45,000+ students realised their study abroad dream with us. Take the first step today

Meet top uk universities from the comfort of your home, here’s your new year gift, one app for all your, study abroad needs, start your journey, track your progress, grow with the community and so much more.

Verification Code

An OTP has been sent to your registered mobile no. Please verify

Thanks for your comment !

Our team will review it before it's shown to our readers.

- Study Abroad /

PhD in Corporate Governance: Top Universities, Course Fees, Scope

- Updated on

- Jun 2, 2023

PhD in Corporate Governance is a 3 years research-based doctoral degree where the learner gains deep knowledge about all the aspects related to the field of business which includes risk assessment, regulations, and sustainability. It also involves balancing the interest of stakeholders like regulators, suppliers, shareholders, etc. This can be a rewarding study program for students who have a bend towards corporate laws , business management, and a perfect degree after post-graduation to study abroad and gain global recognition.

| in Corporate Governance | |

| Doctorate | |

| 3 to 4 Years | |

| Merit-Based | |

| Entrance-Based Exam |

This Blog Includes:

Why study phd in corporate governance, major topics in phd corporate governance, eligibility criteria, application process for phd in corporate governance, salary and job scope.

A PhD in Corporate Governance allows you to explore various aspects of corporate governance in depth and contribute new knowledge to the field. It can also prepare you for a career in academia, consulting, policy-making, or corporate leadership. Additionally, here are some benefits we have listed below related to this study program:

- You can develop advanced skills such as research analysis, communication, and critical thinking.

- You can gain expertise in a relevant topic that affects businesses and society.

- Creating original and impactful research can work in a positive way and may influence corporate governance practices and policies.

- You can build a network of peers, mentors, and experts in this field.

- This can also enhance your career and open more opportunities for you in various sectors and industries.

Also, Read- PhD in Commerce

Here are a few important topics that are related to the PhD in Corporate Governance:

| 1 | Corporate Governance- Definitions and Origin |

| 2 | Corporate Governance- Accountability and Performance |

| 3 | Corporate Governance- Main Theoretical Approaches |

| 4 | Corporate Governance Systems in Europe and North America |

| 5 | The Italian Corporate Governance Code |

| 6 | Corporate Governance in Italy- Key Issues |

| 7 | Executive and Director Remuneration |

Top Universities

Here is a list of world-renowned Universities that are well-recognized due to their modern education and innovative teaching methods.

You can easily enrol yourself in any of the Universities listed below without worrying about the quality of education:

| #3 | USD 73,000 (INR 60 Lakh) | |

| #5 | USD 54,200 (INR 44 Lakh) | |

| – | GBP 25,000 (INR 25 Lakh) | |

| – | AUD 55,000 (INR 29 Lakh) | |

| #11 | SGD 37,000 (INR 22 Lakh) | |

| #15 | EUR 27,000 (INR 27 Lakh) | |

| #412 | GBP 18,000 (INR 18.5 Lakh) |

Here are the top 5 colleges in India best for PhD in Corporate governance:

- Indian Institute of Management

- Indian School of Business

- Institute of Management Studies

- Lovely Professional University

Relevant Read – PhD in Management

Here are the basic eligibility criteria that you need to fulfil to pursue a PhD in Corporate Governance:

- You need to have a master’s degree or equivalent qualification in business management, law, or economics. Example- MBA

- You need to maintain a strong academic record and have the potential for research

- You should have a minimum aggregated score of 55%

- For International Students, A Letter of Recommendation ( LOR ) and Statement of Purpose ( SOP ) are required.

- It is also mandatory to prove your proficiency in the English language by qualifying for exams like SAT , IELTS , and TOEFL . To prepare for your English Proficiency test you can check Leverage Live .

- You may also need to clear the National level entrance exam like the NET

Here are some steps to make your application process a bit easier:

Step 1: Research and find a suitable university

You need to find out the best suitable university and program according to your liking and then cross-check other fees like tuition fee breakup, accommodation, etc. After that, you can head over to the official website of the desired university to apply for your study program.

Step 2: Collect documental proof related to proficiency exams and other documents

As mentioned earlier, it is mandatory to prove your proficiency in the English language by qualifying for exams like IELTS , and TOEFL . Other documents like LOR , SOP , updated resume , and previous academic transcripts like undergraduate and postgraduate are also necessary. So keep those documental proofs handy because you will need them while filling out the form.

Step 3- Submit your application and wait for the offer letter

Once you got all the required documents in one place you are ready to fill out the application form. Make sure you are entering all your personal details correctly. After the application is submitted you may need to wait for a few weeks for your offer letter as the university needs to evaluate your application properly. Once you received your offer letter you now need to apply for a Student Visa for your Study abroad dream to come true.

Must Read: An Ultimate Guide to PhD Courses

A PhD in Corporate Governance as mentioned earlier can easily provide you with diverse job opportunities and its demand is also anticipated to see a growth spike of 5% in the coming days, so here are a few job profiles with their yearly salary:

| Senior Corporate Governance Manager | INR 15 Lakh per annum | INR 60 Lakh per annum |

| Engagement Manager | INR 20 Lakh per annum | INR 64 Lakh per annum |

| INR 35 Lakh per annum | INR 98 Lakh per annum | |

| Business Consultant | INR 10 Lakh per annum | INR 49 Lakh per annum |

| Business Associate | INR 8 Lakh per annum | INR 38 Lakh per annum |

Teaching as a professor of PhD in Corporate Governance can be a good career option as you can get more time to spend with your family and better job security. Additionally, you will also get more respect in society as teaching is considered one of the noble professions across the globe.

The key skills or areas required in the field of corporate governance are: Risk Oversight Corporate Strategy Critical Thinking Skills Communication Skills Leadership Skills Executive Compensation

Corporate governance is all about protecting the company’s brand value, and assets, and maintaining corporate affairs whereas corporate management is all about the growth of the company and improvising new strategies.

This was everything related to PhD in Corporate Governance. As we all know how hectic and overwhelming the whole process of studying abroad can be so if you are searching for a top university and planning for studying abroad, you can reach us at 1800 57 2000 and contact our Leverage Edu experts also for much more amazing blogs you can always stay updated by following Leverage Edu Blogs . Additionally, you can also connect with us through our socials like Facebook , Instagram , Twitter , and LinkedIn .

Team Leverage Edu

Leave a Reply Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Contact no. *

Connect With Us

45,000+ students realised their study abroad dream with us. take the first step today..

Resend OTP in

Need help with?

Study abroad.

UK, Canada, US & More

IELTS, GRE, GMAT & More

Scholarship, Loans & Forex

Country Preference

New Zealand

Which English test are you planning to take?

Which academic test are you planning to take.

Not Sure yet

When are you planning to take the exam?

Already booked my exam slot

Within 2 Months

Want to learn about the test

Which Degree do you wish to pursue?

When do you want to start studying abroad.

January 2024

September 2024

What is your budget to study abroad?

How would you describe this article ?

Please rate this article

We would like to hear more.

Have something on your mind?

Make your study abroad dream a reality in January 2022 with

India's Biggest Virtual University Fair

Essex Direct Admission Day

Why attend .

Don't Miss Out

- Harvard Business School →

- Doctoral Programs →

PhD Programs

- Accounting & Management

- Business Economics

- Health Policy (Management)

- Organizational Behavior

- Technology & Operations Management

Students in our PhD programs are encouraged from day one to think of this experience as their first job in business academia—a training ground for a challenging and rewarding career generating rigorous, relevant research that influences practice.

Our doctoral students work with faculty and access resources throughout HBS and Harvard University. The PhD program curriculum requires coursework at HBS and other Harvard discipline departments, and with HBS and Harvard faculty on advisory committees. Faculty throughout Harvard guide the programs through their participation on advisory committees.

How do I know which program is right for me?

There are many paths, but we are one HBS. Our PhD students draw on diverse personal and professional backgrounds to pursue an ever-expanding range of research topics. Explore more here about each program’s requirements & curriculum, read student profiles for each discipline as well as student research , and placement information.

The PhD in Business Administration grounds students in the disciplinary theories and research methods that form the foundation of an academic career. Jointly administered by HBS and GSAS, the program has four areas of study: Accounting and Management , Marketing , Strategy , and Technology and Operations Management . All areas of study involve roughly two years of coursework culminating in a field exam. The remaining years of the program are spent conducting independent research, working on co-authored publications, and writing the dissertation. Students join these programs from a wide range of backgrounds, from consulting to engineering. Many applicants possess liberal arts degrees, as there is not a requirement to possess a business degree before joining the program

The PhD in Business Economics provides students the opportunity to study in both Harvard’s world-class Economics Department and Harvard Business School. Throughout the program, coursework includes exploration of microeconomic theory, macroeconomic theory, probability and statistics, and econometrics. While some students join the Business Economics program directly from undergraduate or masters programs, others have worked in economic consulting firms or as research assistants at universities or intergovernmental organizations.

The PhD program in Health Policy (Management) is rooted in data-driven research on the managerial, operational, and strategic issues facing a wide range of organizations. Coursework includes the study of microeconomic theory, management, research methods, and statistics. The backgrounds of students in this program are quite varied, with some coming from public health or the healthcare industry, while others arrive at the program with a background in disciplinary research

The PhD program in Organizational Behavior offers two tracks: either a micro or macro approach. In the micro track, students focus on the study of interpersonal relationships within organizations and the effects that groups have on individuals. Students in the macro track use sociological methods to examine organizations, groups, and markets as a whole, including topics such as the influence of individuals on organizational change, or the relationship between social missions and financial objectives. Jointly administered by HBS and GSAS, the program includes core disciplinary training in sociology or psychology, as well as additional coursework in organizational behavior.

Accounting & Management

Business economics , health policy (management) , marketing , organizational behavior , strategy , technology & operations management .

Program on Corporate Governance

Courses taught at Harvard Law School on topics related to corporate governance include the following:

- Analytical Methods for Lawyers

- Business Valuation and Analysis

- Conceptions of Legal Entities

- Corporate Fraud, Abuse, and Other Health Care Regulatory Schemes

- Corporations

- Law and Economics

- Law, Business, and the Public Good

- Private Equity: Practice and Policy

- Regulation of International Finance

- Securities Litigation

- A Comparative Perspective on Corporations, Ownership, and Capital Access

- Bankruptcy and Corporate Restructuring: Current Issues

- Business Negotiations

- Comparative Corporate Governance

- Corporate and Capital Markets Law and Policy

- Corporate Criminal Investigations

- Corporate Finance

- Corporate Restructuring

- Economic Analysis of Law

- Empirical Law and Finance

- Empirical Methods and Data Analysis for Lawyers

- ESG: Corporate Ethics in the 21st Century

- Fiduciary Duties and Delaware Entity Law

- Law and Finance of Venture Capital and Start-ups

- M&A Litigation

- Mergers and Acquisitions Workshop: Boardroom Strategies and Deal Tactics

- Nuts and Bolts of Forming a Venture Capital Fund

- Private Equity Public Policy Issues

- Regulation of Financial Institutions

- Research Seminar in Law, Economics, and Organizations

- Securities Regulation

- Stakeholder Capitalism

- Venture Law and Finance

- Drafting and Negotiating Complex Cross-Border M&A Transactions

- Failed Corporations: A Post-Mortem

- Valuing and Modeling M&A and LBOs

- Corporate Governance: Corporate Purpose

- Critical Corporate Theory Lab

- Advanced Corporate Transactions

- Corporate Reorganization

- Hedge and Private Equity Funds: Law and Policy

- Investments Workshop: Public and Private Equity

- Mergers and Acquisitions

- Mergers and Acquisitions: Boardroom Strategies and Deal Tactics Workshop

- Emiliano Catan

- Holger Spamann

- Law and Economics Seminar

- Business Strategy for Lawyers

- Corporate Governance

- Cross Border M&A: Drafting, Negotiation & the Auction Process

- Shareholder Activism

- Taxation of Business Corporations

- The Rise of ESG in Corporate Law & Governance

- Professor Jesse Fried

- Professor Reinier Kraakman

- Professor Holger Spamann

- Professor J. Mark Ramseyer

- Current Issues in Securities Regulation

- Investment Management Law: Private Funds and Other Issues

- Professor Michal Barzuza

- Professor Jon Hanson

- Entrepreneurial Agreements and Startup Decisions

- Comparative Corporate Governance and Finance

- Mergers and Acquisitions in the Technology Sector

- Controlling Shareholders

- Corporate Governance: The Short-Termism Problem

- Corporations from a Comparative Perspective

- Empirical Law and Economics

- The Corporation as a Citizen

- Corporate Governance: Short-Termism and Current Controversies

- Professor Anthony Casey

- Professor Robert Clark

- Index Funds and the Concentration of Corporate Ownership

- Institutional Investors and Alternative Investment Forms: Private Equity, Venture Capital, and Hedge Funds

- International Investment Arbitration: Policies, Issues and Challenges

- Financial Analysis and Business Valuation

- Structuring Venture Capital, Private Equity, and Entrepreneurial Transactions

- Comparative Corporate Law, Finance and Governance

- Professor Jennifer Taub

- Current Issues in Corporate Governance

- International Investment Arbitration

- Introduction to Finance Concepts

- Investing in VC Funds

- Law and Business

- Legal History: History of American Economic Regulation

- Securities Regulation: Law and Policy

- Advisor Liability in M&A

- Bankruptcy: Current Issues

- Entrepreneurship and Venture Capital

- Executive and Board Turnover in the S&P 500: Research Seminar

- Anatomy of Deal Litigation in Practice

- The Art and Science of Financial Regulation

- Corporate Tax B: Mergers, Acquisitions and Divisions

- Advanced Topics in Financial Regulation

- Capital Markets Regulation

- Professor Holger Spamann

- Professor Guhan Subramanian

- Hedge and Private Equity Funds: Law & Policy

- Topics in Mergers and Acquisitions

- Capstone Seminar for the LL.M. Concentration in Comparative Law, Finance, and Corporate Governance

- Challenges of a General Counsel

- Professor John Coates

- Corporate Boards and Governance

- Professor Guhan Subramanian

- Drafting and Negotiating Cross-Border Merger & Acquisition Transactions

- Hedge Fund Law and Policy

- Mergers and Acquisitions Processes and Structures

- Globalization: Business, Legal and Public Policy Issues

- Introduction to Empirical Methods

- Boards of Directors and Corporate Governance

- Investment Management Law: Private Funds, Money Market Funds and Other Issues

- Antitrust Law

- Corporate Governance and Finance of the Public Firm

- Professor Ryan Bubb

- Empirical Methods in Corporate, Securities and Capital Markets Law

- International Corporate Debt Solutions and Cross-Border Insolvency

- International Finance

- Introduction to Securities Regulation

- Law and Economics

- Law and Finance of Start-Up Companies

- Research Seminar: Management Turnover in the S&P 500

- Professor Andrew Gold

- Insider Share Ownership, Management Compensation, and CEO Turnover in U.S. Public Corporations

- Mergers, Acquisitions, and Split-Ups

- The Law and Finance of the Japanese Firm

- Professor David Skeel

- Governance of U.S. Public Corporations

- Topics in Financial Regulation: Consumer and Investor Protection

Fall/Spring

- Laws, Markets, and Religions

- Bankruptcy Deal-Making

- Hedge Fund Law and Regulation

- Current Issues in Executive Compensation and Corporate Governance

- Law, Economics, and Organizations Research

- Mergers and Acquisitions Law

- Comparative Corporate Governance: USA, Western Europe, Asia

- Corporate Finance: Advanced

- Assistant Professor Holger Spamann

- Professor Vikramaditya Khanna

- The 2007-2009 Financial Crisis

- European Securities Regulation

- Financial Statement Analysis and Valuation

- Derivatives Regulation

- Introduction to Accounting and Corporate Financial Reports

- Readings and Empirical Investigation in Managerial Turnover and Corporate Acquisitions

Knowledge Partners

HLS Faculty & Senior Fellows

- Lucian Bebchuk

- Robert Clark

- John Coates

- Stephen M. Davis

- Allen Ferrell

- Jesse Fried

- Oliver Hart

- Howell Jackson

- Kobi Kastiel

- Reinier Kraakman

- Mark Ramseyer

- Robert Sitkoff

- Leo E. Strine, Jr.

- Guhan Subramanian

- Roberto Tallarita

Program Advisory Board

- William Ackman

- Peter Atkins

- Kerry E. Berchem

- Richard Brand

- Daniel Burch

- Arthur B. Crozier

- Renata J. Ferrari

- John Finley

- Carolyn Frantz

- Andrew Freedman

- Byron Georgiou

- Joseph Hall

- Jason M. Halper

- David Millstone

- Theodore Mirvis

- Maria Moats

- Erika Moore

- Morton Pierce

- Philip Richter

- Elina Tetelbaum

- Marc Trevino

- Steven J. Williams

- Daniel Wolf

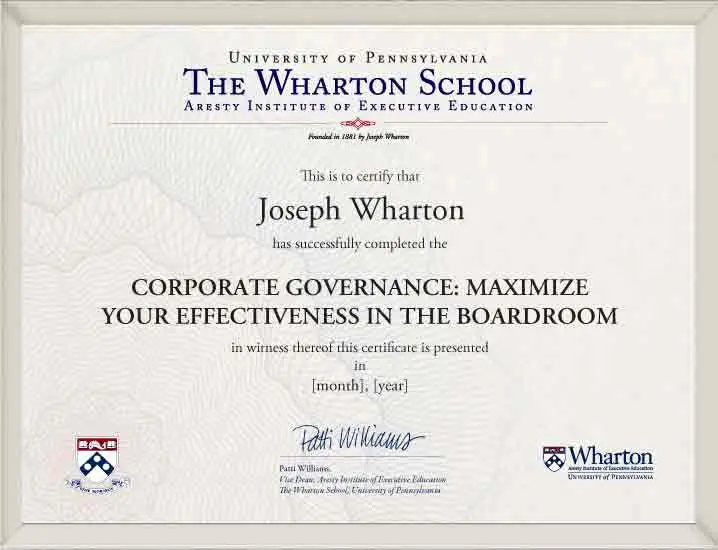

Corporate Governance: Maximize Your Effectiveness in the Boardroom

Drive strategic directions and succeed as a board member

Get Your Brochure

By clicking the button below, you agree to receive communications via Email/Call/WhatsApp/SMS from Wharton & Emeritus about this program and other relevant programs. Privacy Policy

Who is this program for?

The Corporate Governance: Maximize Your Effectiveness in the Boardroom program is designed to give participants a deeper understanding of corporate governance and help boost their effectiveness on a corporate board.

The program is ideal for:

Current board members and senior executives interested in joining a board who want to understand the various aspects of proactive governance and help drive strategic direction, risk oversight and the establishment of compensation.

C-suite executives looking to explore the duties and nuances of board service, help strengthen their company's financial return, enterprise risk management and governance diversity, and learn to effectively take on existing and emerging issues.

Attorneys engaged in legal services who are seeking to learn the fundamentals of corporate governance from a variety of angles and how to assess the effectiveness and execution of governance roles and responsibilities.

Key Takeaways

Wharton’s Corporate Governance program explores the role, structure, and responsibilities of corporate governance to help you succeed as a board member. This program will enable you to:

Define the board’s role and responsibilities as well as characteristics of successful board leaders

Ensure proactive governance and learn how to prepare for potential risks

Recognize key considerations of compensation and succession planning

Define strategies for board members, executives, and other environmental, social, and governance (ESG) integrators to respond to conflicting demands and societal challenges to their organization

Plan for how to manage the competing interests of stakeholders and shareholders

Program Modules

Program experience.

Discussion Boards

Reflections

Industry Examples

Assignments

Live Office Hours

Try-it Activities

Self-Study Quizzes

This online program provides real-world learning examples to help you understand the realities of corporate governance in practice through the experiential lens of leading global brands.

Analyze Apple’s board demographics to understand the value of diversity in background, experience, and skill sets.

Understand the importance of board accountability and how a captive board can reduce oversight in governance via this example of Disney’s board being comprised of friends and acquaintances of its president, Michael Ovitz.

Understand the impact of non-market factors through this example of the pharmaceutical organization, Mylan.

See how some companies (Starbucks,in this case) take diversity to heart and the influence that a diverse board can have.

Recognize the impact of diversity in background, experience, and skill sets through an analysis of Wells Fargo’s board composition.

Corporate Governance Handbook

This program enables you to explore the processes and responsibilities that drive corporate governance. It also includes a handbook where you can reflect on the program content and how it can help you succeed in a board member role. Topics addressed in the handbook include:

Laying the groundwork: Begin by drafting your director bio and exploring the importance of marketing yourself.

Conducting a personal skills audit: Assess your professional background to help you understand your strengths and any critical gaps in your knowledge or experience for board positions you’re seeking.

Finding your director doppelganger: Focus on strategically networking with directors who possess experience/characteristic profiles that are similar to yours, as they can help point you toward boards that are looking for a candidate with your profile.

Demonstrating your grit: Be able to persuasively articulate your experience in crisis/adversity situations.

Completing a leadership style assessment: Consider how your style informs the way you would manage various stakeholders, as well as which stakeholders you’re most comfortable interacting with and/or advocating for in the boardroom.

Putting the pieces together: Define and characterize your personal guiding principles via a concise and effective board value statement.

Associate Professor of Management, Organizational Behavior, The Wharton School

Mary-Hunter McDonnell studies organizational behavior within challenging institutional contexts, such as contentious social environments and uncertain regulatory environments....

Guest Speaker

Partner, Mayer Brown

Sean McDonnell is a partner in Mayer Brown's Washington D.C. office and a member of the global Litigation & Dispute Resolution practice. Previously, Sean was an Assistant Unit...

Testimonials

Certificate

Upon successful completion of the program, you will earn a digital certificate of completion from the Wharton School.

Note: After successful completion of the online program, your verified digital certificate will be emailed to you in the name you used when registering for the program. All certificate images are for illustrative purposes only and may be subject to change at the discretion of the Wharton School.

Didn't find what you were looking for? Write to us at [email protected] or Schedule a call with one of our Program Advisors or call us at +1 680 205 5118 (US) / +44 185 845 9995 (UK) / +65 3135 1422 (SG)

Early registrations are encouraged. Seats fill up quickly!

Flexible payment options available. View payment plans

- Contributors

Post-Doctoral and Doctoral Corporate Governance Fellowships

The Program on Corporate Governance at Harvard Law School (HLS) is seeking applications from highly qualified candidates who are interested in working with the Program as Post-Doctoral or Doctoral Corporate Governance Fellows.

Applications are considered on a rolling basis, and the start date is flexible. Appointments are commonly for one year, but can be extended for additional one-year period/s contingent on business needs and funding.

To be eligible to apply candidates should (i) have a J.D., LL.M., or S.J.D. from a U.S. law school, (ii) by the time they commence their fellowship, (ii) be pursuing an S.J.D. at a US law school, provided that they have completed their program’s coursework requirements by the time they start, or (iii) have a doctoral degree in law, or have completed much of the work toward such a degree, in a law school outside the U.S.

During the term of their appointment, Fellows will be in residence at HLS and will be required to work on research and other activities of the Program, depending on their skills, interests, and Program needs. Fellows will also be able to spend significant time on their own projects. The position will provide a competitive fellowship salary and Harvard University benefits.

Interested candidates should submit to [email protected] : CV; transcripts; any research papers they have written or a writing sample; and a cover letter. The cover letter should describe the candidate’s experience, reasons for seeking the position, career plans, and the period during which they would like to work with the Program.

Supported By:

Subscribe or Follow

Program on corporate governance advisory board.

- William Ackman

- Peter Atkins

- Kerry E. Berchem

- Richard Brand

- Daniel Burch

- Arthur B. Crozier

- Renata J. Ferrari

- John Finley

- Carolyn Frantz

- Andrew Freedman

- Byron Georgiou

- Joseph Hall

- Jason M. Halper

- David Millstone

- Theodore Mirvis

- Maria Moats

- Erika Moore

- Morton Pierce

- Philip Richter

- Elina Tetelbaum

- Marc Trevino

- Steven J. Williams

- Daniel Wolf

HLS Faculty & Senior Fellows

- Lucian Bebchuk

- Robert Clark

- John Coates

- Stephen M. Davis

- Allen Ferrell

- Jesse Fried

- Oliver Hart

- Howell Jackson

- Kobi Kastiel

- Reinier Kraakman

- Mark Ramseyer

- Robert Sitkoff

- Holger Spamann

- Leo E. Strine, Jr.

- Guhan Subramanian

- Roberto Tallarita

Smart. Open. Grounded. Inventive. Read our Ideas Made to Matter.

Which program is right for you?

Through intellectual rigor and experiential learning, this full-time, two-year MBA program develops leaders who make a difference in the world.

A rigorous, hands-on program that prepares adaptive problem solvers for premier finance careers.

A 12-month program focused on applying the tools of modern data science, optimization and machine learning to solve real-world business problems.

Earn your MBA and SM in engineering with this transformative two-year program.

Combine an international MBA with a deep dive into management science. A special opportunity for partner and affiliate schools only.

A doctoral program that produces outstanding scholars who are leading in their fields of research.

Bring a business perspective to your technical and quantitative expertise with a bachelor’s degree in management, business analytics, or finance.

A joint program for mid-career professionals that integrates engineering and systems thinking. Earn your master’s degree in engineering and management.

An interdisciplinary program that combines engineering, management, and design, leading to a master’s degree in engineering and management.

Executive Programs

A full-time MBA program for mid-career leaders eager to dedicate one year of discovery for a lifetime of impact.

This 20-month MBA program equips experienced executives to enhance their impact on their organizations and the world.

Non-degree programs for senior executives and high-potential managers.

A non-degree, customizable program for mid-career professionals.

Corporate Governance

Ideas and insights about corporate governance from MIT Sloan.

‘Doughnut economics’: 4 questions for industry leaders

Kara Baskin

Economist Kate Raworth offers a framework to guide global development, government policy, and corporate strategy in the 21st century.

How, and why, to run a values-based business

Deborah Lynn Blumberg

A new book offers a four-point framework for tapping the submerged benefits of running a values-based business.

The savings of corporate giants

Large corporations like Apple, Microsoft, and Alphabet hold complex financial portfolios. Many investors are not aware that these holdings expose them to additional risk.

Why cash is still king for these chief financial officers

Betsy Vereckey

Bank collapses in 2023 caused financial executives to reexamine their cash management strategies. Here are five tips from CFOs on the front lines.

After SVB, what’s next for regional banks? 3 takeaways from MIT Sloan

Four MIT Sloan economists on lessons learned and next steps after the demise of Silicon Valley Bank, Signature Bank, and First Republic.

An MIT Sloan economist runs the numbers on ESG

Financial economist Andrew W. Lo became an ESG believer after developing a mathematical formula that quantifies the financial return on impact investing.

Digital transformation for family-owned companies

Family-run companies often struggle with modernization. To start, they should create a digital thesis and promote an agile board culture.

How Intel’s CFO threads the needle on geopolitics — and more

Intel’s chief financial officer, David Zinsner, talks geopolitical challenges, intellectual property, and creative financing at the MIT Sloan CFO Summit.

Download: MIT Sloan research on sustainable business

Companies are under pressure to adopt sustainable business practices. Here is strategic advice for an effective, efficient, and equitable future.

Why sustainable business needs better ESG ratings

Beth Stackpole

Data on environmental, social, and governance performance is noisy — and may not help companies help the environment. MIT Sloan experts investigate.

- Postgraduate

- PhD and Professional Doctorates

- PhD opportunities

Corporate Governance and Artificial Intelligence

- School: Nottingham Business School

- Study mode(s): Full-time / Part-time

- Starting: 2024 / 2025

- Funding: UK student / International student (non-EU) / Self-funded

Staff profiles

Entry qualifications, how to apply, fees and funding, guidance and support.

This PhD project will take a multidimensional approach to exploring how Corporate Governance responds to the fast-changing and broad application of Artificial Intelligence (AI) at the organisational levels.

AI is considered one of the most important technological innovations at present. AI holds myriad uses for different organisations and industries. For example, retail and shipping use AI for predictive logistics, Q&A through chatbots, or making recommendations related to customer preferences. Financial firms have found its use in fraud detection, automated trading, or financial advisory services. Healthcare organisations use AI to improve patient outcomes by automating clinical documentation and patient communication. While the possibilities of its use are endless, it is important to make it responsible for not disrupting the operational environment. Therefore, corporate governance has a crucial role in ensuring that AI adoption is safe and sound.

In addition, while organisations try to build their strategies around AI, they need to consider various associated AI risks, such as investment and compliance failures, operational, cyber-security, data, output, or people management-related risks. Thus, organisations must ensure solid ethical foundations that can manage risks and provide adaptable governance frameworks.

Corporate governance needs to be more vigilant in its oversight duties by asking the right questions and pressure-testing management’s plan to embed AI in its processes. Directors need to properly oversee cybersecurity risks, ensure strong governance mechanisms, promote healthy communication policies and implementation, and comply with ongoing regulatory requirements.

This project aims to (but is not limited to):

i.Explore the AI adoption trends in various industries

ii.Examine the role played by corporate governance in AI adoption

iii.Examine how corporate governance is tackling the risks associated with AI adoption

iv.Examine how corporate governance adopts AI for sustainable business practices or outcomes.

Methodology :

The project can be conducted based on quantitative, qualitative, or mixed methods.

We would welcome candidates who would like to explore the role of corporate governance in countering the threats and opportunities related to AI in different organisational settings.

MSc in business, management or other social science discipline relevant to the topic.

Applications for October 2024 intake closes on 1 st August 2024 and applications for Jan 2025 intake closes on 1 st October 2024. Please visit our how to apply page for a step-by-step guide and make an application.

This is a self-funded PhD project for UK and International applicants.

For more information about the NBS PhD Programme, including entry requirements and application process, please visit: https://www.ntu.ac.uk/course/nottingham-business-school/res/this-year/research-degrees-in-business

Nottingham Business School is triple crown accredited with EQUIS, AACSB and AMBA – the highest international benchmarks for business education. It has also been ranked by the Financial Times for its Executive Education programmes in 2023 and 2024. NBS is one of only 47 global business schools recognised as a PRME Champion, and held up as an exemplar by the United Nations of Principles of Responsible Management Education (PRME).

Its purpose is to provide research and education that combines academic excellence with positive impact on people, business and society. As a world leader in experiential learning and personalisation, joining NBS as a researcher is an opportunity to achieve your potential.

Still need help?

Corporate Governance: Essentials for a New Business Era

Program overview.

Today’s corporate boards face historic and unprecedented challenges. Boards of directors must navigate these sources of unexpected enterprise risk while capably monitoring their firms’ financial performance. For those responsible for filling board seats, the push toward making boards more diverse and inclusive adds complexity. Meanwhile, new opportunities are emerging for those seeking board service.

Corporate Governance: Essentials for a New Business Era provides critical tools for aspiring, newly appointed, and veteran board members, and for executives working with their board or other boards. Participants will gain insight into the duties and nuances of board service and learn to forge partnerships with company officers to strengthen financial return, enterprise risk management, and governance diversity.

Date, Location, & Fees

If you are unable to access the application form, please email Client Relations at [email protected] .

April 22 – 25, 2025 Philadelphia, PA $9,850

Drag for more

Program Experience

Former guest speakers, who should attend, highlights and key outcomes.

In Corporate Governance: Essentials for a New Business Era , you will:

- Explore board opportunities for C-suite officers in areas including technology, human resources, and sustainability

- Grasp how a director’s role is changing in today’s social, legal, and business environment

- Learn to present yourself as an attractive candidate for boards

- Look inside the process for nominating, selecting, and onboarding directors

Experience and Impact

Traditional board governance is a thing of the past. Today’s directors must be ready and able to handle a wide range of enterprise risks that could impact a large company. Led by top Wharton management faculty, Corporate Governance: Essentials for a New Business Era offers those aspiring to be on boards, recently appointed to a board, or experienced directors and company executives a wide-ranging look at what constitutes successful board service in the current environment. The specific content of the program will also be informed by the most pressing issues facing corporate boards. The focus will include company and legal issues related to diversity and inclusion; environmental, social, and governance (ESG) metrics; and leading in the boardroom.

Participants will explore how to present themselves as candidates for boards against the backdrop of social and legislative efforts to make boards more ethnically diverse and gender inclusive. You will also learn about the functional capabilities that are valued on boards, including strategy, technology, human resources, sustainability, and international experience. You will acquire strategies for marketing yourself to recruiters and come to recognize the value you can bring to a boardroom setting.

Individuals already on boards will gain new insights into managing emerging sources of enterprise risk and how best to diversify their board to address new regulations and investor expectations.

In addition to the outstanding faculty, selected guest speakers will enhance the program’s practical, real-world approach. Speakers may include veteran board chairs and lead directors; a federal prosecutor who has conducted internal investigations for major telecommunications and financial firms; and an executive-search partner experienced in board recruitment and onboarding.

A valuable benefit of this program is the substantial networking opportunity. You will have time to interact with seasoned and board-ready individuals from a wide variety of backgrounds and experience, providing for an expanded peer group. The need has never been greater for board members with new perspectives and experience. Timely and unique, Corporate Governance helps you take full advantage of the rapidly changing environment for both board selection and director responsibilities.

Session topics include:

- Overview of board structure, committees and emerging best practices

- Enterprise challenges and risks including climate change, job displacement, global trade, disease epidemics, and social responsibility

- Creating opportunities for those who have been underrepresented in the boardroom

- Characteristics of successful board leaders

- Overseeing management

- Building diversity, equity, and inclusion in the boardroom

- Leading boards through legal issues and other crises

- Succession planning

- Bringing environmental and social issues into the boardroom

- Designing political and social strategies

- Shareholder activism

Convince Your Supervisor

Here’s a justification letter you can edit and send to your supervisor to help you make the case for attending this Wharton program.

Due to our application review period, applications submitted after 12:00 p.m. ET on Friday for programs beginning the following Monday may not be processed in time to grant admission. Applicants will be contacted by a member of our Client Relations Team to discuss options for future programs and dates.

Janet Foutty

Executive Chair of the Board, Deloitte

Janet Foutty is executive chair of the board, Deloitte. She leads the board in providing governance and oversight on critical business matters including strategy, brand positioning, risk mitigation, talent development, and leadership succession. Janet is also a member of Deloitte’s Global Board of Directors, and chair of Deloitte Foundation, the 90-year old not-for-profit organization that helps develop future talent and promote excellence in teaching, research, and curriculum innovation.

Janet’s leadership experience includes most recently serving as chair and chief executive officer for Deloitte Consulting LLP where she led a $10B business comprised of over 50,000 professionals in helping Fortune 500 companies and government agencies translate complex issues into opportunity.

She previously led Deloitte’s federal practice dedicated to improving the efficacy and efficiency of US government agencies; as well as Deloitte Consulting LLP’s technology practice, which achieved exponential growth through acquisitions and the launch of businesses including Deloitte Digital. She has also held leadership roles on client programs that span retail, technology, government, energy, and financial services industries. Janet is a frequent author and popular public speaker. She regularly communicates with executive-level audiences about the changing business landscape, technology disruption, and leadership. Janet is a passionate advocate for inclusion in the workplace; women in technology; and the need for science, technology, engineering, and mathematics (STEM) education. She has founded Women in Technology groups in India and the United States. Janet serves on the board of directors of Bright Pink, a nonprofit dedicated to women’s health, and Catalyst, a global nonprofit working to build more inclusive workplaces. She serves on the advisory boards of NYU Stern’s Tech MBA program, Columbia Law School’s Millstein Center for Global Markets and Corporate Ownership, and the executive committee for the Council on Competitiveness.

Janet holds a Bachelor of Science from Indiana University, and a Masters of Business Administration in finance from the Kelley School of Business at Indiana University. She is an inductee of the Kelley School of Business Academy of Alumni Fellows, and a member of the Kelley School of Business Dean’s Council.

Watch the Video: Janet Foutty, Chair of the Board for Deloitte, talks about the key principles of board agility.

Katina Dorton

Chief Financial Officer; Board Director

Katina Dorton is a recognized and internationally experienced financial executive, corporate director, and public company CFO. Dorton's strategic insights, expert perspective, and financial acumen are informed by earlier career experience as a Wall Street investment banker and corporate transactions attorney. Dorton's industry expertise includes health care and life sciences, industrial services, and financial services.

Throughout her career, Dorton has advised executive leaders and boards of directors on capital markets, fund raising, mergers and acquisitions, and other strategic transactions, collectively valued at more than $50 billion. As CFO, Dorton has built financial, legal, and operational functions to support companies through aggressive growth and transition including IPO preparation. Dorton has served on several public company boards and has demonstrated strong leadership as lead director, audit chair and governance committee chair. She meets the qualifications of an SEC financial expert, is a National Association of Corporate Directors (NACD) Corporate Governance Fellow, and serves on the NACD Lead Director Steering Committee. Dorton was named as one of Women Inc's 2019 Most Influential Corporate Directors and a 2020 NACD Directorship 100 Honoree.

William McNabb

Former Chairman and Chief Executive Officer, Vanguard; Senior Fellow, Center for Leadership and Change Management, The Wharton School

F. William McNabb III is the former chairman and chief executive officer of Vanguard. He joined Vanguard in 1986. In 2008, he became chief executive officer; in 2010, he became chairman of the board of directors and the board of trustees. He stepped down as chief executive officer at the end of 2017 and as chairman at the end of 2018. Earlier in his career, he led each of Vanguard’s client-facing business divisions.

McNabb is active in the investment management industry and served as the chairman of the Investment Company Institute’s board of governors from 2013 to 2016. A board member of UnitedHealth Group and the chairman of Ernst & Young’s Independent Audit Committee, he is also chairman of the board of the Zoological Society of Philadelphia, a board member of CECP: The CEO Force for Good, and a board member of the Philadelphia School Partnership.

In addition, McNabb is the executive in residence at the Raj & Kamla Gupta Governance Institute at the Le Bow College of Business and a member of the Advisory Board of the Ira M. Millstein Center for Global Markets and Corporate Ownership at Columbia Law School. He is a member of the Wharton Leadership Advisory Board of the Wharton Center for Leadership and Change Management and a member of the Wharton School’s Graduate Executive Board. He also serves on the Dartmouth Athletic Advisory Board.

McNabb earned an AB at Dartmouth College and an MBA from the Wharton School of the University of Pennsylvania.

Paula Price

Public and Private Company Independent Board Director and Strategic Advisor

Paula A. Price was EVP and chief financial officer of Macy’s Inc. from July 2018 to May 2020, and served as advisor to the renowned retailer until the end of 2020. As CFO, she was also a principal architect of Macy’s transformation journey and, during the COVID-19 pandemic, led its financial restructuring, including raising $4.5 billion to recapitalize and sustain the company.

Price has been a visiting executive with Harvard Business School since July 2018, and was a full-time senior lecturer of business administration in the Accounting and Management Unit, having joined the faculty in July 2014. Until January 2014, Price was executive vice president and chief financial officer of Ahold USA, which she joined in 2009. At Ahold, Price was responsible for finance, accounting, and shared services; strategy and planning; real estate development and construction; and information technology. Price transformed the finance function, delivered a $1 billion cost savings program to fund strategic growth initiatives, and led a team of over 1,000.

Prior to joining Ahold, Price was senior vice president, controller, and chief accounting officer for CVS Caremark Corporation, and a key player in the $26 billion CVS/Caremark merger transaction. Price began her career as an intern in public accounting at Arthur Andersen & Co. before joining full time with clients that spanned financial services, consumer packaged goods, and health care.

Price currently serves as an independent director for public, private, and not-for profit companies. Today, she serves on the boards of the following publicly traded companies: Accenture, chairing its Audit Committee; Bristol Myers Squibb; Western Digital; and Davita, chairing its Audit Committee. She is a qualified audit committee financial expert as defined by the SEC and a certified public accountant.

Price’s career includes senior-level finance, general management, and strategy roles based in New York, Boston, London, and Chicago in the retail, financial services, health care, and consumer packaged goods industries.

Price earned her MBA in Finance and Strategy from the University of Chicago and her BSc in Accountancy from DePaul University.

Price and her family live in Manhattan and on Martha’s Vineyard, where she enjoys painting and outdoor activities.

Mark Turner

President, Chief Executive Officer and Director of WSFS Financial Corporation and WSFS Bank

Mark A. Turner, has been President, Chief Executive Officer and a Director of WSFS Financial Corporation and WSFS Bank since 2007. Mr. Turner was previously both the Chief Operating Officer and the Chief Financial Officer of WSFS. Prior to joining WSFS in 1996, he worked at CoreStates Bank, Meridian Bancorp and at the international professional services firm of KPMG, LLP. WSFS is a multi-billion dollar, publicly-traded financial organization (NASDAQ:WSFS), the largest bank and trust company headquartered in Delaware and the Delaware Valley, and the 7th oldest bank in the U.S. Mr. Turner is privileged to be leading a Company that has been named by an independent survey as a “Top Workplace” in Delaware for the last 11 years in a row (with special recognitions for the Company’s leadership, ethics, and career development), and has also been voted as the “#1 Bank” in Delaware for six years in a row.

Mr. Turner received his MBA from the Wharton School of the University of Pennsylvania, his Master’s Degree in Executive Leadership from the University of Nebraska-Lincoln, and his Bachelor’s Degree in Accounting and Management from LaSalle University (Philadelphia). Among other executive leadership programs, Mr. Turner has studied at National Training Labs, Aspen Institute, Gallup University, Toyota University, Center for Creative Leadership, UC Berkeley, and Buckley School for Public Speaking.

Mr. Turner is an active leader in his community. He has served as: Chairman of the Board of Delaware Business Roundtable (DBRT); a member of U.S. Federal Reserve Board’s Advisory Council; Chairman of the Board of Delaware Bankers Association (DBA); a member of Executive Committee of the Board of Delaware State Chamber of Commerce (DSCC); a member of the Board of Trustees of Delaware State University (DSU); a member of the Board of Directors of Delaware Alliance for Non-Profit Advancement (DANA); a member of the Board of Advisors of Teach for America (TFA), Delaware; and a founding member of both Delaware Talent Live (DTL) and Wilmington Leaders Alliance (WLA).

Corporate Governance: Essentials for a New Business Era prepares executives with diverse backgrounds who aspire to join a board or wish to enhance their knowledge for ongoing board service. This program offers a wide-ranging look at what constitutes successful board service in the current climate with a focus on the fiduciary duties of directors, strategies for filling and seeking board seats, and navigating the politics of board service.

This program is ideal for:

- Senior-level women or minority executives who aspire to board service or have recently joined a board

- C-suite executives including general counsels, chief technology officers, chief financial officers, chief human resource officers, chief risk officers, and chief sustainability officers

- Partner-level attorneys in law firms with experience in corporate investigations, mergers/acquisitions, and compliance

- Leaders of major nonprofit organizations and academic institutions

- Board members who wish to become better informed and more productive in their role

- Members of governance and nominations committees seeking to diversify their boards

- Corporate secretaries

- Institutional investors

Fluency in English, written and spoken, is required for participation in Wharton Executive Education programs.

Group Enrollment

To further leverage the value and impact of this program, we encourage companies to send cross-functional teams of executives to Wharton. We offer group-enrollment benefits to companies sending four or more participants.

Michael Useem, PhD See Faculty Bio

Academic Director

William and Jacalyn Egan Professor Emeritus of Management; Faculty Director, Center for Leadership and McNulty Leadership Program, Wharton School, University of Pennsylvania

Research Interests: Catastrophic and enterprise risk management, corporate change and restructuring, leadership, decision making, governance

Mary-Hunter McDonnell, JD, PhD See Faculty Bio

Bantwal Family Goldman Sachs Presidential Associate Professor; Associate Professor of Management

Research Interests: Organizational theory (political sociology, institutional theory); nonmarket strategy; corporate governance; corporate misconduct and punishment

Peter Cappelli, DPhil See Faculty Bio

George W. Taylor Professor of Management; Director, Center for Human Resources, The Wharton School

Research Interests: Human-resource practices, public policy related to employment, talent and performance management

Emilie Feldman, PhD See Faculty Bio

Michael L. Tarnopol Professor; Professor of Management, The Wharton School

Research Interests: Corporate governance, corporate strategy, diversification, divestitures, firm scope, spinoffs, mergers and acquisitions

Witold Henisz, PhD See Faculty Bio

Vice Dean and Faculty Director, ESG Initiative; Deloitte & Touche Professor of Management in Honor of Russell E. Palmer, former Managing Partner

Research Interests: Political and social risk management; project management; ESG integration; stakeholder engagement

Nancy Rothbard, PhD See Faculty Bio

Deputy Dean; David Pottruck Professor; Professor of Management, The Wharton School

Research Interests: Emotion and identity, work motivation and engagement, work-life and career development

How does a diverse board of directors help increase organizational performance?

Companies with diverse boards (in terms of race, ethnicity, gender, age, professional experience, and other factors) — and who work to benefit from that diversity — have been shown to have higher than average ROI, have better than average growth, and pay higher dividends to stockholders. They can better monitor senior leaders, challenge the status quo, be more innovative, and provide more agile leadership in the face of change and disruptions. Diverse boards tend to be more aware of market trends and take steps to improve the company’s brand and overall reputation. They also tend to acknowledge a wider variety of risks and thus are more risk-averse.

How do you measure board diversity? Are there different methods that different companies use to measure it?

Diversity laws that mandate a specific number or percentage of women directors were first passed in Europe (Norway was first in 2003). By 2018, they extended to the United States: California and Illinois have diversity laws, and Hawaii, Massachusetts, Michigan, and New Jersey are currently drafting them. Most of these laws, like those in Europe, focus solely on gender diversity.

Companies are also now facing pressure from institutional and activist investors, as well as social movements, to improve board diversity, but standards for measuring that diversity range widely. Most firms must define and benchmark progress toward diversity for themselves.

What are the qualities of a good board member?

A good board member should bring unique perspectives and sources of information and be willing to share them. They are honest and ethical, exercise discretion, and are cooperative with and respectful of their fellow directors. Good directors are also forward thinking, actively considering new issues to monitor that could become problematic for the firm in the future.

What skills do you need to be a board member?

Directors must be knowledgeable about and able to participate meaningfully in the duties their board is charged with. Those include making strategic decisions about mergers and acquisitions, CEO succession, executive compensation, and other high-level issues. Board members should possess strong critical thinking skills, awareness of the industry and positioning the company within it, and leadership experience. Business acumen in areas such as finance, operations, technology, and marketing is required of the board as a whole, but not every member needs expertise in each area.

What role does the board of directors play in corporate governance?

Corporate governance makes managers accountable to the best interests of their firm. The board acts as the intermediary, monitoring and guiding the firms’ senior leaders. In the United States, because shareholders typically do not own a very large block of shares in a company, the board plays a crucial role in representing those shareholders’ interests by actively working on their behalf.

How does corporate governance affect the image of the company?

Boards that actively monitor senior leadership and that maintain a level of independence can help safeguard a firm’s reputation by preventing or rectifying potentially disastrous situations. Many well-known company failures, such as Enron’s and recent #MeToo-related debacles, can be linked to failures in corporate governance.

Why is board composition important in corporate governance?

A board has to effectively decide on and implement a number of critical, diverse strategic tasks. Those include hostile takeovers, capital allocation strategy, and executive compensation and succession. To perform optimally, the board's composition must match the skill sets needed.

Download the program schedule , including session details and format.

Hotel Information

Fees for on-campus programs include accommodations and meals. Prices are subject to change.

Read COVID-19 Safety Policy »

Related Programs

- Shareholder Activism: Activating Change for Value Creation

- Women on Boards: Building Exceptional Leaders

Schedule a personalized consultation to discuss your professional goals:

+1.215.898.1776

Still considering your options? View programs within Leadership and Management or:

Find a new program

- Liberty University

- Jerry Falwell Library

- Special Collections

- < Previous

Home > ETD > Doctoral > 2809

Doctoral Dissertations and Projects

The role of leadership on corporate governance.

John Brackett Follow

Graduate School of Business

Doctor of Business Administration (DBA)

Melissa Washington

Leadership, Corporate Governance, Internal Controls, Financial Reporting

Disciplines

Accounting | Business

Recommended Citation

Brackett, John, "The Role of Leadership on Corporate Governance" (2021). Doctoral Dissertations and Projects . 2809. https://digitalcommons.liberty.edu/doctoral/2809

Corporate governance and internal controls over the accounting and financial reporting processes are critical to timely and accurate financial data reporting. Sheikh (2019) concluded that internal controls establish accepted practices, manage risk choices in decision-making, and improve ongoing monitoring activities to ensure compliance with laws, regulations, and company policy. Wang and Zhou (2016) identified leadership as a critical component of corporate governance and concluded that a company’s accounting process and related controls were interdependent with enterprise management and directly correlated to the sustainability of operations and business success. The Board of Directors and the Chief Audit Executives are responsible for assessing, influencing, and monitoring these controls. Essen et al. (2013) concluded that leadership establishes good corporate governance through proper leadership roles, including an effective Board of Directors, and alignment of operational processes to employees and stakeholders. The researcher completed an extensive review of leadership styles and analyzed the Board of Directors' and the CAE’s role to complete this study. The researcher also analyzed leadership’s involvement in corporate governance oversight, including strategy development, risk assessment, and operational improvements. This study's recommendations provide insight into the role leadership plays in corporate governance over the accounting and financial reporting processes and provide guidance to the Board of Directors and Chief Audit Executives to enhance and maintain a strong corporate governance program.

Since February 12, 2021

Included in

Accounting Commons

- Collections

- Faculty Expert Gallery

- Theses and Dissertations

- Conferences and Events

- Open Educational Resources (OER)

- Explore Disciplines

Advanced Search

- Notify me via email or RSS .

Faculty Authors

- Submit Research

- Expert Gallery Login

Student Authors

- Undergraduate Submissions

- Graduate Submissions

- Honors Submissions

Home | About | FAQ | My Account | Accessibility Statement

Privacy Copyright

Export citation

Select the format to use for exporting the citation.

Corporate Governance Meets Data and Technology

By Wei Jiang , Asa Griggs Candler Professor of Finance, Goizueta Business School, Emory University, USA, [email protected] | Tao Li , Bank of America Associate Professor of Finance, Warrington College of Business, University of Florida, USA, [email protected]

Free Preview:

Journal details.

| 1. Introduction | |

| 2. Big Data and a New Era for Information and Information Asymmetry | |

| 3. Governance via Blockchain Technology | |

| 4. Using Smart Contracts and DAOs to Implement Governance | |

| 5. Conclusion and Future Research | |

| Acknowledgments | |

| References | |

Corporate governance encompasses a set of processes, customs, policies, laws, and institutions that affect how a corporation is directed, administered, or controlled. Technology both enhances and disrupts the traditional board-centric corporate governance system, enhancing efficiency and transparency while introducing new challenges and risks. In this work we examine three key themes comprehensively: the redefinition of information and information asymmetry through the generation of and access to big data; blockchain technology’s transformative potential for aggregating preferences and exercising shareholder voting rights while blurring the line between securities and tokens; and the impact of smart contracts and their underlying infrastructure on the expansion of contracts and the implementation of decentralized governance through decentralized autonomous organizations. These innovative technological solutions empower stakeholders to exercise governance rights effectively, but their complexity also gives rise to new barriers and inequalities. As technology evolves, collaboration among researchers, policymakers, and practitioners is imperative to ensure that corporate governance remains effective and responsive to the current dynamic business environment.

Book details

Corporate governance encompasses the processes, policies, and institutions shaping how corporations are directed and controlled. Technology plays a dual role in this context, enhancing traditional governance systems while introducing novel challenges and risks. Corporate Governance Meets Data and Technology explores this intersection through three main themes: the impact of big data on information asymmetry, blockchain's potential to transform shareholder rights and ownership structures, and the implications of smart contracts for decentralized governance. These innovations empower stakeholders with new tools for effective governance but also raise concerns about complexity and inequalities.

As technology evolves, collaboration among researchers, policymakers, and practitioners becomes crucial to adapt corporate governance to the dynamic business landscape. Addressing these issues in-depth provides valuable insights into the future of governance in a technology-driven world, highlighting both opportunities for efficiency and transparency, and challenges related to security, fairness, and regulatory frameworks.

Fidelity Bank affirms commitment to data protection, corporate governance

The management of Fidelity Bank has affirmed its full commitment to data protection and corporate governance.

A statement by Meksley Nwagboh, Divisional Head, Brand & Communications, assured the public that the financial institution adheres to the highest ethical standards by ensuring full compliance with extant laws on data protection.

The official also gave a breakdown of Fidelity Bank’s dealings with the NDPC since it received the letter informing of alleged data breach.

Nwagboh said on April 30th, 2023, there was a notice of investigation from the Nigerian Data Protection Agency (NDPA), now Nigerian Data Protection Commission (NDPC), in respect of a complaint who claimed that own details were used to open an account in the bank without consent.

“We conducted an internal investigation into the circumstances around the claim and discovered as follows: An account opening request was received online in the name of [name withheld], and an email was sent to the email address attached to the request informing them,” he noted.

“In compliance with our Data Protection policy, accounts created online without full documentation are not allowed to be operational and are closed after 30 days if the outstanding documents are not provided to authenticate the identity of the person seeking to open the account.

“In compliance with our data protection laws, the account was not allowed to be operational as the passport photograph and BVN were not provided.

“The account was immediately placed on “Post No Debit” status as the applicant was expected to complete the account opening process by providing the outstanding documents for verification within 30 days. This was not done, and the account was eventually closed.

“On May 2nd 2023, we responded to the NDPC that the bank did not violate any law because there was no data breach and that the account opening process was not completed. We carried out due diligence by immediately blocking the account and subsequently closing the account when we did not receive the outstanding documents.

“At no point in the process was the account ever operational. On July 7th, 2023, we were invited for a Pre-Action meeting with NDPC. During the meeting, we restated our position as earlier communicated to them in our letter dated May 2nd.

“However, despite our explanation and evidence provided to support our claim, the agency informed us that they had reached a conclusion to impose a penalty on the bank. On 5th December of 2023, we got a letter from NDPC demanding we pay a ‘remedial fee’ of N250 million within 21 days.

“We immediately commenced another round of engagements with the Commission as we were convinced we had not breached any extant law or regulation. While discussions were still ongoing with the NDPC, we received another letter on the 20th of August demanding that we now pay N555.8m naira.

“As a responsible financial organization with a history of strong corporate governance standards, we remain committed to the due process of the law, and we wish to assure all our customers of our unwavering commitment to upholding the highest level of ethical standards in all our dealings with customer data.

“Our commitment to strong corporate governance has earned us local and international recognition, including the prestigious CG+ award. This is the highest rank under the Corporate Governance Rating System (CGRS) of the Nigerian Exchange Group (NGX), which evaluates listed companies against established best practices and standards.”

The statement by the spokesperson added that Fidelity Bank remains in discussions with the NDPC over an amicable resolution to the matter.

Most Nigerian manufacturers boycott national grid – Adelabu

You may like

Stock Exchange rates Fidelity Bank highest on corporate governance

Fidelity Bank promotes 11% of staff after record financial performance

Fidelity Bank CEO Onyeali-Ikpe among MIPAD’s 2024 Top 100 Trade Champions

Fidelity Bank leads trading as equities gain N324bn

Fidelity Bank undertakes N29.6bn Rights Issue, N97.5bn Public Offer

Fidelity Bank investors earn 406% gain in 5 years

More From Forbes

Corporate governance in the post-covid era.

- Share to Facebook

- Share to Twitter

- Share to Linkedin

Christina L. Sgro , Founder and CEO, WR.x | Whilton Rowe.

The Covid-19 pandemic crippled businesses and ushered in a flood of unprecedented challenges across the corporate world. The seismic shift it prompted has changed the corporate landscape considerably, challenging long-held ideas around governance and responsible leadership. Businesses have been forced to reexamine the predictive analysis of potential crises and their associated social, economic and financial implications like never before. And, as is so often the case during times of crisis, the pandemic also exposed a number of vulnerabilities.

The Pandemic's Impact On Stakeholder Connectedness

As many businesses struggled to remain solvent over the course of the pandemic, they could no longer maintain a strict separation between participant groups and, instead, were forced to acknowledge a simple but powerful truth: All stakeholder groups are intrinsically connected.

Regardless of rank, all stakeholders were deeply impacted by the pandemic; no one was exempt. Companies were faltering, and investing in social capital became essential. Developing new approaches to effective corporate social responsibility proved necessary for near- and long-term success. New initiatives, such as investing locally or attracting a more diverse workforce, signaled a direct investment in people, a much-needed shift.

As a result, many companies adjusted their CSR practices in order to establish a stronger commitment to diversity and, specifically, vulnerable groups. Adapting quickly and flexibly meant that companies could survive the pandemic and, in some cases, thrive in the face of it.

Netflix’s Best New Mystery Crime Show Has A Perfect 100% Critic Score

Apple iphone 16 pro: new design echoed in latest leak, will beyoncé perform at dnc’s final night conflicting reports after tmz says she’ll appear..

Interconnectedness, as a practice, was not necessarily a chief consideration prior to the pandemic. For many, globalization and cultural diversity were often perceived as indicators of individual influences rather than a naturally symbiotic dynamic across the corporate landscape. Historically, consumers have determined profits for shareholders and available work for employees.

However, during the pandemic, these connections could no longer be dismissed. Instead, establishing a better balance between stakeholder groups in order to promote improved relationships and, more importantly, better outcomes, became a must.

Prioritizing Corporate Social Responsibility

Studies have shown that corporations that continue to invest in the staunch belief that CSR does not equal increased shareholder value risk leaving their employees and shareholders stripped of the ability to adapt appropriately.

The opposite is true as well. The “ overinvestment hypothesis ” posits that insiders might overinvest in CSR activities with the primary goal of curating a socially responsible image, but they do so at the expense of shareholders, which can effectively reduce a company’s performance and, correspondingly, its value. Corporations investing in CSR for vanity’s sake neither benefit their employees, nor do they convey any degree of value for other stakeholders.

However, when done correctly, increased CSR efforts can help resolve conflicts between stakeholder groups, thereby improving organizational culture and, potentially, company value. As such, maintaining a strong investment in CSR should serve as a valuable lesson for mitigating future crises, increasing shareholder value and achieving higher profitability.

The inherent relationship between CSR and reputation is typically directed at shareholders and, on a broader scale, consumers. While some aspects of employee-focused corporate responsibility—for instance, fair pay practices—might entice consumers, these may come at a cost to shareholders. This is where meaningful leadership and clear communication can help ensure strong and effective governance.

The Need For Board Diversity And Flexibility

Nevertheless, a corporation that remains stagnant risks eventual collapse. Notably, a distinct absence of flexibility may be attributed to a lack of diversity among board members.

Ideally, a board's decision-making process should reflect the knowledge and experience of all members, from all backgrounds and walks of life. A stale approach to board composition can result in "clusters of same" member types with interests specific to niche groups. As a result, their priorities are rarely reflective or welcoming of new and innovative ideas or supportive of progressive leadership. Without a proper balance of power across the board (pun intended), employees may indeed be left behind.

A practical standard for success should reflect all stakeholder groups, and boards should be formed with current conditions and potential future challenges in mind. For some corporations, former definitions of success focused exclusively, and often erroneously, on shareholders. In the case of well-established and formally entrenched boards, adjusting a corporation’s direction or position on multiple fronts can be challenging. However, success in the age of Covid-19 has often been viewed through the lens of sustainability .

Moving Forward

A corporation with the desire to thrive must remain resilient in the face of ever-changing trends. The pandemic had an undeniable effect on socioeconomic trends; ensuring a more diverse mindset has become increasingly important. Many companies have failed to recognize potential hazards because board members and shareholders acknowledged only those risks that impacted them personally, few of which were representative of the risks being faced by other stakeholders.

For those companies that prized efficiency over sustainability and adaptability, resiliency appeared to become a lesser consideration, as did risk management. Challenges brought on by the pandemic stirred a call for diversity and fresh perspectives in the boardroom in an effort to modernize outdated protocols and ensure survival. As different groups experienced varying levels of risk, the chance for greater health or financial disparities and, resultantly, negative outcomes, was also much higher.

When companies lack true diversity, it becomes impossible to engage in candid discussions regarding potentially serious issues affecting stakeholder groups; this leaves the decision-making process to a select few, thereby further encouraging an unhealthy cycle of disproportionate representation. Without diversity, decisions cannot be made effectively or proportionately. Without diversity, flexibility cannot be achieved.

To achieve diversity, leaders must first reevaluate their role in creating a more diverse work environment while challenging their current definition of the term. It is imperative to understand that true diversity is the sum of many parts.

In the post-pandemic climate, flexibility is now a must. It must be seamlessly embedded into an organization’s core structure to such a degree that it is expected at all levels, from entry-level staff to senior management. A lack of flexibility in this post-pandemic era will prevent organizations from adequately preparing and adapting to change, thus impacting the long-term success and viability of even the largest and most profitable corporations.

Forbes Business Council is the foremost growth and networking organization for business owners and leaders. Do I qualify?

- Editorial Standards

- Reprints & Permissions

- Undergraduate Admission

- Student Affairs

- Events Calendar

- George W. Bush Presidential Center

- Prospective Students

- Current Students

- Information for Faculty & Staff

Degrees and programs at SMU

Get ready for jobs that don’t yet exist. Through eight degree-granting schools you have the variety and flexibility of SMU’s offerings to pursue multiple competencies that employers value.

Search programs

Filter by degree type, area of interest, or school, program type, area of interest.

- Graduate Certificate

Advertising