.

Find the best lawyer for your project

Quick, user friendly and one of the better ways I've come across to get ahold of lawyers willing to take new clients.

Real Estate lawyers by city

- Atlanta Real Estate Lawyers

- Austin Real Estate Lawyers

- Boston Real Estate Lawyers

- Chicago Real Estate Lawyers

- Dallas Real Estate Lawyers

- Denver Real Estate Lawyers

- Fort Lauderdale Real Estate Lawyers

- Houston Real Estate Lawyers

- Las Vegas Real Estate Lawyers

- Los Angeles Real Estate Lawyers

Contracts Counsel was incredibly helpful and easy to use. I submitted a project for a lawyer's help within a day I had received over 6 proposals from qualified lawyers. I submitted a bid that works best for my business and we went forward with the project.

I never knew how difficult it was to obtain representation or a lawyer, and ContractsCounsel was EXACTLY the type of service I was hoping for when I was in a pinch. Working with their service was efficient, effective and made me feel in control. Thank you so much and should I ever need attorney services down the road, I'll certainly be a repeat customer.

I got 5 bids within 24h of posting my project. I choose the person who provided the most detailed and relevant intro letter, highlighting their experience relevant to my project. I am very satisfied with the outcome and quality of the two agreements that were produced, they actually far exceed my expectations.

How It Works

Post Your Project

Get Free Bids to Compare

Hire Your Lawyer

Find lawyers and attorneys by city

FindLegalForms .com

- United Kingdom

- Affidavits & Declarations

- Bill of Sale Forms

- Borrowing, Lending & Credit

- Divorce & Separation

- Health Care

- Landlord & Tenant

- Living Wills

- Name Change

- Power of Attorney

- Promissory Notes

- Real Estate

- Releases & Indemnifications

- Spanish Forms

- Wills & Estates

- Attorney Forms

- Confidentiality & NDA

- Corporations

- Entertainment Contracts

- Equipment Leases & Rentals

- Intellectual Property

- Limited Liability Co.

- Partnership

- Sales & Purchases

- Technology & Internet

- Notice of Assignment of Mortgage

This Notice of Assignment of Mortgage acts as official notification that a borrower's mortgage has been assigned to a new mortgage lender. This notice sets out the name of the new lender and the address where future mortgage payments should be sent.

For immediate download, file types included.

- Microsoft Word

- WordPerfect

- Rich Text Format

Compatible with

Attorney prepared

Our forms are kept up-to-date and accurate by our lawyers, valid in your state, our forms are guaranteed to be valid in your state, over 3,500,000 satisfied customers, free esignature, sign your form online, free with any form purchase, 60-days money back, try our forms with no risk.

- Description

- Borrower: Sets out the name of the mortgage borrower;

- Mortgage Information: The date of the mortgage, its recording information and a brief description of the property (such as address or legal description);

- New Lender: Sets out the name of the new mortgage lender and the address where all future mortgage payments should be sent, as well as new lender’s phone number;

- Signature: This notice must be signed by the original mortgage lender in the presence of a witness.

- General Instructions

Looking for something else?

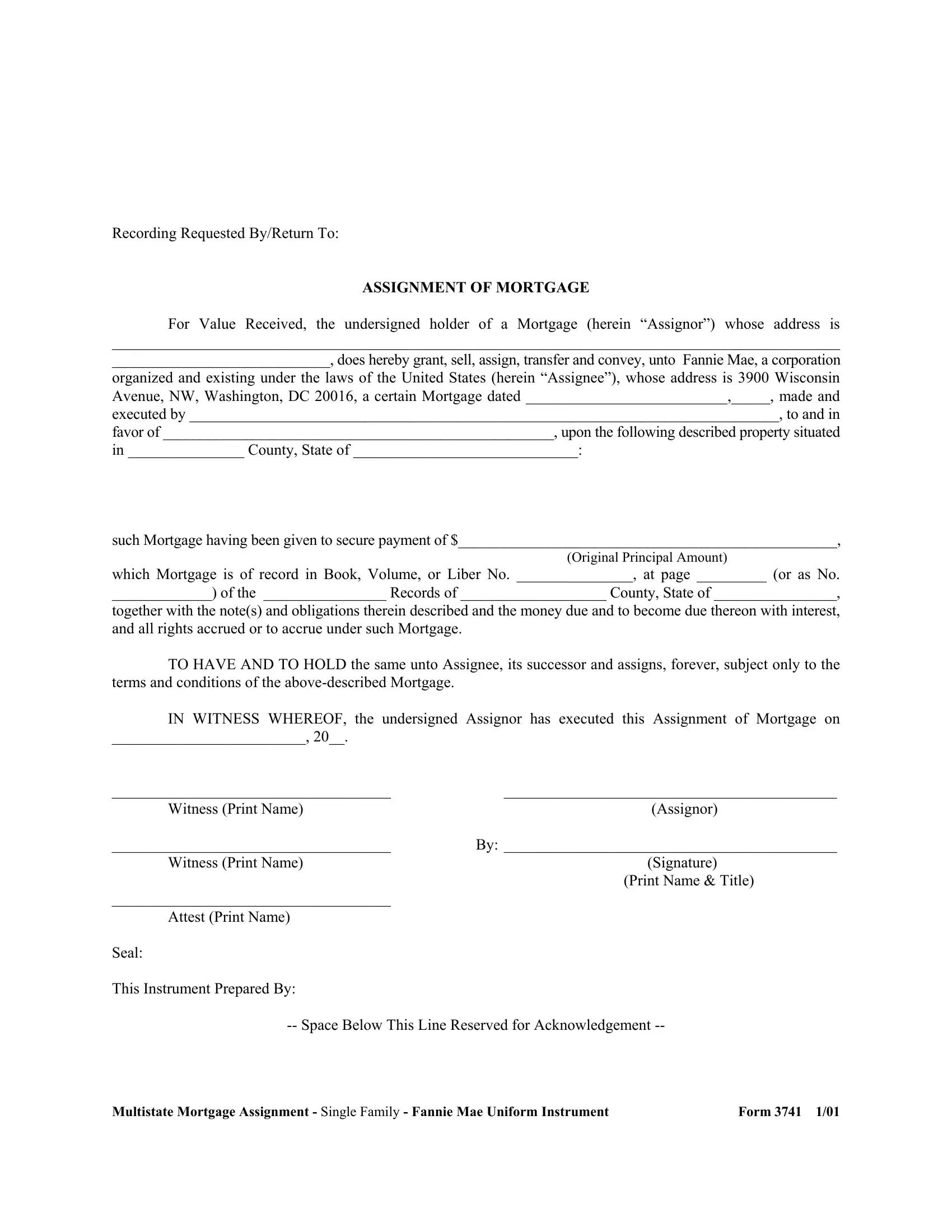

Assignment Of Mortgage Form – Fill Out and Use This PDF

The Assignment Of Mortgage Form is a legal document that transfers the ownership of a mortgage from your name to another person's name. It contains basic information about the borrower, loan number, and property title.

Assignment Of Mortgage Form PDF Details

Mortgage assignments are a vital part of the mortgage process. They document the transfer of a mortgage from one party to another. The form is used to record the new lender's interest in the property and to provide notice to the borrower. Assignment of mortgages can be NECESSARY when refinancing or selling a home, so it's important that you understand their function and how they work. This blog post will outline everything you need to know about mortgage assignments, including what they are, when they're used, and how they're executed. So if you're ready to learn more, keep reading!

| Question | Answer |

|---|---|

| Form Name | Assignment Of Mortgage Form |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | blank assignment of mortgage form, assignment of mortgage florida, fannie mae assignment of mortgage fillable form, assignment of mortgage example |

Form Preview Example

Recording Requested By/Return To:

ASSIGNMENT OF MORTGAGE

For Value Received, the undersigned holder of a Mortgage (herein “Assignor”) whose address is

______________________________________________________________________________________________

_____________________________, does hereby grant, sell, assign, transfer and convey, unto Fannie Mae, a corporation

organized and existing under the laws of the United States (herein “Assignee”), whose address is 3900 Wisconsin Avenue, NW, Washington, DC 20016, a certain Mortgage dated __________________________,_____, made and

executed by _____________________________________________________________________________, to and in

favor of ____________________________________________________, upon the following described property situated

in _______________ County, State of _____________________________:

such Mortgage having been given to secure payment of $__________________________________________________,

(Original Principal Amount)

which Mortgage is of record in Book, Volume, or Liber No. _______________, at page _________ (or as No.

_____________) of the ________________ Records of ___________________ County, State of ________________,

together with the note(s) and obligations therein described and the money due and to become due thereon with interest, and all rights accrued or to accrue under such Mortgage.

TO HAVE AND TO HOLD the same unto Assignee, its successor and assigns, forever, subject only to the terms and conditions of the above-described Mortgage.

IN WITNESS WHEREOF, the undersigned Assignor has executed this Assignment of Mortgage on

_________________________, 20__. |

|

____________________________________ | ___________________________________________ |

Witness (Print Name) | (Assignor) |

____________________________________ | By: ___________________________________________ |

Witness (Print Name) | (Signature) |

| (Print Name & Title) |

____________________________________ |

|

Attest (Print Name) |

|

Seal: |

|

This Instrument Prepared By: |

|

-- Space Below This Line Reserved for Acknowledgement --

Multistate Mortgage Assignment - Single Family - Fannie Mae Uniform Instrument | Form 3741 1/01 |

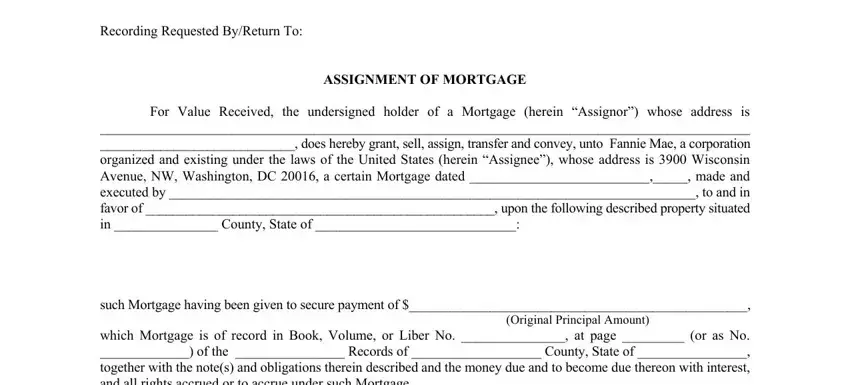

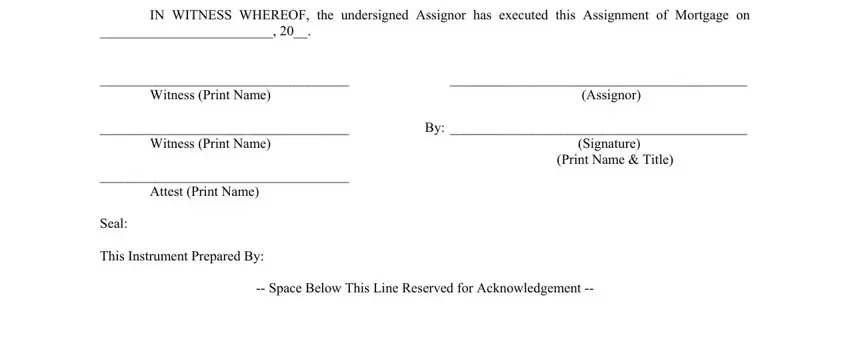

How to Edit Assignment Of Mortgage Form Online for Free

Whenever you would like to fill out assignment of mortgage example, you don't have to install any kind of software - simply use our PDF tool. The tool is continually improved by our staff, acquiring new features and turning out to be more convenient. To get the process started, go through these easy steps:

Step 1: Hit the orange "Get Form" button above. It's going to open our tool so that you can start completing your form.

Step 2: The editor enables you to modify your PDF in a variety of ways. Transform it by writing personalized text, adjust original content, and add a signature - all when you need it!

It's easy to finish the document with our detailed tutorial! Here's what you want to do:

1. The assignment of mortgage example involves certain information to be entered. Be sure that the next blank fields are finalized:

2. Once your current task is complete, take the next step – fill out all of these fields - IN WITNESS WHEREOF the undersigned, Witness Print Name, Assignor, By , Witness Print Name, Attest Print Name, Seal, This Instrument Prepared By, Signature Print Name Title, and Space Below This Line Reserved with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

As to By and Seal, make sure that you review things in this current part. The two of these could be the most significant ones in the form.

Step 3: Once you have glanced through the details in the blanks, click on "Done" to complete your form. Sign up with FormsPal now and instantly use assignment of mortgage example, ready for downloading. Every last modification you make is handily saved , allowing you to modify the pdf at a later point as required. We don't share or sell any details that you provide when filling out forms at FormsPal.

Assignment Of Mortgage Form isn’t the one you’re looking for?

Related documents.

- Assignment Insurance Form

- Assignment Of Payment Form

- Db2 Assignment Form

- Fop Insurance Form

Assignments: why you need to serve a notice of assignment

Catherine phillips.

PSL Principal Associate

It's the day of completion; security is taken, assignments are completed and funds move. Everyone breathes a sigh of relief. At this point, no-one wants to create unnecessary paperwork - not even the lawyers! Notices of assignment are, in some circumstances, optional. However, in other transactions they could be crucial to a lender's enforcement strategy. In the article below, we have given you the facts you need to consider when deciding whether or not you need to serve notice of assignment.

What issues are there with serving notice of assignment?

Assignments are useful tools for adding flexibility to banking transactions. They enable the transfer of one party's rights under a contract to a new party (for example, the right to receive an income stream or a debt) and allow security to be taken over intangible assets which might be unsuitable targets for a fixed charge. A lender's security net will often include assignments over contracts (such as insurance or material contracts), intellectual property rights, investments or receivables.

An assignment can be a legal assignment or an equitable assignment. If a legal assignment is required, the assignment must comply with a set of formalities set out in s136 of the Law of Property Act 1925, which include the requirement to give notice to the contract counterparty.

The main difference between legal and equitable assignments (other than the formalities required to create them) is that with a legal assignment, the assignee can usually bring an action against the contract counterparty in its own name following assignment. However, with an equitable assignment, the assignee will usually be required to join in proceedings with the assignor (unless the assignee has been granted specific powers to circumvent that). That may be problematic if the assignor is no longer available or interested in participating.

Why should we serve a notice of assignment?

The legal status of the assignment may affect the credit scoring that can be given to a particular class of assets. It may also affect a lender's ability to effect part of its exit strategy if that strategy requires the lender to be able to deal directly with the contract counterparty.

The case of General Nutrition Investment Company (GNIC) v Holland and Barrett International Ltd and another (H&B) provides an example of an equitable assignee being unable to deal directly with a contract counterparty as a result of a failure to provide a notice of assignment.

The case concerned the assignment of a trade mark licence to GNIC . The other party to the licence agreement was H&B. H&B had not received notice of the assignment. GNIC tried to terminate the licence agreement for breach by serving a notice of termination. H&B disputed the termination. By this point in time the original licensor had been dissolved and so was unable to assist.

At a hearing of preliminary issues, the High Court held that the notices of termination served by GNIC , as an equitable assignee, were invalid, because no notice of the assignment had been given to the licensee. Although only a High Court decision, this follows a Court of Appeal decision in the Warner Bros Records Inc v Rollgreen Ltd case, which was decided in the context of the attempt to exercise an option.

In both cases, an equitable assignee attempted to exercise a contractual right that would change the contractual relationship between the parties (i.e. by terminating the contractual relationship or exercising an option to extend the term of a licence). The judge in GNIC felt that "in each case, the counterparty (the recipient of the relevant notice) is entitled to see that the potential change in his contractual position is brought about by a person who is entitled, and whom he can see to be entitled, to bring about that change".

In a security context, this could hamper the ability of a lender to maximise the value of the secured assets but yet is a constraint that, in most transactions, could be easily avoided.

Why not serve notice?

Sometimes it's just not necessary or desirable. For example:

- If security is being taken over a large number of low value receivables or contracts, the time and cost involved in giving notice may be disproportionate to the additional value gained by obtaining a legal rather than an equitable assignment.

- If enforcement action were required, the equitable assignee typically has the option to join in the assignor to any proceedings (if it could not be waived by the court) and provision could be made in the assignment deed for the assignor to assist in such situations. Powers of attorney are also typically granted so that a lender can bring an action in the assignor's name.

- Enforcement is often not considered to be a significant issue given that the vast majority of assignees will never need to bring claims against the contract counterparty.

Care should however, be taken in all circumstances where the underlying contract contains a ban on assignment, as the contract counterparty would not have to recognise an assignment that is made in contravention of that ban. Furthermore, that contravention in itself may trigger termination and/or other rights in the assigned contract, that could affect the value of any underlying security.

What about acknowledgements of notices?

A simple acknowledgement of service of notice is simply evidence of the notice having been received. However, these documents often contain commitments or assurances by the contract counterparty which increase their value to the assignee.

Best practice for serving notice of assignment

Each transaction is different and the weighting given to each element of the security package will depend upon the nature of the debt and the borrower's business. The service of a notice of assignment may be a necessity or an optional extra. In each case, the question of whether to serve notice is best considered with your advisers at the start of a transaction to allow time for the lender's priorities to be highlighted to the borrowers and captured within the documents.

For further advice on serving notice of assignment please contact Kirsty Barnes or Catherine Phillips from our Banking & Finance team.

NOT LEGAL ADVICE. Information made available on this website in any form is for information purposes only. It is not, and should not be taken as, legal advice. You should not rely on, or take or fail to take any action based upon this information. Never disregard professional legal advice or delay in seeking legal advice because of something you have read on this website. Gowling WLG professionals will be pleased to discuss resolutions to specific legal concerns you may have.

Related services

IMAGES

COMMENTS

A mortgage assignment agreement is between a holder of debt (assignor) and a party that assumes the debt (assignee). Under most mortgages, the borrower has no rights to object. Since a mortgage is centered upon a specific borrower's credit profile, it is difficult to replace with a new borrower.

A mortgage assignment is the transfer of a mortgage from its initial lender to another party. Learn how this affects you!

An assignment transfers all the original mortgagee's interest under the mortgage or deed of trust to the new bank. Generally, the mortgage or deed of trust is recorded shortly after the mortgagors sign it, and, if the mortgage is subsequently transferred, each assignment is recorded in the county land records.

Mortgages are assigned using a document called an assignment of mortgage. This legally transfers the original lender's interest in the loan to the new company. After doing this, the original lender will no longer receive the payments of principal and interest. However, by assigning the loan the mortgage company will free up capital.

ASSIGNMENT OF MORTGAGE For value received, the undersigned holder of a Mortgage known as:

FOR VALUE RECEIVED, the receipt and sufficiency of which is hereby acknowledged, the undersigned, "Assignor", whose address is above, does hereby grant, sell, assign, transfer and convey to "Assignee," whose address is above, all interest of the undersigned Assignor in and to the following described mortgage:

An assignment of mortgage is a legal term that refers to the transfer of the security instrument that underlies your mortgage loan − aka your home. When a lender sells the mortgage on, an investor effectively buys the note, and the mortgage is assigned to them at this time. The assignment of mortgage occurs because without a security ...

An assignment of a mortgage refers to an assignment of the note and assignment of the mortgage agreement. Both the note and the mortgage can be assigned. To assign the note and mortgage is to transfer ownership of the note and mortgage. Once the note is assigned, the person to whom it is assigned, the assignee, can collect payment under the ...

In real estate, an assignment of mortgage is the transfer of a mortgage, or mortgage note , to another party which typically happens on the servicing side or lender side. This is commonly seen one when lender sells or transfers your mortgage to another lender. Lenders typically have the right to to sell mortgages and assign them to new parties ...

Find a legal form in minutes. Select your State. Last Will and Testament. Power of Attorney. Promissory Note. LLC Operating Agreement. Living Will. Rental Lease Agreement. Non-Disclosure Agreement.

An assignment agreement transfers ownership interest from an assignor (giving party) to an assignee (receiving party). The interest usually consists of a benefit with any included liabilities. If any payment is required, it should be mentioned in the assignment.

That said mortgage has not been further assigned. TOGETHER with the bond or note or obligation described in said mortgage, and the moneys due and to grow due thereon with the interest; TO HAVE AND TO HOLD the same unto the assignee and to the successors, legal representatives and assigns of the assignee forever.

Pennsylvania Law Assignment: An assignment must be in writing and recorded. Demand to Satisfy: The mortgagor, upon full payoff, must make request upon the mortgagee to satisfy the mortgage of record, and pay the mortgagee's reasonable expenses thereof. Recording Satisfaction: Any mortgagee of any real or personal estates in the Commonwealth ...

Opt for the file format for your Letter Of Assignment Mortgage and download it to your device. Print out your form to complete it manually or upload the sample if you prefer to do it in an online editor.

Details. This Notice of Assignment of Mortgage will act as official notice to a mortgage borrower that his/her mortgage has been assigned to a new mortgage lender. This notice sets out the name of the borrower, date of the mortgage and its recording information, legal description of the mortgaged property and the name of the new mortgage lender.

The assigmnent, sale or transfer of the servicing of the mortgage loan does not affect any term or condition of the mortgage instruments, other than terms directly related to the servicing of your loan. Except in limited circumstances, the law requires that your lender send you this notice at least 15 days before the effective date of transfer ...

Assignment Of Mortgage Form PDF Details Mortgage assignments are a vital part of the mortgage process. They document the transfer of a mortgage from one party to another. The form is used to record the new lender's interest in the property and to provide notice to the borrower. Assignment of mortgages can be NECESSARY when refinancing or selling a home, so it's important that you understand ...

The undersigned covenants with ______________________________, assignee's executors, administrators, and assigns, that the sum of ______________________________ is owing and unpaid on the note and mortgage, and that the undersigned has a good right to assign and transfer the mortgage and note.

What do you need to consider when deciding whether to serve notice of assignment? Our legal experts explore the key points businesses need to know.

South Carolina Notice of Assignment: This type of letter informs the borrower about the assignment of their mortgage to a new lender or service. It includes details such as the effective date of the assignment, new contact information, any changes in payment processing, and instructions for future communication with the new entity.

How to fill out Letter Mortgage Form? Make use of the most complete legal library of forms. US Legal Forms is the best place for finding updated Letter of Notice to Borrower of Assignment of Mortgage templates. Our service offers 1000s of legal forms drafted by certified lawyers and sorted by state.

A letter to the recording office for recording assignment of mortgage is a document used to officially record the transfer of a mortgage from one party to another. It ensures that the new mortgage holders name is properly documented with the recording office.

Types of Oklahoma Letters of Notice to Borrower of Assignment of Mortgage: 1. Basic Notice Letter: This letter simply notifies the borrower that their mortgage loan has been assigned to a new lender or service, providing relevant contact information and payment instructions. 2.